Amidst media reports of SoftBank proposing the sale of India’s falling ecommerce unicorn Snapdeal to rival online marketplace Flipkart, Snapdeal’s employees that were offered ESOPs are now raising concerns regarding the value for their shares.

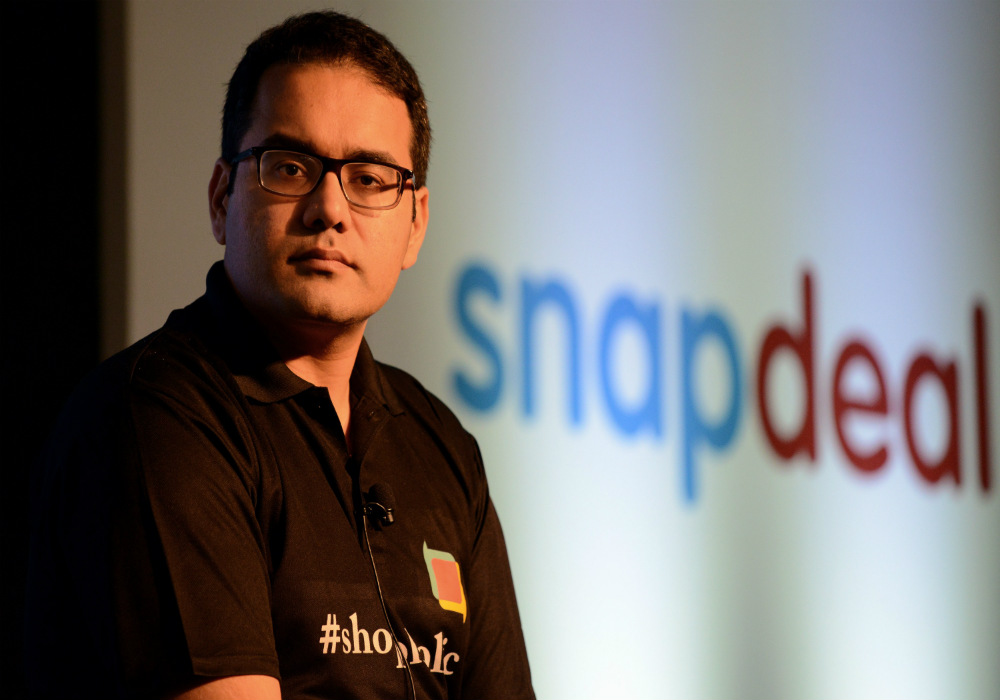

Earlier this month, Snapdeal’s CEO Kunal Bahl sent an email to his team stating that employee well-being continues to be “top priority” for the founders. But with the beleaguered company’s uncertain future, employees have reportedly questioned the value and validity of the ESOPs they were offered at the time of joining.

An employee stock ownership plan (ESOP) is an employee-owner programme that provides a company’s workforce with an ownership interest in the company. In an ESOP, companies provide their employees with stock ownership, often at no upfront cost to the employees. ESOP shares, however, are part of employees’ remuneration for work performed. Shares are allocated to employees and may be held in an ESOP trust until the employee retires or leaves the company. The shares are then sold.

As per a report by Moneycontrol, if the potential takeover of Snapdeal by Flipkart takes place, ESOPs that were issued to employees would lose value and credibility due to the company’s declined valuation. As per the above mentioned report, currently around 2,500-3,000 current as well as former employees hold around 5%-6% stake in company.

In May 2015, Snapdeal had expanded the proportion of its equity to be distributed from 6% to 10%, in a bid to gain employee loyalty. Amongst the 4,000 employees, the company had selected one third of its workers i.e. 1200 as the top performers, to be rewarded with stock options.

Requesting anonymity, a former Snapdeal employee told Moneycontrol, “There is no clarity what the ESOPs are worth now. Nobody is discussing what is to be done. A lot of people came because of the ESOPs. There’s a lack of communication from the company right now. It was like an unsaid rule. You have to take an approval from the promoters and the investors if you plan to liquidate your ESOPs. Somehow they convinced me that they had a plan for people having decent ESOPs.”

As per the same report, each ESOP offered by the ecommerce company was valid for a period of 10 years. An employee getting an option would have to serve in the company for a period of at least one year, before getting a chance of vesting his/her stock.

An email sent to Snapdeal didn’t elicit a response at the time of publication.

Are Founder(s) Promises Too Good To Be True?

It was reported earlier that Snapdeal co-founders Kunal Bahl and Rohit Bansal who, together own 6.5% equity in Snapdeal, are expected to receive $25 Mn each by selling their shares in the ecommerce marketplace. Earlier last month, reports also surfaced that the two founders of the company: Kunal Bahl and Rohit Bansal sold 11,462 shares in their personal capacity in 2015 to Ontario Teachers’ Pension Plan. The two sold 5,731 shares each, subsequently raising $24.4 Mn through the transaction.

Founded in February 2010, by Kunal Bahl along with Rohit Bansal, Snapdeal boasts to have over 65 Mn products across 1000+ categories. As per the same report, the Jasper Infotech-run company is looking to raise funds again, but its current valuation is pegged at around $4 Bn. The falling unicorn has raised about $1.76 Bn funding in 12 rounds, till date.

In February this year, the company fired about 600 people from its workforce, in its exercise of cost-cutting. In an email sent by the founders to their staff, they also conveyed their intent of taking a 100% pay cut. Snapdeal also stopped the incentive programme for customers that it previously launched through affiliates.

ESOPs are essentially illiquid stocks, the employees know what they are getting into, before they accept that option. If at all the company is to be blamed if and when employees lose value of their stock still remains unclear.

Just yesterday, it was reported that Flipkart had decided to issue differential stock options to its eligible employees. The move on Flipkart’s part came as an attempt to protect its employees from the price drop in share value, post the funding round. In 2015, Flipkart sold a marginal stake, worth $27 Mn-$30 Mn (INR 180 Cr-INR 200 Cr), in its employee trust fund to high-net-worth individuals, in a bid to allow employees to cash out their shares pre-IPO. In November 2016, reports surfaced that Flipkart had issued ESOPs to over a third of its workforce.

Following the suite, Housing.com ex-CEO Rahul Yadav allotted all of his personal shares – said to be worth between $23 Mn and $31 Mn( INR 150 Cr and INR 200 Cr) – to all of the 2,251 Housing employees. In March 2017, Paytm’s employees entered the mile-high club by selling shares worth $15.3 Mn (INR 100 Cr) to both internal and external buyers in Paytm’s parent company One97 Communications.