Prime Minister Narendra Modi’s ‘Startup India, Standup India’ initiative is no less than a rock concert in its own. Scheduled for 16th January, the event has seen a massive response for the coveted 1,500 passes, with about 1 lakh participants for the same. That is a ratio of 1:0.015 which means everyone who applied stood a chance of just 1.5% to be a part of this event which is being waited upon with bated breath by the startup community!

And why not? The event is supposed to be a watermark event in 2016 as PM Modi is expected to launch a slew of reforms aimed at revolutionising the Indian startup ecosystem and will unveil the Startup Action Plan. Be it taxation policies or regulatory approval or increase in FDI or infrastructural support, Indian startup founders and investors and mentors, all want some clarity, some assurance, some support, and a lot of relief from the government to catapult the nation into the league of the best startup nations in the world.

Besides entrepreneurs, industry veterans like Mukesh and Anil Ambani, Tata group chairman Cyrus Mistry, Bharti’s Sunil Mittal and Aditya Birla Group’s Kumar Birla will also be attending the event. The attendees would also get a chance to hear from Softbank CEO Masayoshi Son, who plans to invest $20 Bn in solar projects in India, Travis Kalanick (founder, Uber) and WeWork (founder, Adam Neumann).

Apart from them, around 40 high-profile Silicon Valley entrepreneurs, venture capitalists and angel investors have also been invited as special guests. There is also a possibility that Google’s Launchpad Accelerator programme could be part of this event, wherein one early-stage startup will be shortlisted from a panel of five.

Saurabh Shrivastava, Chairman, Indian Angel Network says, “It bodes well for the country that the current government, for the first time in modern Indian history, has understood the criticality of startups for employment and economic growth and has launched “The Startup India, Standup India mission”. This revolution can make us the second largest entrepreneurial hub in the world after the US, take us to double digit GDP growth, eliminate poverty and take India to the position it enjoyed 300 years ago, when it accounted for 25% of global GDP.”

As the curtain unfolds on what the PM has in store for startups this year, we spoke to some investors, startup clubs, ecosystem enablers, and founders on what is it that they wanted from the PM.

The Investor WishList

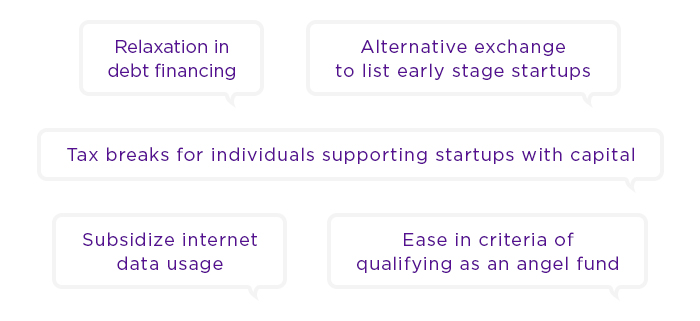

Stressing on the ease of financing for startups and liquidity for investors, venture capitalists would like the PM to take some steps in this regard. Says Shubhankar Bhattacharya, Venture Partner at Kae Capital, “ Some relaxation in debt financing norms for startups is much needed so that they can avail loans from formal banking channels even while making losses or little/no revenue. Additionally, an alternative exchange to list early-stage startups should be created, offering retail investors with high risk-appetite to invest in such companies, while offering liquidity to entrepreneurs and early-stage investors.”

Shubhankar also suggested creation and promotion of a structured program that facilitates and encourages entrepreneurship, either as an alternative or supplementary to traditional education, similar to what the Thiel Fellowship offers. Similarly, the ‘Make in India’ program could be extended to encourage startups operating in core sectors such as agriculture, infrastructure, healthcare, education etc. focused on developing innovations tailored for Indian consumers.

On the infrastructural side, Bhattacharya suggested subsidising internet data usage to encourage internet and mobile businesses.

Meanwhile, the industry body Internet and Mobile Association of India (IAMAI) has come up with specific fiscal and non-fiscal measures required by the internet industry in order to boost the digital startup ecosystem in India. In order to improve the investment environment, the association suggests that there should be tax breaks and incentives for individuals supporting startups with capital. IAMAI says that India’s entrepreneurs need early stage venture capital, but the domestic venture capital sector needs to develop further. In the US, the VC industry took off when their government allowed the large pension funds to put 5-10% of their assets into VC firms

Adds IAMAI, “Angel Tax under Sec 56 (2) of the Income Tax Act has not been actually tailored to restrict startups funding but it has put startups under the Income tax scanner, questioning the valuation by domestic individual investors. The criteria to qualify as an angel fund are stringent and need to be eased to support the startup ecosystem in the country.”

Mahesh Bhalla, President Qwikcilver Solutions and an angel investor stated, “We would like to see the government align capital gains tax between publicly traded shares and investments in venture capital. Currently this is asymmetrical – Angels & VC’s take a higher risk (compared to publicly traded shares), but end up paying higher taxes as well. A standardization of tax rates between the two will encourage more capital investment into the startup space, thus enabling more entrepreneurs to pursue their dreams, and in turn create more jobs.”

Nitin Sharma, Principal at Lightbox VC feels that though has been a massive expansion in the VC funding ecosystem, not much risk capital is available for startups truly innovating in terms of core technology, hardware or India-specific problems without global parallels. He hoped that the initiative provides a big boost to that in conjunction with academia. Says Nitin, “ For me, digitizing of education on a massive scale is the biggest revolution in the making, which can also make the startup revolution more universal and inclusive, and pay rich dividends in enhancing our talent pool.”

He also wished for announcements to further enhance infrastructure investments – especially around bandwidth or digital payments, reducing regulatory, compliance and tax requirements, simplification of documentation requirements around closing of fundraises, implementing Nasscom suggestions of harmonizing capital gains tax rates for resident and non-resident angel investors, and clarity in tax implications around M&A by foreign acquirers would avoid the issues caused by retroactive taxation.

The Ecosystem Enablers WishList

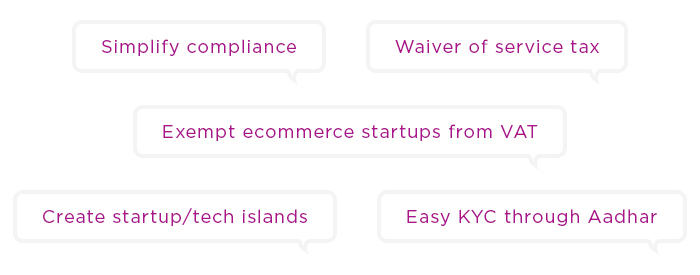

Salma Moosa, founder of Startups Club Networks LLP, a two year plus old community with around 6000+ members, advocates simplifying compliance related activities for early stage startups. Says Salma,

“One of the challenge that early stage startups face today is typically in terms of compliance related activities. Currently one needs to replicate forms for incorporation, service tax and other such compliances. These can be brought under a single umbrella and redundancies can be removed.”

She also adds that some measures should be put in place to retain the talent that India loses out to the Silicon Valley. She wishes there should be top level policy from the education ministry which allows students to take a year off and pursue ventures, thus retaining talent in India.

On boosting the ecosystem, IAMAI suggests incentivizing internet services startups by waiving off the service tax for the first three years. Stated IAMAI, “Unfortunately, startups have to pay huge amount over the first three years as service tax. It is not that they don’t want to pay, but they have survival issues and this takes a back seat and penalties just make a struggling startup’s life harder. The association recommends that for the first three years, the service tax could be waived off or incentivizes the startups, if they pay their service taxes on time.”

Similarly, the body has also recommended streamlining of taxation for ecommerce marketplaces. It said that the ecommerce marketplaces are being subjected to onerous VAT demands from several states. They should be recognized as marketplaces and exempt from VAT demands in states. As marketplaces, they provide a service to online sellers and pay the service tax on that account. The State of Rajasthan for example, treats ecommerce players as marketplaces.

Additionally, IAMAI also suggested that measures should be put in place to boost fintech startups as they play a significant role in serving those underserved or not served by formal institutional mechanisms. Consequently, P2P lending and crowdfunding need an impetus and clarity from Government. The body asked for a clear policy on P2P lending from the government. Similarly, it asked for measures such as an easy KYC through Aadhar in order to allow innovators to build new services which in turn will help bring more people under the ambit of financial services.

While the government is doing a lot to bolster the ecosystem by taking steps such as setting aside a fund for startups in the budget, launching the digital India initiatives and creating a number of technology warehouses in many cities, there is much more which needs to be done to make India a top startup hub.

Keshav R. Murugesh, Group CEO, WNS Global Services & Chairman, NASSCOM BPM Council advocates creation of 3-4 startup / tech islands across India where there is free flow of capital and talent from across the world with easy visas and no taxes. International talent (high tech and marketing talent) should find it easy to do work in India in these islands and repatriate earnings without taxes. Adds Keshav,

What Silicon Valley in the US has really created is an enabling atmosphere and talent that gravitates there and some of these steps can help create the next Facebook or Google out of India.

Similarly, he also advocated tax relief for startups, saying that no taxes should be levied on them for 5-7 years so as to enable them to focus on their business first and pay taxes when they actually have some earnings.

On the infrastructural side, he suggested that state governments should provide fitted warehouses as well as free world class office accommodation inside SEZs to encourage startups to set up inside that state. They could charge rentals later and first focus more on quality projects as opposed to rental income. Similarly, world class residential accommodation, schools and hospitals should be made available inside SEZs by state governments to encourage the best talent to shift to these locations and work with these startups.

The Entrepreneur Wish List

Startup entrepreneurs are waiting with bated breath to hear the PM speak about relaxation in regulations, taxation, and more infrastructural support from the government. While entrepreneurs believe that the Indian startup ecosystem has been a strong enabler for India’s economic growth, multiple policy challenges restrict startup growth in the country.

Simpler Regulations, Lesser Tax

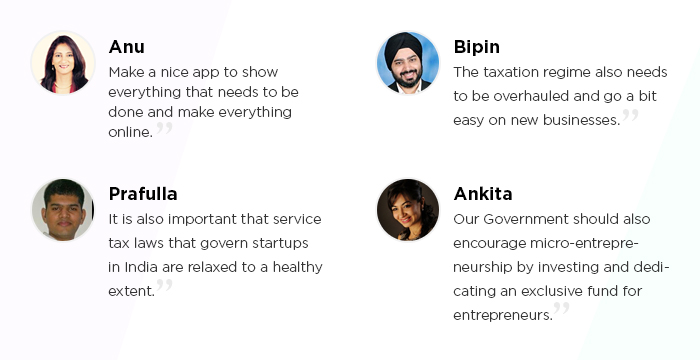

Anu Acharya, CEO, Mapmygenome India Limited, wishes that the government should simplify regulations and make them transparent, do away with retroactive laws and rules, and create an online chat or phone no. to help startups through the process.

Active support from the government in terms of infrastructure is also the wish of Bipin Preet Singh,CEO of MobiKwik. Only then can millions of Indians can benefit from the positive change and value generated by the startups. He also stressed on improving regulations, making it easy for young entrepreneurs to startup, and overhauling the tax regime. The taxation regime also needs to be overhauled and go a bit easy on new businesses.

Prafulla Mathur, Founder and CEO, WudStay, also seconded concern about the current tax regulations that hamper a startup’s growth. He stated that tax relaxations during the early stages would help startups create greater value for customers and also generate higher employment. It is also important that service tax laws that govern startups in India are relaxed to a healthy extent.

Similarly, he voiced concerns about the long and tedious approvals in getting foreign investment, which put a strain on the startup’s resources and time. Prafulla also wished for more support from the government in terms of building business corridors with other countries that could help Indian startups take operations global.

Similar thoughts were echoed by Kiran Gopinath, Founder & CEO Adadyn, who advocated that waiving off the service tax for an agreeable period of time and offering assistance in establishing and winding down companies could be done. Additional measures like reducing paperwork involved in outward remittances can be rather useful for startups that utilise global technologies and software products.

Encourage Product Innovation, Foster Micro Entrepreneurship

While startups laud the government’s efforts to encouraging entrepreneurship, they also wish that some attention is also paid to product innovation. Krispian Lawrence, co-founder & CEO, Ducere Technologies says, “Despite its laudable effort to ease the company incorporation process and emphasis on manufacturing in India, not enough focus has been put on encouraging product innovation. India is in a unique position to create innovative technologies, and the government should simplify the processes and protocols for companies to develop intellectual property and file patents. Currently, it takes an average of seven years to get a utility patent issued. This is extraordinarily slow, and creates massive impediments in the innovation process, which is the bedrock on which startups are built. Additionally, the government should also offer tax incentives on filing foreign patent applications as well as on attorney fees when doing so.”

Startups also wish that ease of doing business is simplified for the startup community to not only set up but also scale up their business. Ankita Tandon, Chief Operating Officer, CouponDunia, says “The general ease of doing business in India is not yet in place. The pace at which startups operate is very fast whereas government processes are lengthy and often take a long time for clearance formalities and paperwork. Through the ‘Startup India, Standup India’ initiative, we expect our government to simplify all these processes. Our Government should also encourage micro-entrepreneurship by investing and dedicating an exclusive fund for entrepreneurs apart from the one’s provided by the VCs and angel investors.”

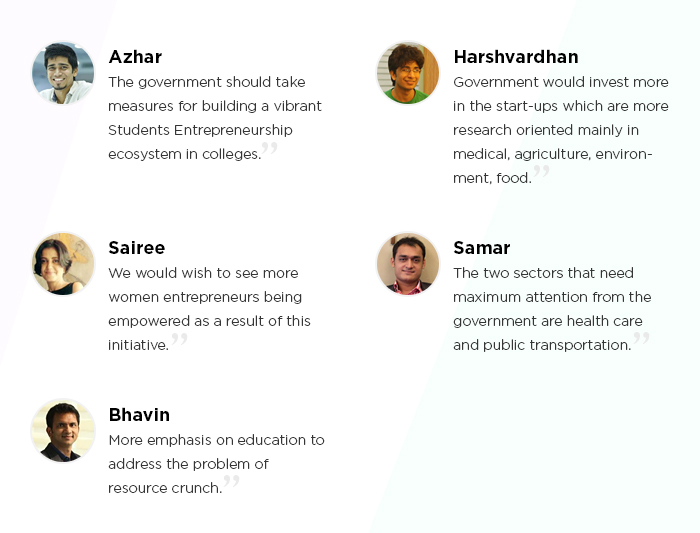

Similar thoughts on encouraging micro entrepreneurship were echoed by Azhar Iqubal, Co-Founder & CEO, Inshorts, who advocated that the government should take measures to build a vibrant Students Entrepreneurship ecosystem in colleges. Says Azhar, “This could be done by firstly including Entrepreneurship as a course at School level, secondly, designing core and optional curriculums on Entrepreneurship at College level, thirdly, by providing Students the liberty to be able to startup in college and complete their degrees later if requested and finally, by enhancing the startup-academia interaction across the board in technical as well as non-technical universities.”

Besides this, more contemporary and startups relevant skills could be included in the college curriculum such as Product Management, App Development, Content Marketing, UI/UX Management etc. This would help create resources that are employable and productive for startups right after college. Azhar also asked for tax exemption for angel investment and ESOPs in order to encourage angel investment as an Investment option.

Harshvardhan Mandad, co-founder & CEO of TinyOwl also wished that the government would invest more in the startups which are more research oriented mainly in medical, agriculture, environment, food which can give India an edge.

Gaurav Hinduja and Sashank Rishyasringa, co-founders, Capital Float, also stressed on the importance of encouraging contributions from SMEs. The duo hope that the initiative would guarantee policies that ensure easier access of capital to the SME community in addition to offering incentives to boost entrepreneurship and job creation.

Amit Mittal , co-founder, Simpli5d Technologies, summed up the hopes of the SME sector well when he stated, “I hope the government takes into account the constraints of a small startup and makes policies which simplify approvals and regulatory compliance. What we need for a Startup India is agile governance.”

More Power For Women Entrepreneurs

The number of women entrepreneurs who are rocking the startup ecosystem is increasing, but a little push from the government would do wonders to encourage more women to break out on their own. This is the change many women entrepreneurs wish to see with the new initiative. Says Sairee Chahal, Founder, SHEROES.in, “We would wish to see more women entrepreneurs being empowered as a result of this initiative. We also hope that some extra support is provided to help them set up, scale up along with funds availability.”

Additionally, Sairee also hopes for a change in decade old entrepreneurial policies, which were drafted mainly for the SMEs kind of organisations and catering mainly to manufacturing sector. She also hoped that the initiative also provides financial support to the entrepreneurial community by making funds easily available.

Similar sentiments were echoed by Aarti Gill, founder, FitCircle, who stated, “Women entrepreneurship is being recognised as an important source of economic growth and the special incentives for women entrepreneurs in the new policy will help overcome gender based barriers in the industry.”

Boost Ecommerce, Healthcare, Education And Transportation

While startup entrepreneurs want the government to make startup environment friendly by relaxing norms and bolstering the infrastructure, they also wish that some special sectors are especially supported to quicken the process.

Says Samar Singla, CEO of Jugnoo, “I think the two sectors that need maximum attention from the government at this point of time, are healthcare and public transportation. The medical facilities in India are not affordable to masses in India. Since it is a basic necessity of every individual, the government needs to put in a lot more efforts to take these provisions to the grassroots. Also, public transportation is a highly underutilized sector in India. The government needs to streamline this space for holistic upliftment.”

As per Swati Gupta, CEO of Industrybuying.com, ecommerce as a sector in India is still relatively small compared to the other developed and developing countries. Swati, says, “India as a country does not even feature in the top 10 ecommerce countries by sales. Manufacturing and SMEs too are very crucial for development of our country and job creation hence the focus should be on these three segments that will help the economic growth.”

Aditya Malik, CEO of Talentedge also wishes that the government should simplify and streamline the processes and systems in the ecommerce sector as it will be one of the primary drivers of growth in the Indian startup ecosystem.

Bhavin Turakhia, CEO of Directi hopes for more emphasis on education to address the problem of resource crunch as a result of poor education and lack of good infrastructure. Bhavin said, “The problem of talent crunch is a big one in our country and would require years of planning and reforms where the government can must not only create more educational forums and institutes, but also provide policy related grants on funding, real estate and create a model that incentivizes the private sector to jump in and solve some of the problems.”

So as the startup community waits with its fingers crossed for the PM’s announcements on 16 January, we hope too that the initiative marks the beginning of a better era for Indian startups. Kiran Murthi, CEO, AskmeBazaar aptly summed up the expectations of the community when he stated, “ India has a reputation that it starts slow but catches up fast and I am sure with this early edge, we will lead in this sector in the times to come. This initiative will be instrumental to catapult us to the position of number one economy in the world as predicted by industry estimates, in the next 15-25 years.”