SUMMARY

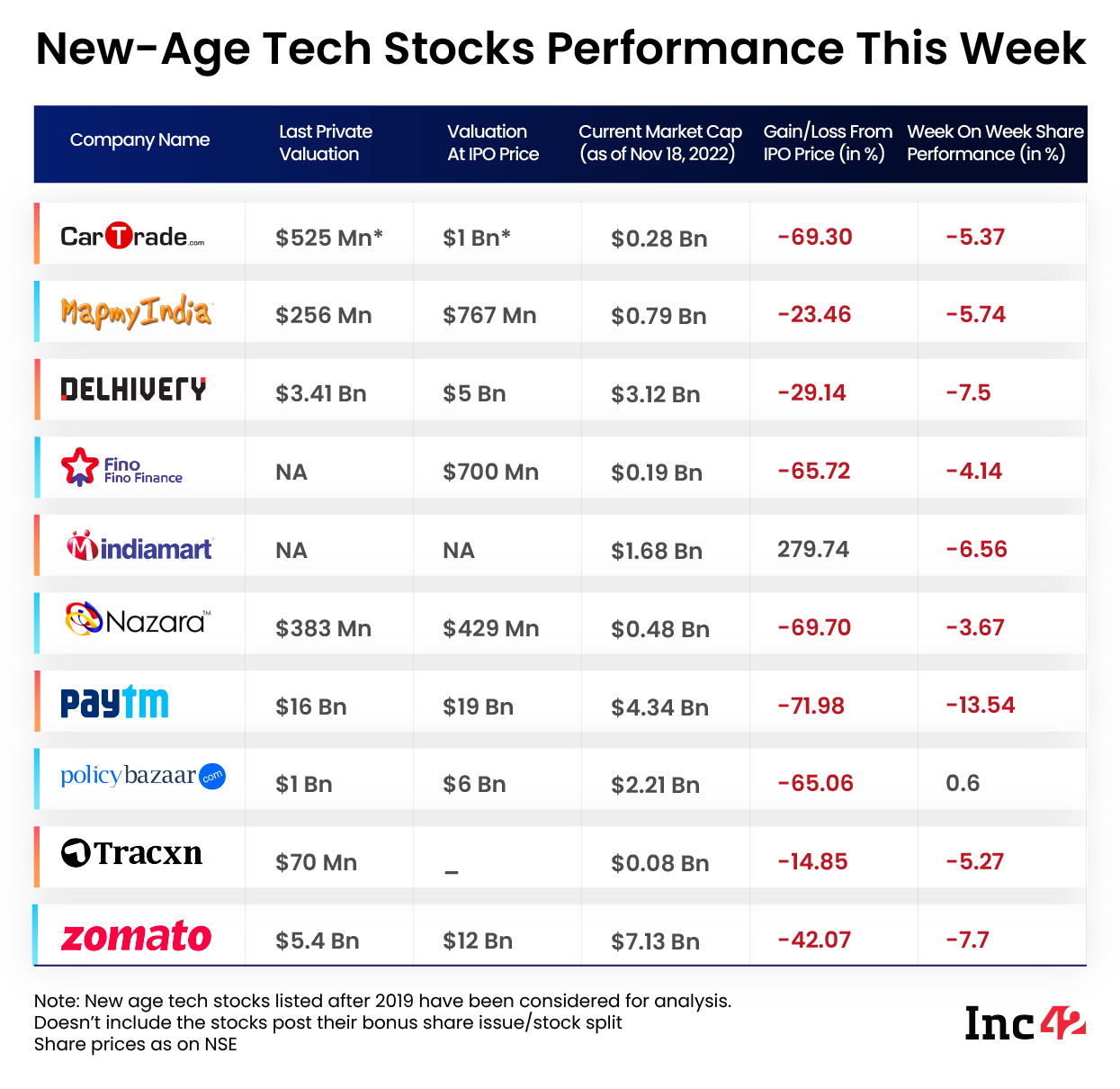

With Paytm's lock-in expiry this week, its shares turned out to be the biggest loser, falling over 13% to INR 546.3 on the BSE

PB Fintech was the only gainer this week, rising 0.9% to end the week at INR 402.8

Benchmark indices NSE Nifty50 and BSE Sensex were also down marginally this week, ending Friday’s session at 18,307.65 and 61,663.48, respectively

After significant upward rallies in two consecutive weeks around the announcement of Q2 financial results, the Indian new-age tech stocks slumped this week. The overall Indian stock market remained volatile during the week.

With Paytm’s lock-in expiring this week, its shares turned out to be the biggest loser among the new-age tech stocks. The stock fell over 13% to INR 546.3 on the BSE. Zomato was the second biggest loser, falling 7.7% to INR 67.15 on the BSE.

All the other tech stocks – from Delhivery to the recently-listed Tracxn Technologies – fell between 4% to 7.5%. Policybazaar parent PB fintech was the only gainer this week, as it rose 0.9% to end the week at INR 402.8. On Friday alone, Policybazaar shares jumped about 8% from Thursday’s close.

Unlike its major peers, Policybazaar did not see any significant slump or sell-off despite the lock-in expiry. Amol Athawale, deputy vice president of technical research at Kotak Securities, said that Policybazaar is in a range-bound formation, but a fresh breakout is possible if it manages to trade above INR 405.

he slump in all the other tech stocks was majorly driven by the overall macroeconomic volatility, which has hurt tech stocks globally. However, the impending lock-in expiry next week could have played a major role in dragging down the share price of Delhivery. Nykaa also came under pressure as several of its pre-IPO shareholders dumped shares this week.

Avendus Capital Public Market Alternate Strategies LLP CEO Andrew Holland told another publication this week that the firm will be closely looking at Nykaa, Paytm, and Zomato in terms of their business models.

Meanwhile, the benchmark indices NSE Nifty50 and BSE Sensex fell marginally this week, ending Friday’s session at 18,307.65 and 61,663.48, respectively.

“Domestic equities witnessed selling pressure amid mixed global cues. Hawkish commentary from Fed officials over continuation of aggressive stance in subsequent meets dented the global sentiments. Next week FOMC (Federal Open Market Committee) meeting minutes are due, which would provide further cues to the market,” said Siddhartha Khemka, head of retail research at Motilal Oswal.

Now, let’s dig deeper into the weekly performance of some of the listed new-age tech stocks from the Indian startup ecosystem.

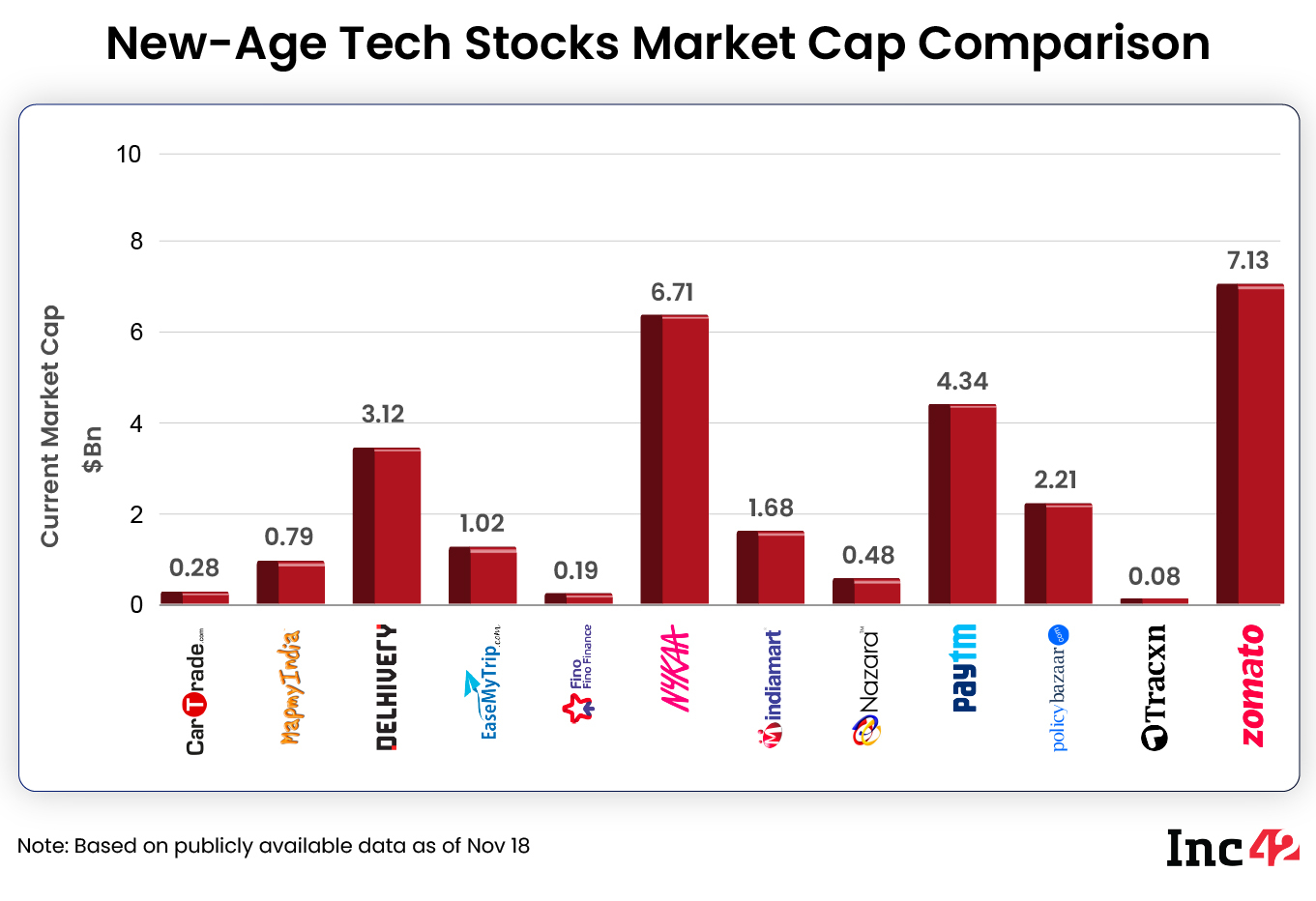

The 12 new-age tech stocks under our coverage ended this week with a total market capitalisation of $28.03 Bn versus $30.82 Bn last week.

Investors Dump Paytm Shares

Shares of Paytm fell in three consecutive sessions this week as some of its pre-IPO shareholders, including SoftBank, dumped the shares with the 12-month lock-in period ending by November 18.

Paytm shares were down 13% to INR 546.3 on the BSE this week. However, the shares rose over 1% from Thursday’s close on Friday.

In The News For:

- SoftBank Group sold 2.9 Cr Paytm shares, or 4.5% of its stake in the fintech giant, for INR 1,630.9 Cr (approximately $200 Mn) in a bulk deal

- As per NSE’s bulk deal data, BofA Securities Europe, Morgan Stanley Asia, and Societe Generale ODI purchased about 2 Cr shares of Paytm

- Enforcement Directorate (ED) conducted searches at the residential premises and offices linked to fintech majors, including Paytm, in connection with a digital part-time job scam involving Chinese nationals

- Paytm issued 3.4 Mn loans worth INR 3,056 Cr ($407 Mn) in October 2022, which was a 2.6X rise in the number of loans disbursed YoY

- Paytm’s net loss widened 21% year-on-year (YoY) to INR 571 Cr in Q2 FY23

Despite the ongoing volatility in its stocks, several brokerages have reiterated their bullish stance on Paytm in the recent days.

Paytm’s texture is still weak because of lower top formation, but it is oversold in the short-term timeframe, said Kotak Securities’ Athawale.

“There is a possibility of a pullback rally if the stock succeeds to trade above INR 560, which could be the immediate resistance zone. Below the same, the stock is likely to trade with a negative bias,” he said.

On the lower side, INR 520 and INR 500 would be the immediate support for the stock, Athawale added.

Nykaa Slumps After A Stellar Week

While Nykaa’s 5:1 bonus share issue cushioned it from any sell-off on the expiry of its lock-in period last week, the stock plunged significantly in two straight sessions as its pre-IPO shareholders started dumping stocks after the bonus shares were credited to its shareholders’ demat accounts mid-week.

The shares fell about 7.5% this week, ending Friday’s session at INR 192.45 on the BSE. However, they recovered a bit on Friday, ending the session 3.7% higher compared to Thursday’s close.

In The News For:

- Several pre-IPO investors including Mala Gopal Gaonkar, Segantii India Mauritius, TPG Capital, and Lighthouse India Fund III sold their stocks in bulk/block deals this week

- The beauty ecommerce giant’s shares going ex-bonus coinciding with its lock-in expiry date has raised questions on corporate governance

- Nykaa, Reliance Retail, Aditya Birla Fashion and Trent Ltd, along with some PE firms, have reportedly shown interest in buying a stake in TCNS Clothing, the parent company of womenswear brands W and Aurelia.

Nykaa shares have now formed a range with higher side at INR 220 and lower side at INR 170. Looking at the current scenario, the stock is likely to trade within a range, said Athawale.

“INR 170-INR 175 would be the immediate support level for the stock and on the flip side, INR 210 to INR 220 is the immediate resistance for the stock,” he added.

Delhivery Witnesses One Of Its Worst Weeks

Shares of logistics unicorn Delhivery slumped 7.7% this week as they fell for three straight sessions. It ended Friday’s session at INR 351.15. Its lock-in period expires next week, which is likely to add more volatility to the stock.

In The News For

- SoftBank, Canada Pension Plan Investment Board, Tiger Global, Alpha Wave Ventures, Times Internet, Steadview Capital, and Fedex are some of the major pre-IPO investors of Delhivery. A total of over 500 Mn shares would be free to be traded in the open market after the lock-in expires next week

- Brokerage CLSA has upgraded Delhivery to ‘buy’ rating with a target price of INR 532 amid the slump as the startup’s long-term growth outlook remains intact

- Delhivery reported a narrowed loss of INR 254.1 Cr in Q2 FY23, down nearly 60% on a YoY basis

Delhivery has formed a trading range with INR 400 on the higher side and INR 350 on the lower side. “There is a possibility of a pullback if the stock succeeds to trade above INR 370-INR 380. If the stock trades above that same level, then the immediate hurdle for the stock would be INR 400 and INR 410,” said Athawale.