SUMMARY

We look at what exactly went wrong for Paytm after its rather lukewarm market debut following the much-hyped IPO

Social media this past week has been abuzz with analysis, hot takes and insights on the Paytm IPO. And as the fintech giant listed publicly, much of that turned into memes as the Paytm stock tanked after listing.

So what exactly went wrong and will Paytm bounce back? We will go into this shortly, but here are two stories that need your attention first:

- ? Flipkart’s Healthtech Play: After the acquisition of SastaSundar, Flipkart is stepping into the lucrative epharmacy and telemedicine verticals.

- ? Tata Neu Goes Live: From grocery shopping to investments to payments and more — Tata has finally launched the super app internally. But we got an early look!

?Paytm IPO Falls Flat, So What’s Next?

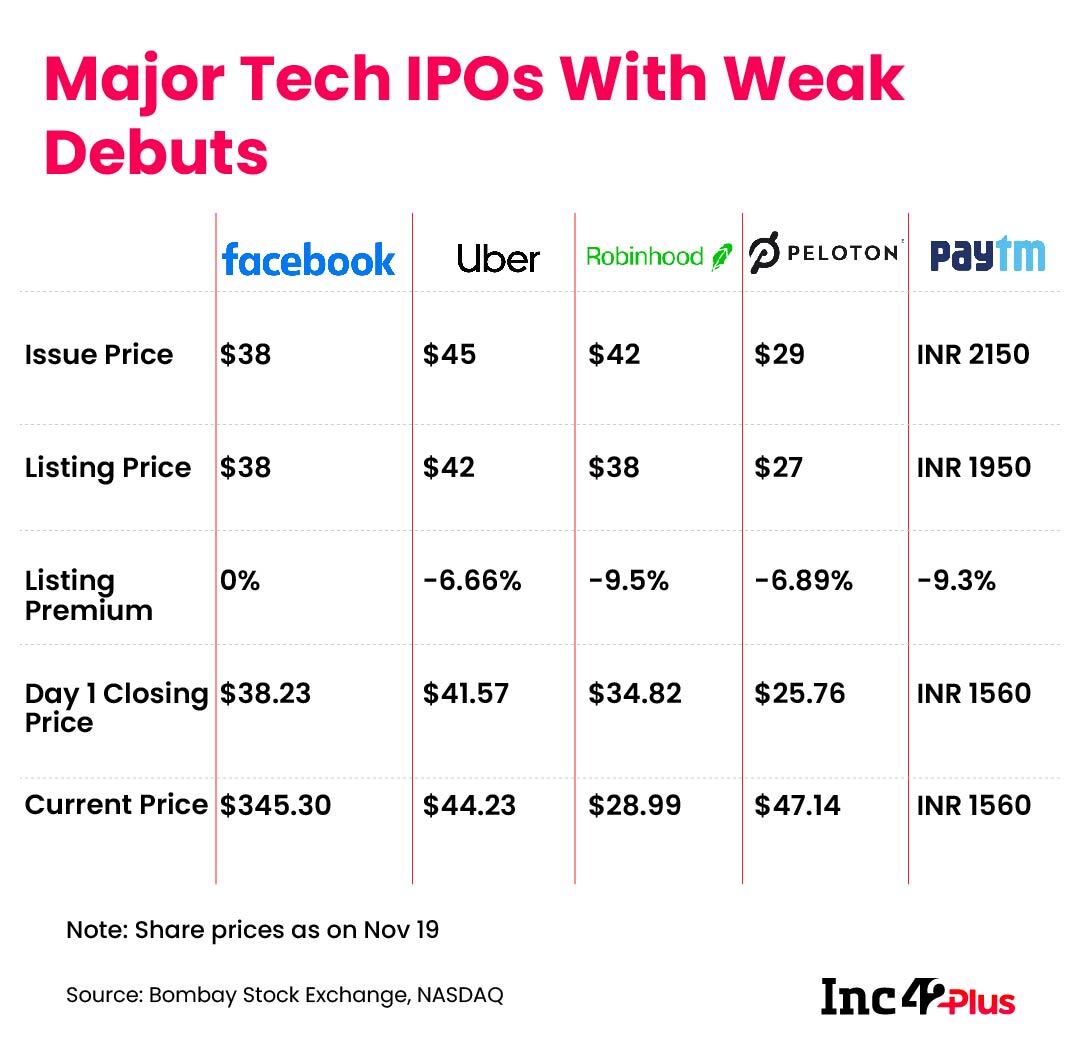

As feared, Paytm’s high pre-IPO valuation has come back to haunt the company after a major 20% discount on its first day of trading. After the hype around India’s biggest initial public offering, Paytm couldn’t last one full trading session on its market debut as its stock hit the lower circuit and was pulled off the trading floor.

Naturally, more concerns and questions are being raised on the Vijay Shekhar Sharma-led fintech giant’s super high valuation, its lack of profitability and the business model itself, which many claim does not have a competitive edge. Considering the lack of profits for Zomato which had a relatively smoother listing, there is some mystery around why Paytm has suffered this dip.

Analysts are now cautioning investors against buying the dip for Paytm. The message is to hold off till the stock gains some momentum.

After hitting the lower circuit of INR 1,560, trades on Paytm were halted by the stock exchanges to prevent extreme price movements and protect existing investors. Paytm’s market cap went below its pre-IPO valuation of $16 Bn and stood at INR 1.01 Lakh Cr ($13.64 Bn).

Of course, the issue of overvaluation of Paytm has been a major point of contention for analysts in the run-up to the IPO. According to pre-IPO reports, Paytm was initially targeting a valuation of $35 Bn, but then brought down its target valuation to $20 Bn for the IPO.

Analysts had cautioned about investing in the stock, fearing a discount on listing. Macquarie Research said, “Paytm’s valuation, at 26x FY23E Price to Sales (P/S), is expensive, especially when profitability remains elusive for a long time.” Worryingly, it also said Paytm is only likely to generate positive free cash flow by FY30, saying that its business model lacks focus.

Another major problem for the fintech giant is the perceived lack of a competitive moat, even though Paytm does have one of the largest payments banks in the country, which it leverages to fulfil payments. But beyond this, the lack of a competitive edge is apparent.

For instance, other payments apps and fintech companies have also added the array of services that Paytm does — either directly or through partnerships — which does dent the company’s prospects in the long term.

According to Paytm founder Sharma, fintech business models are not well understood widely. He was insistent this week that cross-selling across Paytm’s various businesses is a key strength. “These are easy to understand models… If I sell a wallet or a phone or I can pick up food from a restaurant… then you know the business model compared to [payments]…” he was quoted as saying.

The focus now would be to turn things around, rake in profits and cut down on businesses which do not move the needle in terms of revenue. All eyes would be on the first quarterly financials from Paytm post the listing.

Of course, all eyes will be on the IPOs that follow Paytm. The likes of PharmEasy, OYO, MobiKwik, Delhivery, ixigo and others are lining up for the public markets and Paytm’s dull performance might just give pause to the stock market investors. With Paytm’s tepid debut, the market sentiment around fintech startups has already soured, leading to Mobikwik’s grey market stock prices falling by 11%.

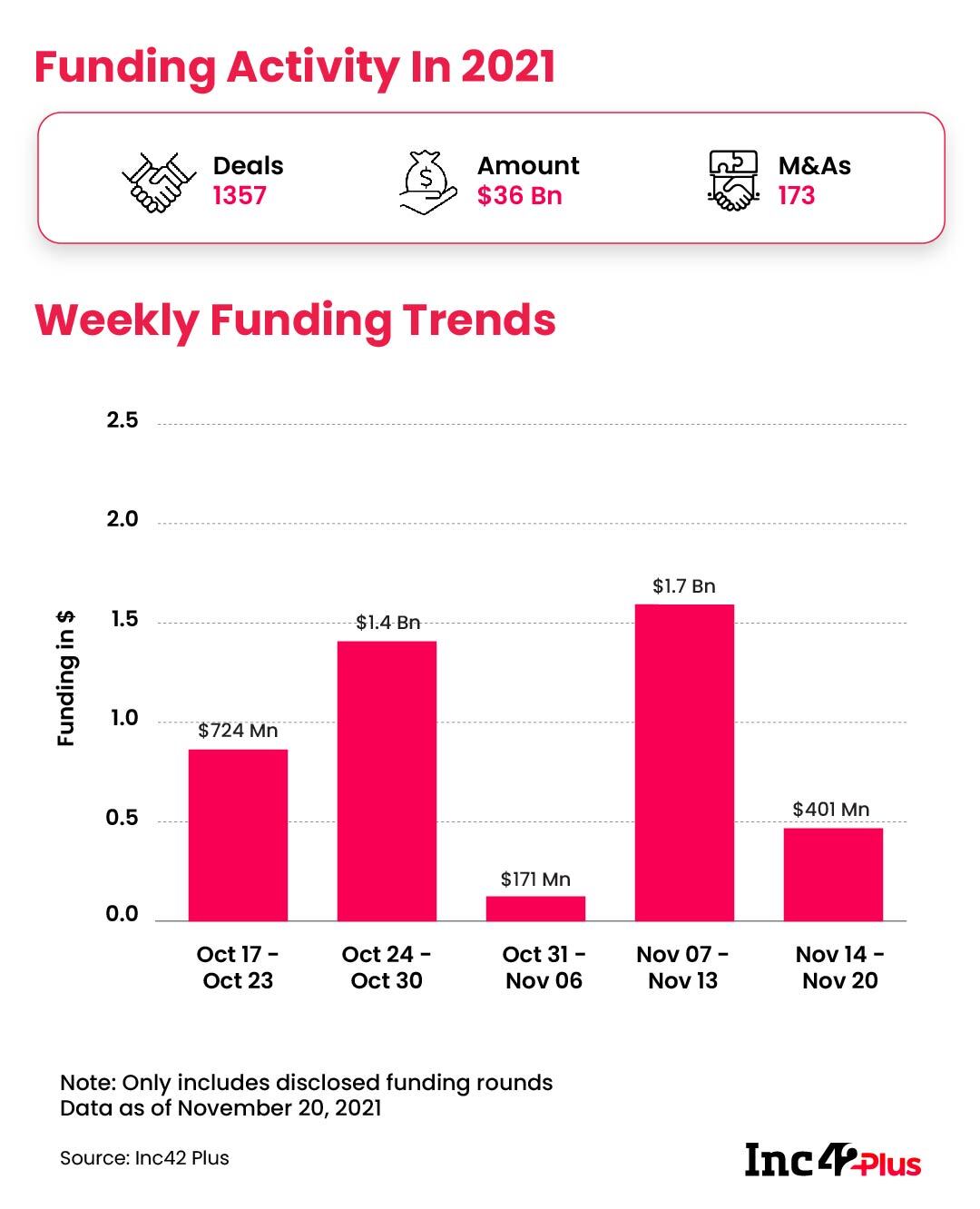

Indian Startup Funding Counter

- ? BYJU’S Staggering Valuation: BYJU’S is raising $363 Mn at a table-topping valuation of $21 Bn.

- ?Funding This Week: Indian startups raised $400 Mn this week across 27 deals, with 19 acquisitions being reported this week. Read this to know more.

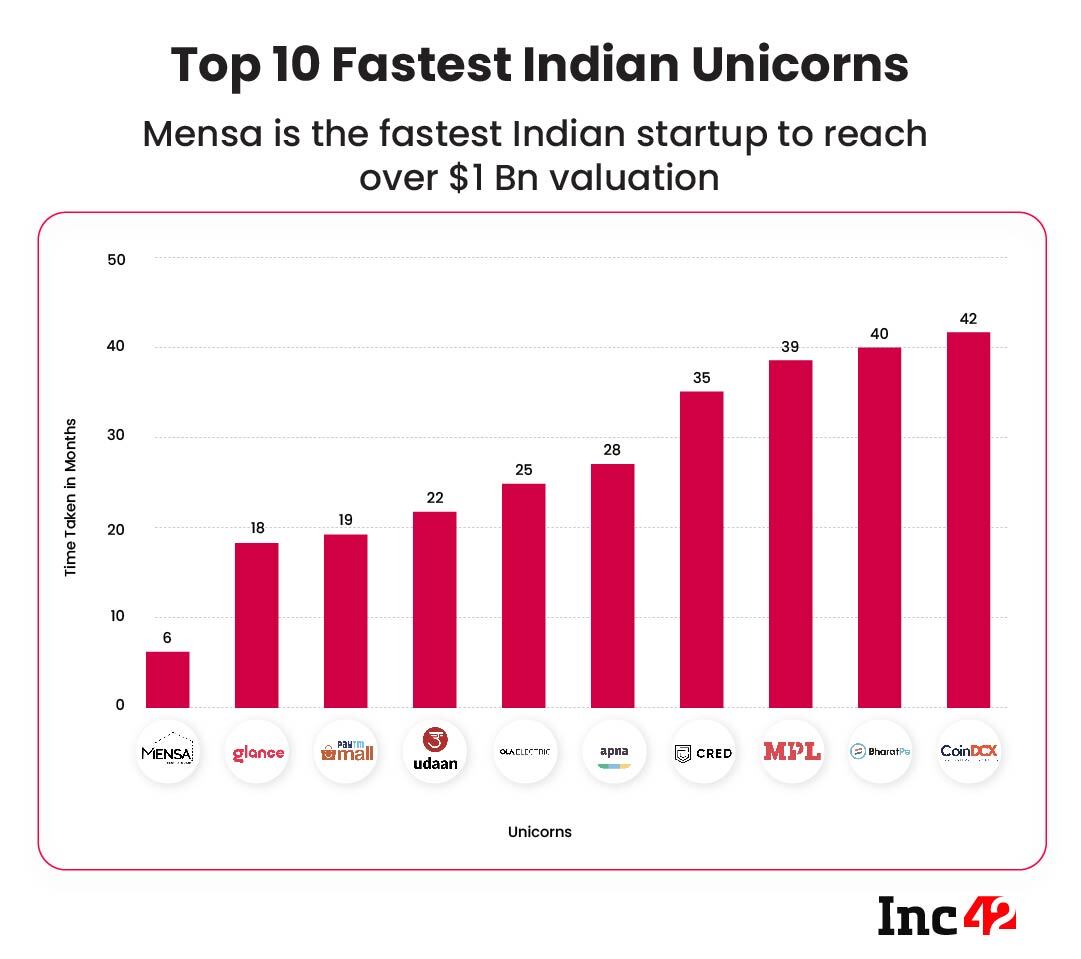

? India’s Fastest Unicorns

Thrasio-style Mensa Brands became the 36th unicorn this year and the fastest ever to get to a $1 Bn+ valuation. But which startups did it beat to get there? Here’s a look at the top 10 fastest unicorns from India so far.

Top Stories

Top Stories

Finally, here’s a look at the other major stories and developments from the week that went by:

- ??Edtech Goes Hybrid: In the latest edition of The Outline, we looked at the prospects and future of hybrid learning in India in the post-pandemic market.

- ⬆️D2C Rising: The direct-to-consumer segment is projected to be a $100 Bn opportunity in India by 2025. Check out our ecommerce market landscape report to see how.

- ?Amazon In Trouble? Amazon’s deal with Future might be in trouble after disclosures claiming the company deliberately misled CCI.

- ⚠️ Say Yes To Vigilance: The latest edition of India’s Crypto Economy explores concerns over crypto ads, regulations, and the upcoming bill.

- ?️Shopee Under Govt Radar: Delhi High Court has asked the central to look into the Shopee India launch over its Chinese connection.

- ?RBI To Rethink Digital Lending: In a working group report, RBI has proposed new legislations to regulate digital lenders and loan apps.

- ?️ D2C Goes Healthy: There’s an unabashed optimism for health foods and beverages in the D2C arena. Check out the latest edition of India’s D2C economy to know more!

- ? Nykaa’s Profit Shrinks: While Nykaa’s shares listed at 96% premium, its Q2 FY22 profits narrowed by 95%, leading to a small drop in its share price this past week.

- ? Caps On IPO Proceeds: Amid IPO frenzy, SEBI has proposed to cap the use of IPO proceeds for acquisitions citing uncertain use cases for a large portion of issues.

That’s all for this week. We’ll be back next Sunday with the best of the week.

Top Stories

Top Stories