SUMMARY

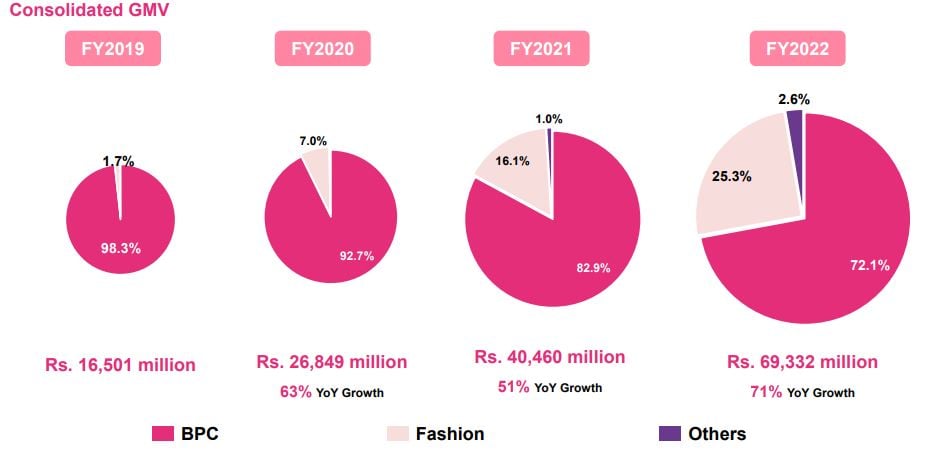

GMV of the fashion vertical contributed 25.3% to consolidated GMV of Nykaa in FY22

Orders for Nykaa’s fashion business more than doubled to 52 Lakh in FY22 from 24 Lakh in FY21

Nykaa’s monthly average unique visitors for its fashion vertical grew 60% YoY to 1.6 Cr in the March quarter of FY22

The gross merchandise value (GMV) of ecommerce platform nykaa

The startup on Friday reported a 33% decline in profit after tax (PAT) at INR 41.3 Cr in FY22. While the beauty and personal care (BPC) continued to contribute the highest value to its total GMV, the nascent fashion vertical, Nykaa Fashion, contributed 25.3% to its consolidated GMV for the year.

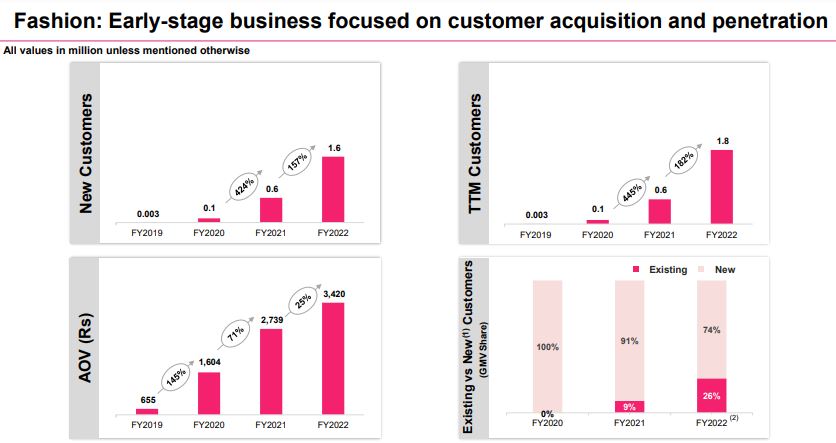

The ecommerce platform also saw its annual unique transacting customers on the fashion vertical grow 182% to 18 Lakh in FY22 from 6 Lakh in FY21. Orders on its fashion business more than doubled to 52 Lakh in FY22 from 24 Lakh in FY21.

The average order value (AOV) for Nykaa Fashion also surged by 25% to INR 3,420 during the year as compared to INR 2,739 in previous fiscal.

Net Sales Volume (NSV) of the fashion segment also soared 148% to INR 572.8 Cr from INR 230.8 Cr, while revenue grew 126% to INR 325.4 Cr.

Nykaa’s fashion business also registered a steep growth of 166% in gross profit to INR 255.5 Cr in FY22. However, its earnings before interest, tax, depreciation and amortisation (EBITDA) remained in negative at INR 68.2 Cr.

On a quarterly basis, Nykaa’s monthly average unique visitors for its fashion vertical grew 60% YoY to 1.6 Cr in March quarter of FY22. Number of orders also soared 62.5% on a yearly basis to 13 Lakh in FY22, while average order value for the quarter ending March 2022 grew 18% to INR 3,632 in Q4 FY22.

Nykaa Fashion’s GMV also rose to INR 482.7 Cr from INR 261.9 Cr during the quarter.

On Friday, shares of FSN Ecommerce Ventures,the parent company of Nykaa, closed 0.93% lower at INR 1351.80 on the BSE.