SUMMARY

In sharp contrast to the rise in losses, the company only saw a 41% increase in operating revenue

This is the company’s first financial performance report since being acquired in July 2021 by Blackstone in a $250 Mn deal.

The higher promotional expenses can be attributed to Simplilearn’s major marketing campaigns in late 2021 and early 2022, where it is reported to have spent over INR 20 Cr

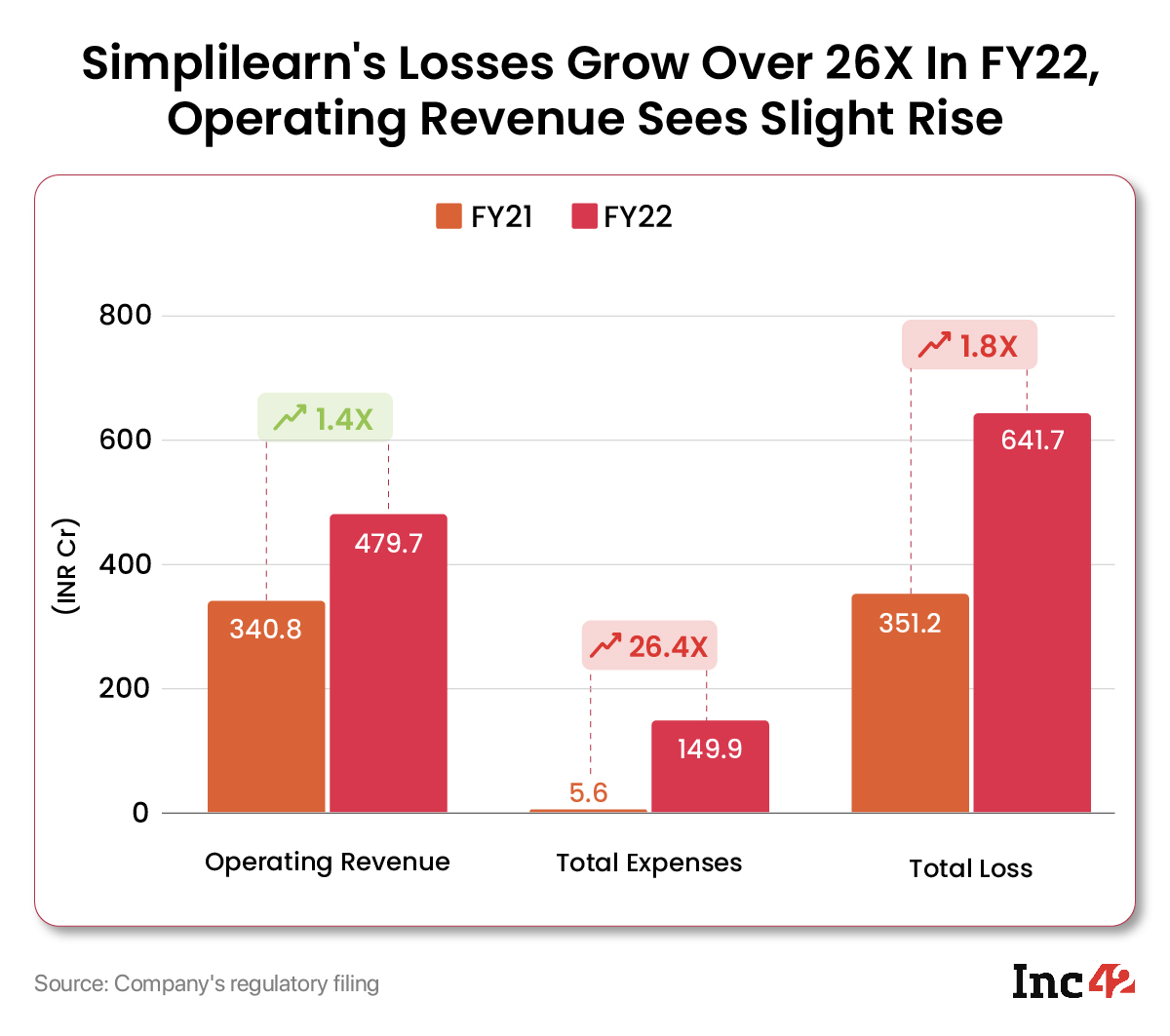

Adding to the escalating crisis in the Indian edtech ecosystem, Bengaluru-based Simplilearn witnessed a 26x rise in its consolidated losses for FY22, reporting arrears of INR 149.9 Cr (up from INR 5.6 Cr in FY21) as its promotional expenses shot up in the year.

In sharp contrast to the rise in losses, the company only saw a 41% increase in operating revenue, which went to INR 479.7 Cr in FY22 from INR 340.8 Cr in FY21. The startup’s total revenue in the reported period stood at INR 492.8 Cr as against INR 346 Cr reported in FY21.

As a platform that provides online training and courses across disciplines and collaborates with global universities to deliver the same, Simplilearn earns most of its revenue from the sale of services.

This is the company’s first financial performance report since being acquired in July 2021 by Blackstone in a $250 Mn deal.

Why Is The Bottomline Hurt?

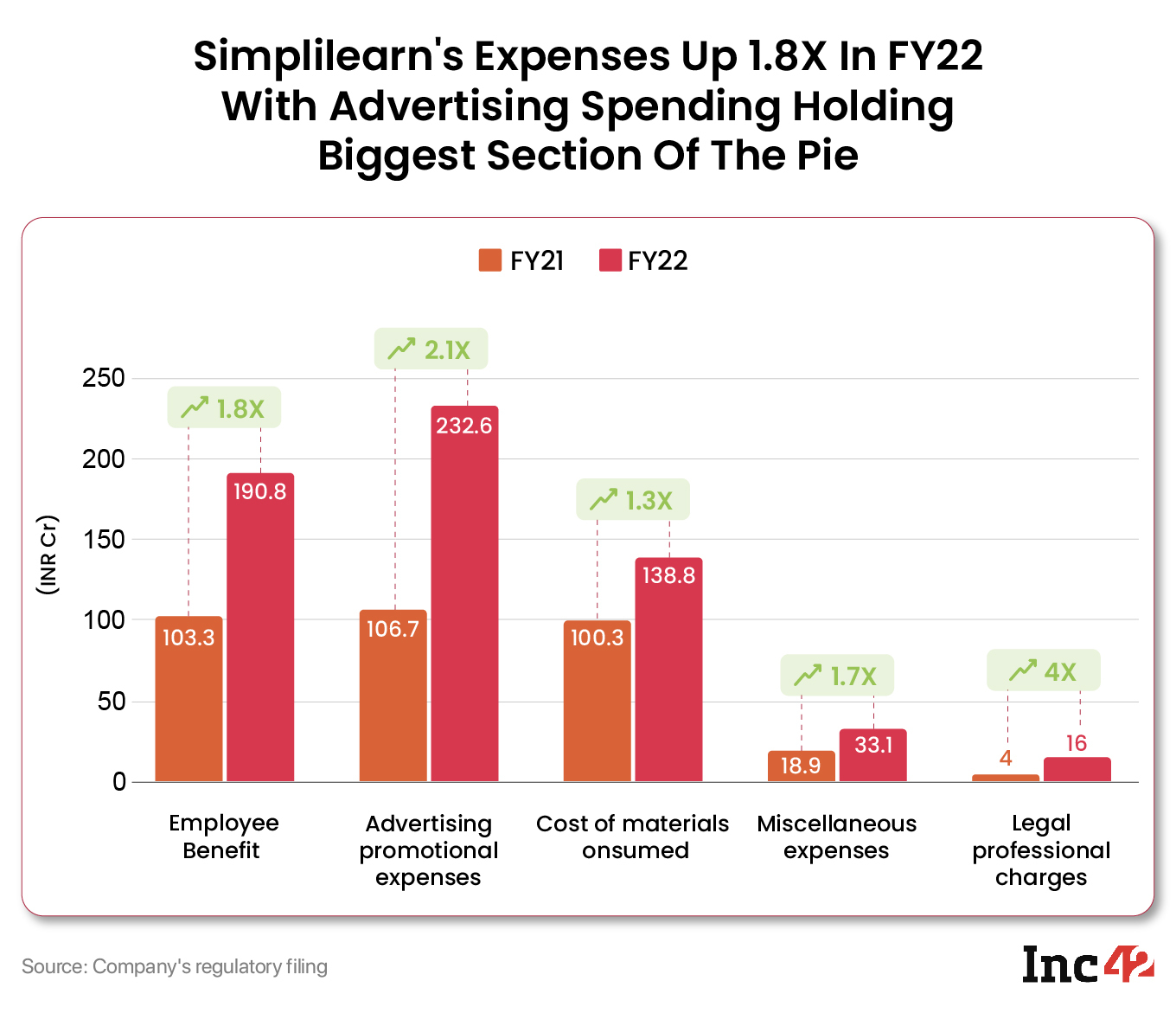

While Simplilearn keeps growing in terms of income generated, it has come at the cost of a massive amount of investment in advertisements and promotions.

With offices in California and Bengaluru, Simplilearn claims to be conducting over 1,500 live classes each month. As per its website, the startup has helped more than 2 Mn professionals and companies across over 150 countries to get trained, upskill, and acquire certifications.

To reach this scale, it spent a whopping INR 232.6 Cr in FY22 in the form of advertising and promotional expenses, which alone was almost half of Simplilearn’s revenue generated from operations. This is more than 2X the INR 106.7 Cr spent during FY21.

The higher promotional expenses can be attributed to Simplilearn’s major marketing campaigns in late 2021 and early 2022. In September 2021, it launched a campaign to celebrate success stories of students on its platform, while around March-April 2022, it is reported to have spent INR 20 Cr for ads around IPL 2022.

The higher spending towards the end of FY22 is in contrast to the cost-cutting at other edtech startups. Over 7,000 edtech employees have been let go in the year to control costs and cash burn by edtech majors such as BYJU’S, Unacademy, Vedantu, FrontRow, Lido and others.

Simplilearn’s employee benefit expenses have actually risen almost 85% in FY22, which goes to show it was on a hiring spree in the year. It is as yet unclear whether the company has rationalised its costs since then given that it has suffered such high losses.

Employee benefits expenses stood at INR 190.8 Cr in FY22 as against INR 103.3 Cr in FY21. The majority of the increase was due to the increase in salaries and wages, which rose 54.7% to INR 137.5 Cr in the year.

Simplilearn’s spending on the employee stock option scheme and employee stock purchase plan (ESOPs) also increased 220% to INR 27.2 Cr in the year.

The startup also witnessed a 4X increase in its legal professional charges to INR 16 Cr in FY22 from INR 4 Cr in the prior fiscal year. Much of this can be attributed to the deal by Blackstone.

Early-stage investor Kalaari Capital also got an exit from the startup in the deal, with almost a 14X return. Having invested about $9 Mn over the years in Simplilearn, the firm exited with $126 Mn as a return on investment.

Edtech Startups In The Red

Simplilearn is not the only edtech platform that is struggling with rising expenses and widening losses. The situation is particularly worse for the edtech players in the K-12 segment.

BYJU’S reported a 20X surge in its loss to INR 4,588 Cr in FY21 from INR 231.69 Cr in FY20. Meanwhile, Gaurav Munjal-led Unacademy’s loss widened by 494% in FY21 to INR 1,537.4 Cr from INR 258.6 Cr in FY20.

As per its latest filings, Unacademy’s losses nearly doubled to INR 2,693.07 Cr in FY22, with a similar growth in revenue from operations, which rose to INR 596 Cr from INR 336 Cr.

Among the startups worst hit by the edtech slowdown were Lido Learning, which shut down and has filed for insolvency. Edtech startups like Udayy, Crejo.Fun, Qin1, and SuperLearn have also shuttered operations. Schools reopening post the Covid-19 pandemic restrictions have hurt these largely online-focused edtech platforms that were booming during the pandemic period. The existing players are currently shifting their focus to offline coaching classes.

Due to a funding crunch in the space, funding fell steeply to $537 Mn in Q2 of 2022 from $1.4 Bn in Q1 of this year and then plummeted further to $289 Mn in the quarter ending September 2022, as per an Inc42 report.