SUMMARY

Policybazaar, which was largely on a losing streak for the past few weeks, rose this week, emerging the second-biggest gainer

Fino Payments Bank changed its rising course this week and declined a little over 2% on a weekly basis

Benchmark indices NSE Nifty50 and BSE Sensex rose 1.68%, ending Friday’s session at 17,833.35 and 59,793.14, respectively

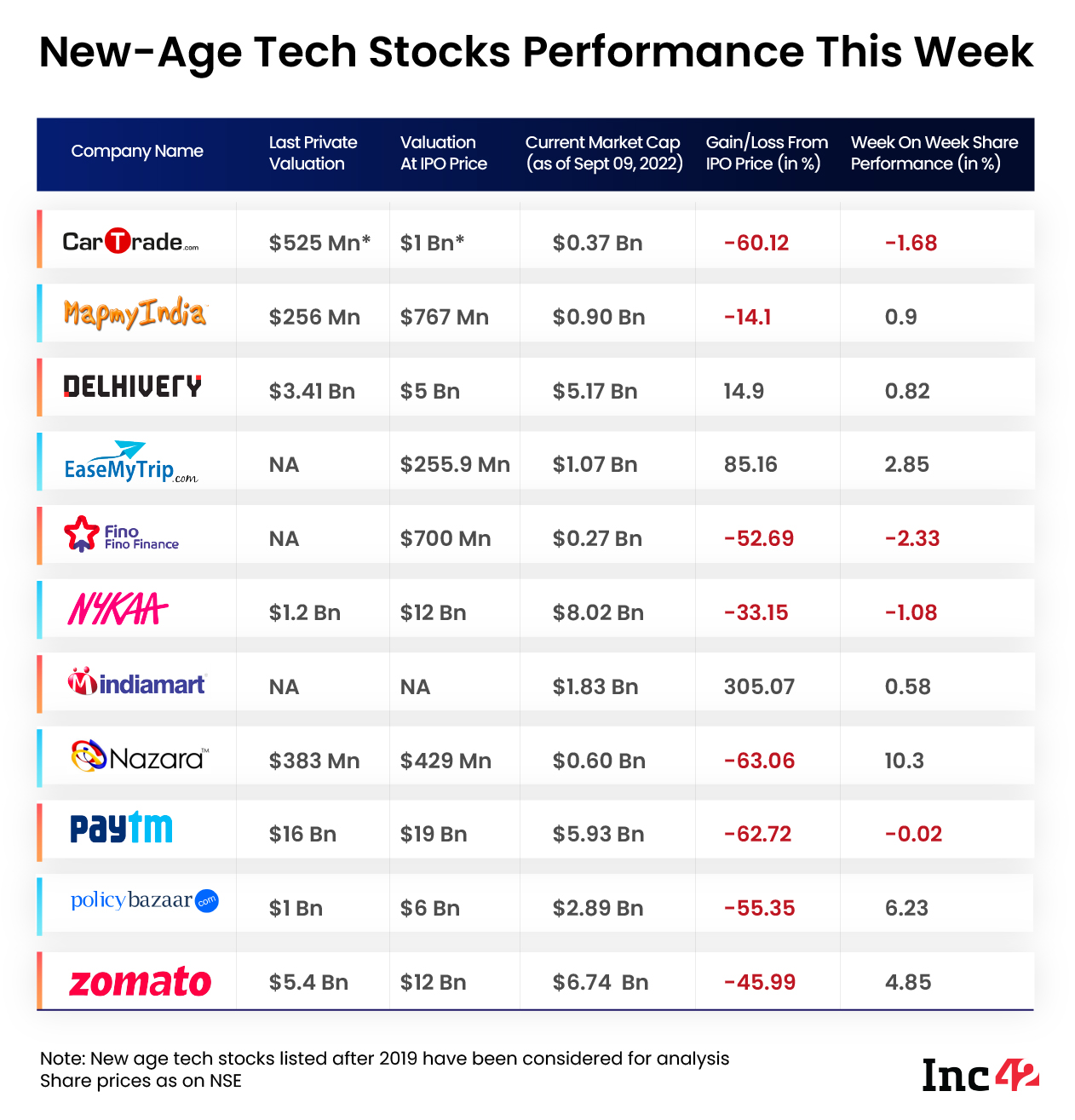

The new-age Indian tech stocks saw an upswing this week, with a majority of them ending higher, in line with the overall Indian stock markets.

Nazara Technologies, which has been on an upward trend since last week, was the biggest winner among the 11 new-age tech stocks tracked by Inc42. On the other hand, Policybazaar, which was largely on a losing streak for the past few weeks, also rose and was the second-biggest gainer.

Zomato regained momentum in the second half of the week after a subdued last week, ending 5% higher on a weekly basis at INR 62.75 on the BSE.

On the other hand, Fino Payments Bank changed its rising course this week and declined a little over 2% on a weekly basis, ending Friday’s session at INR 257.1 on the BSE.

The decline in Nykaa’s share price continued despite positive commentary from brokerage JM Financial. The Indian brokerage in a research note on Thursday (September 8) said that despite inflationary pressures, Nykaa remains well positioned to capitalise on the growth of the Indian beauty and personal care and fashion market.

Nykaa shares ended over 1% lower on a weekly basis, ending Friday’s session at INR 1,346.5 on the BSE.

Overall, the Indian stock market rose during the week after a few dull weeks. Both the benchmark indices NSE Nifty50 and BSE Sensex were up 1.68%, ending Friday’s session at 17,833.35 and 59,793.14, respectively.

Sensex hitting the psychological 60,000-mark intra-day on Friday signified investors’ faith in the domestic economy, said Amol Athawale, deputy vice president of technical research at Kotak Securities.

“While stock markets may look a bit pricey, India’s long-term growth potential does bring some stability at a time when economic slowdown in key economies are staring at recession fears,” he said.

Now, let’s take a look at the weekly performance of the listed new-age tech stocks from the Indian startup ecosystem.

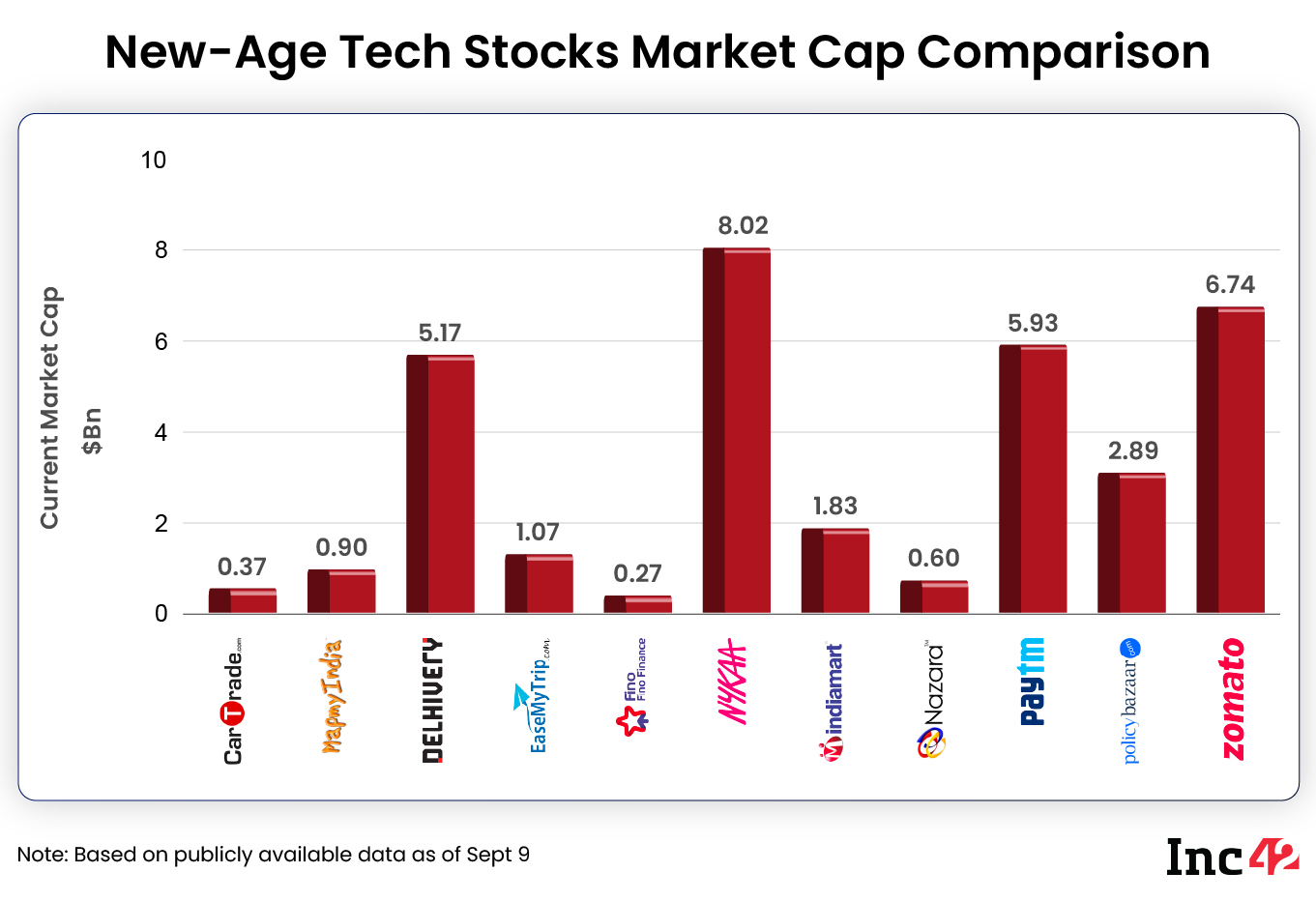

The 11 new-age tech stocks ended the week with a combined market cap of around $33.79 Bn versus $33.2 Bn last week.

Paytm Remains Range-Bound

Shares of One 97 Communications, the parent entity of payments technology startup Paytm, traded sideways during the week, but ended Friday’s session in the green.

Paytm shares rose about 3% on Friday compared to Thursday’s close and ended the week at INR 727.85 on the BSE.

However, on a weekly basis, the shares were down marginally even as the gains in the later half of the week offset some of the loss made in the first session of the week after reports emerged about the Enforcement Directorate’s (ED) searches at its premises.

In The News For:

- Paytm disbursed 3.1 Mn loans worth INR 2,427 Cr during August 2022 compared to 2.9 Mn loans in July. The startup said that the number of loans rose 246% year-on-year (YoY) during the two months ending August 31.

- The ED searched the premises of Paytm along with Cashfree and Razorpay as part of its investigation in the Chinese loan apps case.

- Paytm said that the ED has instructed the startup to freeze certain amounts from the merchant IDs of a specific set of merchant entities, and none of the funds, which have been instructed to be frozen, belong to Paytm or any of its group companies.

Paytm shares are currently trading over 62% lower than their debut price on stock exchanges. The shares listed at INR 1,950 on the NSE and INR 1,955 on the BSE in November last year.

Nazara Technologies Jumps Over 10%

Continuing its upward momentum from last week, shares of gaming startup Nazara Technologies jumped over 10% this week, ending Friday’s session at INR 736 on the BSE.

Shares of Nazara started rising after it announced the acquisition of 100% stake in the US-based gaming firm WildWorks in an all-cash deal early last week. Though the shares fell in the first three sessions this week, they rose sharply in the next two sessions.

The shares rose a little over 11% on the BSE on Friday alone.

Brokerage Prabhudas Lilladher increased its sales estimates for Nazara last week by 5% and 10% for FY23 and FY24, respectively, following the acquisition of WildWorks.

The startup this week also said that it will hold its 23rd AGM on September 29.

At the current level, Nazara shares are trading over 62% lower on the BSE from their debut price.

Policybazaar Reverses Direction, Rises Over 6%

Shares of PB Fintech, the parent company of insurtech startup Policybazaar, were on a decline for almost a month since August 17, driven by various factors including regulatory changes in the insurtech segment, a data breach event, among others.

However, the shares gained back some momentum this week, rising over 6% and emerging as the second-biggest gainer among the new-age tech stocks.

Shares of Policybazaar ended Friday’s session about 3% higher at INR 512.8 on the BSE.

Meanwhile, the startup disclosed that it granted employee stock ownership plans (ESOPs) worth INR 1,044.13 Cr to its three executives in FY22.

PB Fintech Chairman and cofounder Yashish Dahiya got INR 613.83 Cr in ESOPs, while its executive vice-chairman and cofounder Alok Bansal received INR 360.92 Cr of options during the year. Its president Sarbvir Singh also received ESOPs of INR 69.38 Cr.

With a current market cap of INR 23,050.35 Cr, Policybazaar shares are trading over 55% lower from their debut price of INR 1,150 on the NSE and the BSE.