SUMMARY

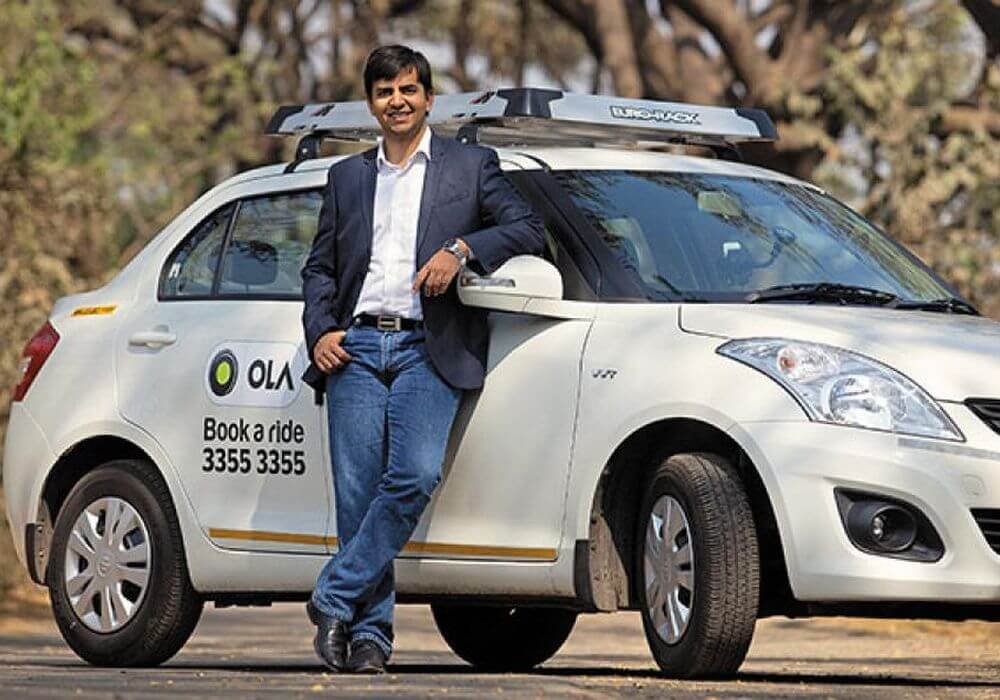

Ola Is Aiming To Post Net Operating Profit Of Over $992 Mn By FY2020-21

Amidst reports of Tiger Global Management looking to sell its stake in Ola to SoftBank, the homegrown cab aggregator is quietly gearing up to become profitable by FY 2019.

As per a valuation report filed with the ministry of corporate affairs compiled by chartered accountancy firm Jain Ambavat and Associates, Ola is projected to become profitable during 2018-19 and report a net operating profit of over $180.7 Mn (INR 1,170 Cr), which is further expected to grow further to $992 Mn (INR 6,423.33 Cr) by FY 2020-21.

The SoftBank-backed cab aggregator had posted a net operating loss after tax of $429.68 Mn (INR 2,781.70 Cr) in FY2016-17, almost double of its losses from the previous year. A year earlier, the company’s losses were about $123.9 Mn (INR 796 Cr).

Ola, SoftBank And The Path To Becoming Profitable

The valuation report comes at a time when Ola is involved in a flurry of investor activity. Just this week, Lee Fixel, Partner at Tiger Global Management, had stepped down from the board of homegrown cab aggregator, Ola. As per filings with the Ministry of Corporate Affairs, the US-based investment firm currently holds a minority stake in Ola.

Under the leadership of Lee Fixel, the firm led major funding rounds in home-bred ecommerce giant Flipkart, Ola and Quikr. Tiger Global has been on Ola’s board since March 2012, when it led a Series A funding round in the cab aggregator. Its last investment in Ola was made in November 2015, when it participated in a $500 Mn Series F round. However in the last two years, Tiger Global has slowed down its funding spree in India significantly. As a result, in 2016, it participated only in four startup funding rounds. As per sources, Tiger Global is still aiming to cut its India bets.

Immediately after Fixel’s step down, reports surfaced that the US-headquartered firm was ready to sell its stake in the cab aggregator to none other than SoftBank. A media report today states that the New York-based investor is expected to sell around 7.5% stake in Ola worth $300 Mn.

If the deal between SoftBank and Tiger Global goes through, the former might become the largest shareholder in the ride-sharing startup. However it needs to be remembered that any move by SoftBank to raise its holding in Ola would need to be approved by the founders as per the changes made by Ola to its Articles of Association this year. Incidentally, one of the clauses states that any investor cannot buy shares in Ola without the approval of founders – Bhavish Aggarwal and Ankit Bhati.

Ola meanwhile is also busy strengthening its fund bank as it is locked in an intense battle for leadership with Uber. In October this year, the ride-sharing startup confirmed $1.1 Bn investment in a round led by Tencent Holdings Limited, in exchange for a 9.75% stake.

In the official statement, Ola also revealed that it was in advanced talks with other investors to close an additional $1 Bn as part of the same financing round, taking the total fundraise to over $2 Bn. Meanwhile rival Uber which is now embroiled in a scandal involving cover up of a massive data breach, had net revenues of $6.5 Bn at the end of 2016, an impressive number if we don’t consider the $2.8 Bn losses it encountered during the same period. In the case of India, total revenue reported in FY15 was only $3 Mn (INR 18.7 Cr) higher than losses incurred. Interestingly, Uber itself is currently in the process of raising a staggering $10 Bn from Softbank and a clutch of other investors, fuelling rumours of a merger with Ola. However what will ultimately happen first- a merger or one of the two managing to become profitable in the hyper competitive Indian market- is something we will have to wait and watch.

[The development was reported by ET]