SUMMARY

The crypto wave is rising again, but India needs a clear framework to cash in on it

Dear Reader,

When Dhruv Shera was invited to a swanky cafe in an upmarket mall by his real estate guru of 10 years, he sensed there was a great business proposal coming his way. He was not disappointed.

It was 2017, and social media platforms were flooded with posts on how people could get rich by investing in Bitcoin at the right time. Shera was one of those hit by FOMO, and he was quick to lap up a Bitcoin scheme that promised monthly returns of 10%.

But just like all other too-good-to-be-true investment schemes, the one he chose in a hurry turned out to be a scam. “We had turned greedy,” reflects Shera. “I still believe crypto is a great asset class but only as long as an investor holds it himself and does not invest through others.”

Much like Shera, lakhs of people in India were duped by scamsters who touted crypto as a get-rich scheme and took advantage of an unregulated sector. In fact, this asset class has reportedly been misused to dupe domestic investors to the tune of $500 Mn between 2017 and 2019.

“Regulation is important to ensure there are no bad players in the ecosystem. If you are new to cryptocurrency, you will go on the internet and search for a way to buy it. But any scammy website can game the algorithm and come on top of those search results. And then suddenly, maybe after a month or two, the site disappears. Had there been regulations (and awareness), everyone would know that an online platform must have a licence to deal in cryptocurrency,” says Nischal Shetty, founder of WazirX, a cryptocurrency exchange.

Besides, such scams could become more commonplace now as the number of cryptocurrency users in India has gone north to 6-7 Mn in December from the reported figure of 1.7 Mn in March 2020. According to data from the Bitcoin marketplace Paxful, India ranks second (after China) among the Bitcoin-trading countries in Asia, both in terms of volume and value of the Bitcoins traded.

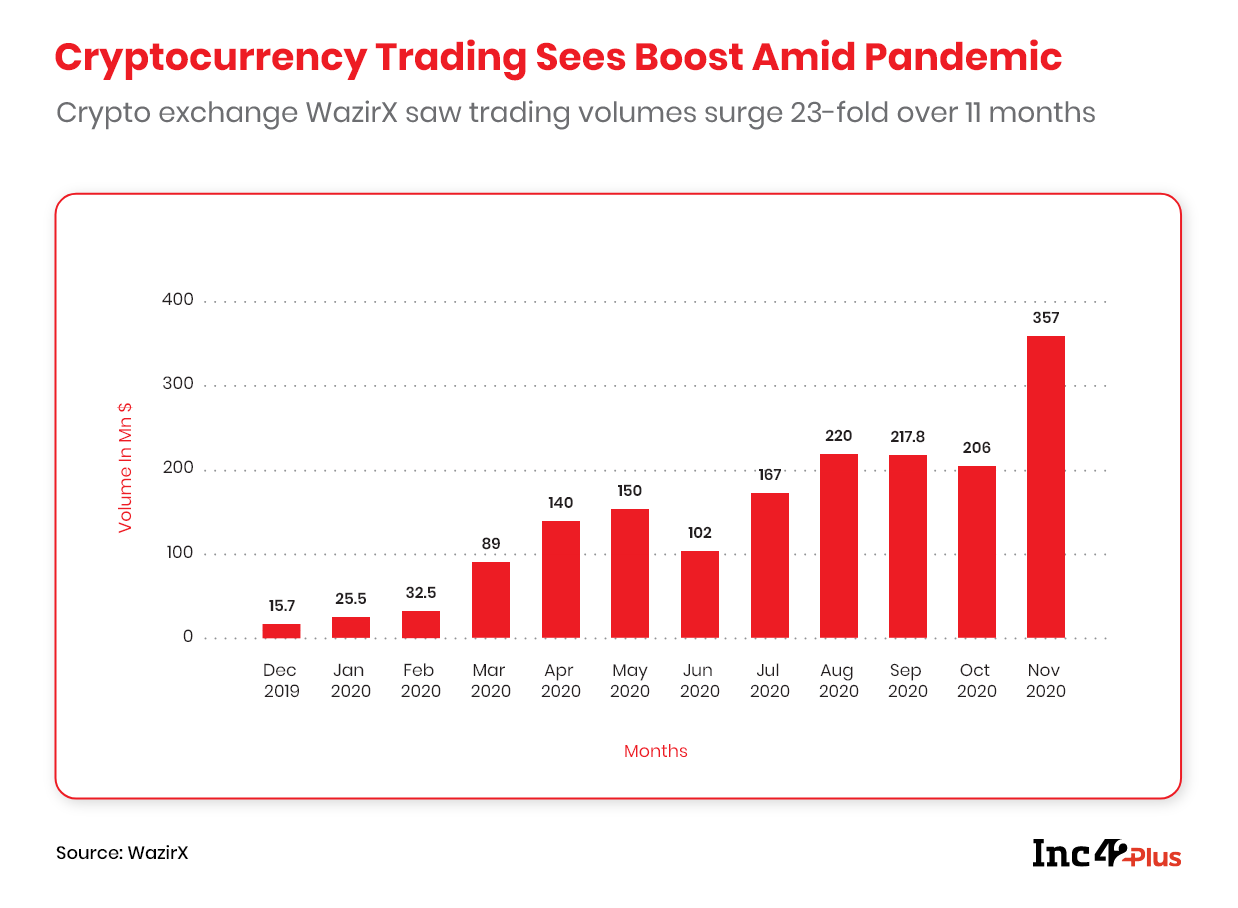

Interestingly, data from Paxful also showed that a total of 7,236.50 Bitcoins were traded in India in 2020, a rise of 234% from 2019. This bulge in trading during the pandemic year could be easily ascertained through the crypto trading data that WazirX shared with Inc42. The platform saw a 301% increase in monthly trading volumes between March and November 2020.

A Flickering Ray Of Hope

The rise in crypto trading volume was further fuelled after the Supreme Court, in March, junked the Reserve Bank of India’s (RBI) decision to bar banks from facilitating cryptocurrency transactions. Plus, this surge in crypto activity was not just limited to investors trading more of these virtual assets. A few funding announcements also came in just before the judgement in the hope of a favourable ruling, and more followed afterwards.

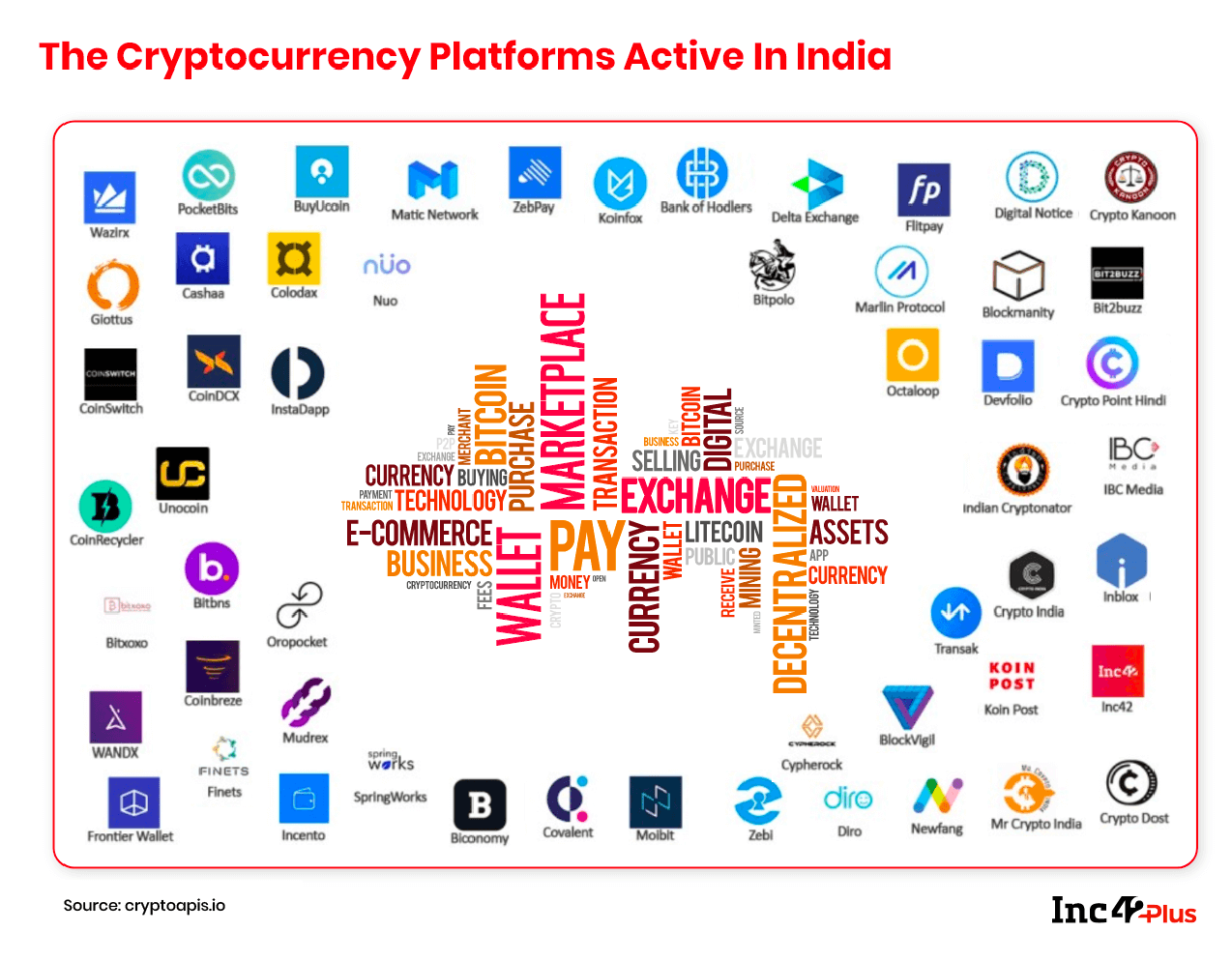

While Mumbai-based CoinDCX announced the closure of its Series A funding, Delhi-based crypto exchange BuyUcoin partnered with fintech company Mobikwik for a seamless fiat-to-crypto conversion. Besides, ZebPay came back to India under a different name and a new leadership team as all its cofounders, including Sandeep Goenka, Mahendrakumar Gupta, and Saurabh Agrawal, resigned after it was found that the company had violated the government’s norms. Global exchanges such as Binance and OKEx also entered the Indian market. Moreover, Binance announced the acquisition of the Indian crypto exchange WazirX while OKEx tied up with CoinDCX.

The apex court’s decision might have ensured that the crypto startups, which were compelled to shut operations due to policy flip-flops, are back in action once more. But the regulatory jerks are far from over. According to media reports in September, the Cabinet could be tabling a Bill in Parliament that would ban cryptocurrency trading in a bid to prevent multiple frauds running into thousands of crores of rupees.

This, in turn, has dried up VC funding from abroad and left the Indian crypto startups in the lurch. “On a macro level, the first important thing is to ask ourselves why things are so different here. If the US has crypto startups valued at $6-7 billion and various funds have invested billions of dollars in this segment, why doesn’t India have crypto startups worth even $100 million? It also tells us we have lost at least $2-3 billion of value creation across the crypto ecosystem in India simply because, in the absence of regulations, there is a fear of uncertainty. As a result, external capital is not coming to India for the crypto sector,” says Shetty of WazirX.

The Many Faces Of Regulatory Conundrum

While clear regulations are necessary for the nascent sector to attract funds, there is a flip side as well – the crypto is a difficult beast to tame. Understandably, no major country has declared them as legal tender. But some jurisdictions such as the US, Japan, Canada and South Korea have legalised crypto exchanges – a move often considered as the first step in a long journey towards the legal adoption of cryptocurrencies.

One major regulatory bottleneck endemic to India is the Foreign Exchange Management Act (FEMA) that practically does not permit buying and selling of cryptocurrencies across the border. The reason: It does not appear in the list of goods and services which are automatically allowed without the RBI’s consent. Given that the central bank is not willing to provide much headroom for crypto’s growth, it is not likely to give the green light to such transactions.

But this is not the only legal maze of reasoning that confounds the crypto sector in the country. Another critical issue is taxation. Although the Indian government has not laid out clear guidelines for crypto investors for declaring their earnings, most Indian crypto exchanges advise their customers to classify those earnings as ‘income from other sources’ in which case a person will have to pay income tax as per the applicable slab.

But a major confusion remains here. How can this earning be treated as income if crypto is not treated as currency, or legal tender, to be precise? In the case gains from crypto cannot be realised in INR, some experts are of the view that these should be taxed as capital gains.

“The government needs to make specific amendments to Indian tax laws, FEMA and the RBI or it should introduce a separate body to start regulating the crypto space. There should be specific rules framed under new legislation for legalising cryptocurrencies. If things are continued in the current form, it is only going to erode the public wealth due to crypto scams,” says Salman Waris, managing partner at the technology-focussed law firm TechLegis.

The fact that cryptocurrency is in a state of flux and still not regarded as a stable asset class does not aid its cause, either. But not bringing the crypto ecosystem under the watchful eye of the State hardly makes sense. When archnemesis China has taken rapid strides in launching a virtual coin, and Pakistan is already drawing up plans to regulate crypto, India should give it a try to deal with scams and security implications.

Moreover, forceful prohibition does not always augur well for a nation. Think of the nightmare when the prohibition of alcohol spawned the Mumbai underworld. Or cut back to the present to find how things could get worse. Only last week, a massive money laundering scam involving cryptocurrency transactions was unearthed in Gujarat that had links to two Chinese companies. Keeping crypto out of the mainstream did not prevent the crime. On the other hand, a comprehensive regulatory framework might have done wonders to safeguard the system and ensure a level playing field for the crypto hopefuls in India. It is, indeed, a wake-up call for the government.

![[The Outline By Inc42 Plus] Cryptocurrency Aches For Regulation](https://inc42.com/wp-content/uploads/2020/12/Artboard-–-21@2x-2-1.png)

Aching To Be Listed

While regulations continue to be a thorn in the side of Indian tech startups from many sectors, listing norms for initial public offering, or IPO, has also seen a lot of discussions lately. And for once, one gets a positive feeling.

The Securities and Exchange Board of India (SEBI) has recommended a slew of relaxations in norms to boost startup listing. These include reducing the holding period for pre-issue capital and allowing discretionary allotment to all eligible investors, among others. The development comes at a time when Indian startups are planning overseas listings in the next couple of years as the existing norms in India make it difficult for loss-making VC-backed firms to go public.

In a press statement, SEBI said it had created an Innovators Growth Platform (IGP) framework for listing of startups on Indian stock exchanges. The capital market regulator also issued a consultation paper, which will be open to the public for suggestions until January 11, 2021.

Aching To Begin Anew

This year has been a tough one for business. Even before the pandemic brought life to a standstill, India’s economy was not in a great shape with some sectors such as automobiles and FMCG suffering from a slowdown in demand. If these were not enough of a dampener, the government’s overzealousness to regulate some sectors further hurt the industry.

Amid such upheavals, a lot has happened across the country’s startup ecosystem that needs to be reviewed and put into context. To make sense of the many changes which have come about, Inc42 has started the Year End Review 2020 series where we take a closer look at the funding landscape, policy changes, Big Tech’s brush with the government and much more.

As the year comes to an end, we should not only take stock of the events which shaped the Indian startup ecosystem but also reflect on the road ahead and future strategies, which will help us cope with the new normal that has just started.

Until next time,

Deepsekhar

![[The Outline By Inc42 Plus] Cryptocurrency Aches For Regulation-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/featured.png)

![[The Outline By Inc42 Plus] Cryptocurrency Aches For Regulation-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/academy.png)

![[The Outline By Inc42 Plus] Cryptocurrency Aches For Regulation-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/reports.png)

![[The Outline By Inc42 Plus] Cryptocurrency Aches For Regulation-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks5.png)

![[The Outline By Inc42 Plus] Cryptocurrency Aches For Regulation-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks6.png)

![[The Outline By Inc42 Plus] Cryptocurrency Aches For Regulation-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks4.png)

![[The Outline By Inc42 Plus] Cryptocurrency Aches For Regulation-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks3.png)

![[The Outline By Inc42 Plus] Cryptocurrency Aches For Regulation-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks2.png)

![[The Outline By Inc42 Plus] Cryptocurrency Aches For Regulation-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks1.png)

![[The Outline By Inc42 Plus] Cryptocurrency Aches For Regulation-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/readers-svg.svg)

![[The Outline By Inc42 Plus] Cryptocurrency Aches For Regulation-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter5.png)

![[The Outline By Inc42 Plus] Cryptocurrency Aches For Regulation-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter4.png)

![[The Outline By Inc42 Plus] Cryptocurrency Aches For Regulation-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter3.png)

![[The Outline By Inc42 Plus] Cryptocurrency Aches For Regulation-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter2.png)

![[The Outline By Inc42 Plus] Cryptocurrency Aches For Regulation-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter1.png)