Paytm disbursed 4.1 Mn loans in March, an increase of 63% year-on-year

Paytm’s average monthly transacting users (MTU) stood at 90 Mn during Q4 FY23, up 27% from the year-ago quarter

The increase in MTU and the number of Soundbox devices took Paytm’s GMV to INR 3.62 Lakh Cr during Q4 FY23

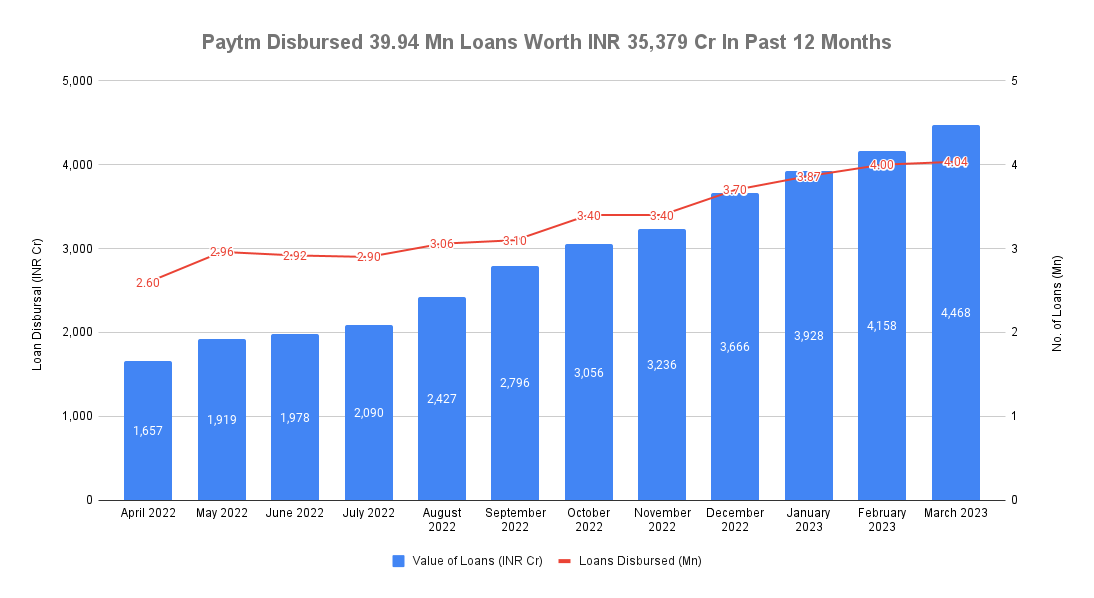

Listed fintech giant Paytm disbursed 4.1 Mn loans worth INR 4,468 Cr in March 2023, registering a year-on-year (YoY) growth of 63% and 206%, respectively.

Compared to February 2023, loan disbursal grew 7.46% from INR 4,158 Cr and the number of loans disbursed rose 0.88% from 4 Mn.

In its monthly business update, filed with the stock exchanges, the fintech company said that its average monthly transacting users stood at 90 Mn during the three months ended March 31, 2023, 27% higher than the year-ago period.

“Average monthly transacting users (MTU) stood at 90 Mn for the quarter (average for three months ended March 2023), up 27% y-o-y, reflecting continued expansion of our customer base,” it said.

Further, the fintech giant installed an additional million point-of-sale devices during the March 2023 quarter, taking the total to 6.8 Mn Soundbox devices across the country.

“With our subscription as a service model, the strong adoption of devices drives subscription revenues and higher payment volumes, while increasing the funnel for our merchant loan distribution,” said Paytm.

The increase in MTU and the number of Soundbox devices took Paytm’s gross merchandise value (GMV) to INR 3.62 Lakh Cr during Q4 FY23, up 40% compared to INR 2.59 Lakh Cr during the year-ago quarter.

Shares of Paytm

Lending Vertical Sees Strong Growth

Paytm recorded its best-ever quarter in terms of loan disbursements in Q4 FY23, recording near-consistent growth over the past five quarters. In the 12 months ended March 31, 2023, the fintech giant disbursed nearly 40 Mn loans worth INR 35,379 Cr.

Similarly, average loan size also increased significantly over the past 12 months, rising from INR 6,373.08 in April 2022 to INR 11,073.11 in March 2023, as per Inc42 analysis.

Paytm has established itself as a strong player in the lending segment, offering personal loans to users. Further, it has partnered with banks such as HDFC Bank to offer co-branded credit cards to users.

In March this year, Paytm said it upgraded its tech stack and the new system would be able to handle up to 10 times the current scale and improve the overall digital payments experience.

During the same month, the listed fintech received more time from the RBI to reapply for the payment aggregator licence, subject to the Centre’s approval of the investments made by Paytm into its wholly-owned subsidiary Paytm Payments Services Limited (PPSL).

Last week, Paytm Payments Bank also said that it has enabled interoperability of its wallet for UPI transactions.

Analysts expect that the National Payments Corporation of India’s move to allow prepaid payment instrument (PPI) issuers to charge interchange fees of 1.1% for merchant transactions of above INR 2,000 to bring in additional revenue for the company.

Fintech

Fintech Travel Tech

Travel Tech Electric Vehicle

Electric Vehicle Health Tech

Health Tech Edtech

Edtech IT

IT Logistics

Logistics Retail

Retail Ecommerce

Ecommerce Startup Ecosystem

Startup Ecosystem Enterprise Tech

Enterprise Tech Clean Tech

Clean Tech Consumer Internet

Consumer Internet Agritech

Agritech