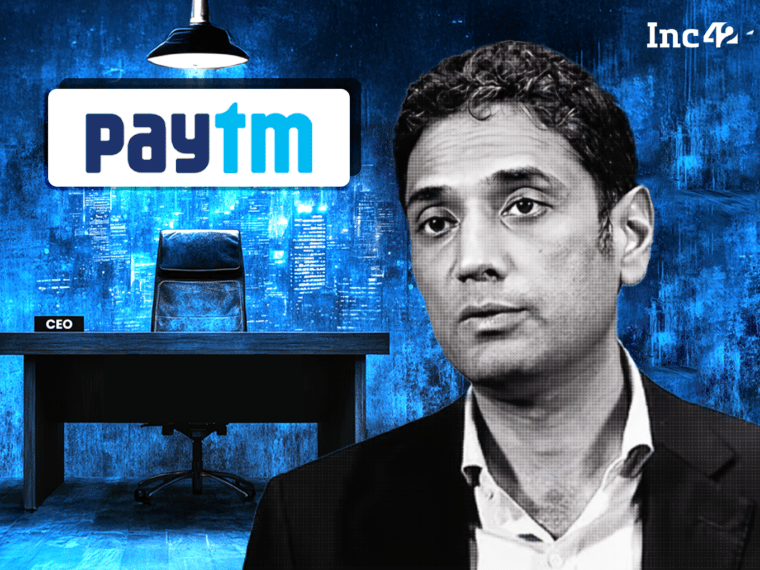

Paytm Payments Services Limited’s managing director and CEO Nakul Jain has stepped down from his position to pursue an entrepreneurial venture, effective March 31

PPSL is actively working on identifying a suitable replacement and will announce the new appointment in due course

Jain, as per his LinkedIn profile, has been working with PPSL for nearly three years

Paytm

In a regulatory filing, the company said, “Jain has decided to pursue an entrepreneurial journey, which has led him to this decision. PPSL is actively working on identifying a suitable replacement and will announce the new appointment in due course.”

Jain, as per his LinkedIn profile, has been working with PPSL for nearly three years. Right before that, he worked with Standard Chartered Bank as managing director of private banking, priority banking, deposits and branch banking, India for a period of almost five years.

He has an overall experience in the banking industry for nearly 25 years.

As of 10:31 AM, Paytm’s shares were down 1.7% at INR 767.00 during the morning trade on the BSE, today. The stock closed at INR 780.20 on Monday (January 27).

This development comes at a time when Paytm has seen multiple leadership exits across various subsidiaries of the company in the past year.

For instance, Paytm’s head of compliance Srinivas Yanamandra resigned from the fintech company in late December 2024.

A month before that, Shreyas Srinivasan, Paytm’s chief product officer and head of consumer products, has announced his departure from the fintech company.

It is also noted that the company’s financial performance has also been tested due to the year long checks from the Reserve Bank of India (RBI).

Even as Paytm trimmed its quarterly net loss by 6% on a YoY basis to INR 208.5 Cr in the quarter ending December 2024 (Q3 FY25) from INR 221.7 Cr, a year ago, its revenue from operations declined by 36% to INR 1,827.8 Cr compared to INR 2,850.5 Cr from the year-ago period.

Updated at 10:36 AM

.svg)

Fintech

Fintech Travel Tech

Travel Tech Electric Vehicle

Electric Vehicle Health Tech

Health Tech Edtech

Edtech IT

IT Logistics

Logistics Retail

Retail Ecommerce

Ecommerce Startup Ecosystem

Startup Ecosystem Enterprise Tech

Enterprise Tech Clean Tech

Clean Tech Consumer Internet

Consumer Internet Agritech

Agritech