SUMMARY

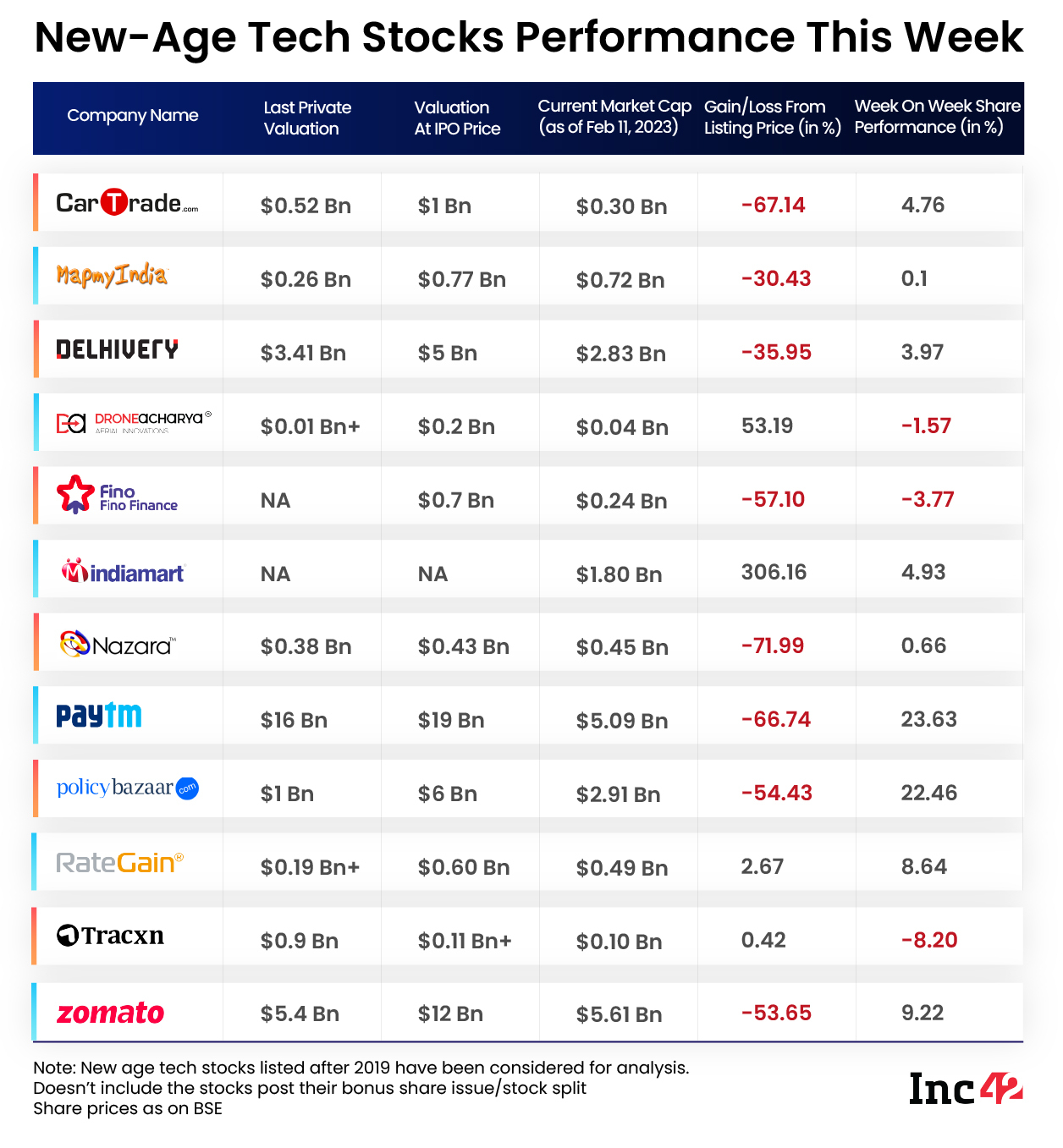

Out of 14 startup stocks under Inc42’s coverage, 11, including Paytm, Zomato, Nykaa, and PB Fintech, rose this week, gaining in the range of 0.1%-23%

While Paytm gained over 23% this week to emerge as the biggest winner, Tracxn was the biggest loser with a fall of over 8%

The broader Indian equity market remained volatile this week; Sensex fell 0.26% to 60,682.70, while Nifty50 ended marginally higher at 17,856.5

New-age Indian tech stocks rallied this week amid positive market sentiments as most of the startups reported Q3 financial results in line with the Street expectations.

Out of 14 startup stocks under Inc42’s coverage, 11, including Paytm, Zomato, Nykaa, and PB Fintech, rose this week, gaining in the range of 0.1%-23%.

Zomato, PB Fintech, Delhivery, RateGain, EaseMyTrip, and Tracxn reported their Q3 results this week. Except for Tracxn, the rest of the stocks gained on a weekly basis either due to their good performance or on expectations of a good performance in the December quarter.

Tracxn was the biggest loser as its shares declined 8.2% this week, ending Friday’s session at INR 83.35 on the BSE. The slump in its performance came despite reporting a year-on-year (YoY) and quarter-on-quarter (QoQ) rise in profit after tax (PAT) at INR 6.21 Cr.

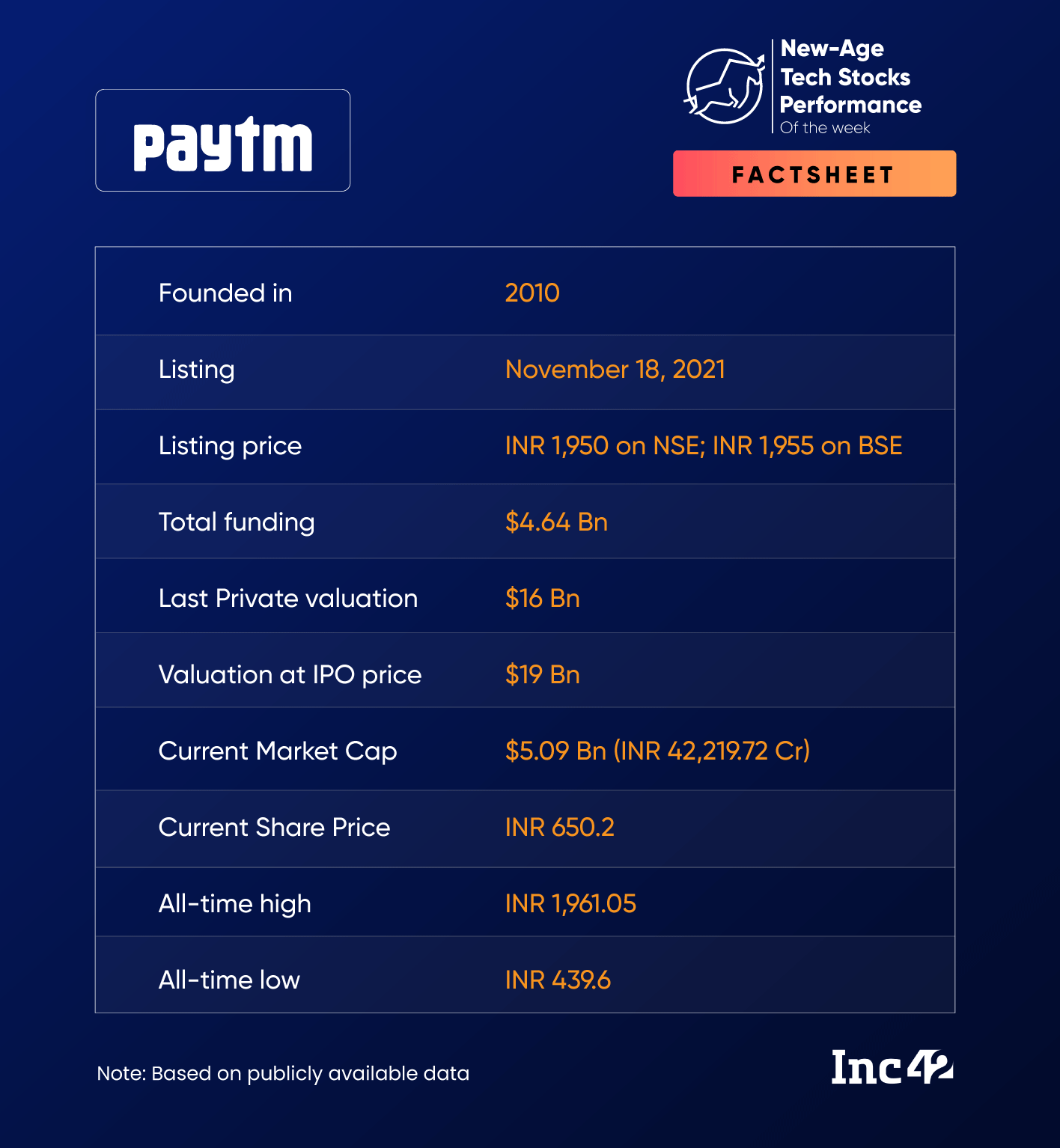

Meanwhile, Paytm gained over 23% this week to emerge as the biggest winner, helped by its strong December quarter performance reported last Friday. The stock ended the week in the green despite the sharp decline on Friday due to Alibaba Singapore exiting the company.

The broader Indian equity market remained volatile this week, partially driven by the ongoing controversies pertaining to the Adani Group companies.

Among the benchmark indices, Sensex fell 0.26% to 60,682.70 this week, while Nifty50 rose 0.01% to 17,856.5.

“RBI monetary policy committee raised the repo rate by 25 bps and remained concerned about core inflation. International oil prices rose this week, with Brent Crude now trading close to $86-87 per barrel. As the Q3 FY23 result season comes towards an end, the investor focus will now shift towards domestic and global macro factors,” said Shrikant Chouhan, head of equity research (retail) at Kotak Securities.

Now, let’s dig deeper to understand the performance of some of the new-age tech stocks from the Indian startup ecosystem.

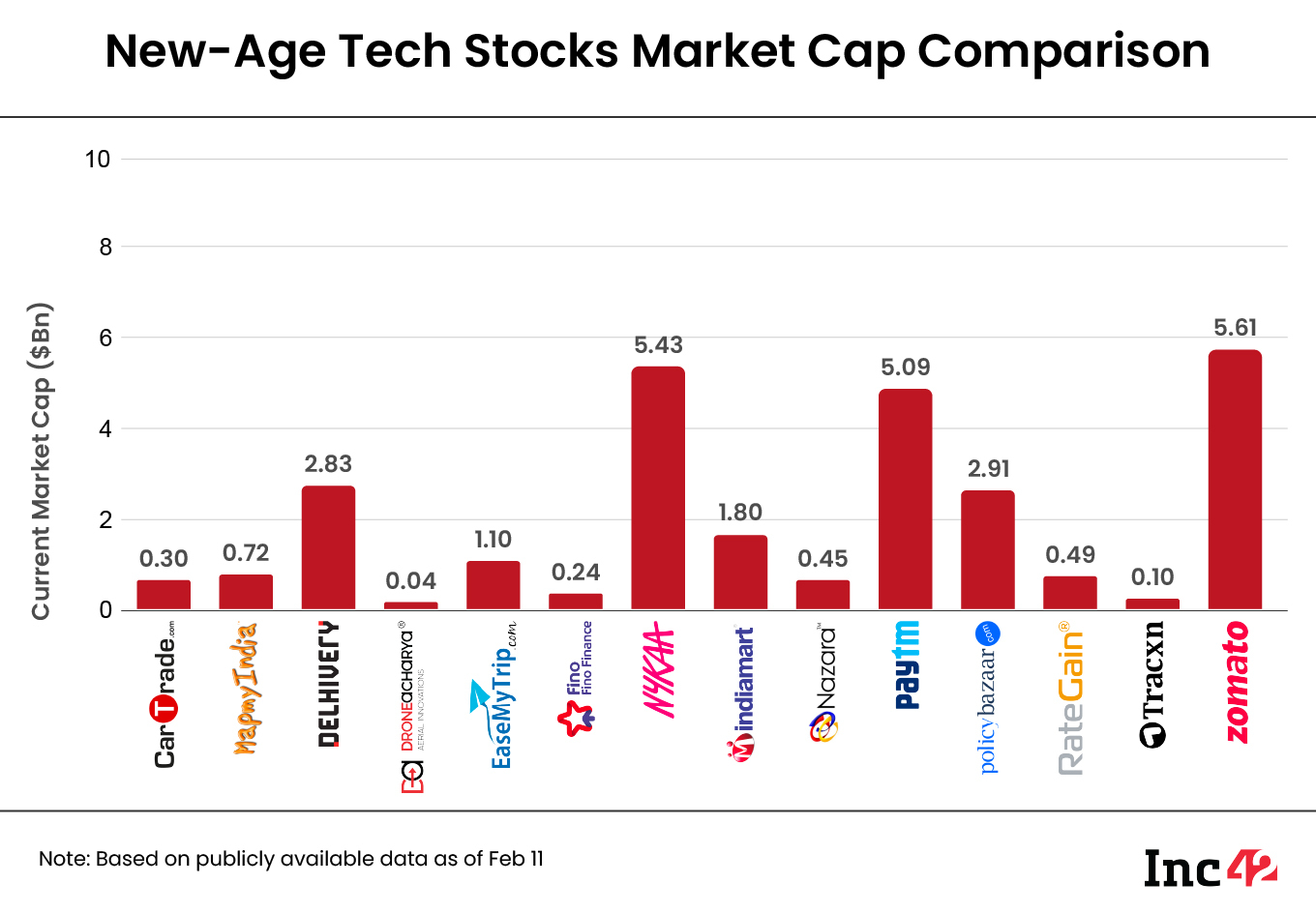

The 14 new-age tech stocks under our coverage ended the week with a total market capitalisation of $27.11 Bn as against $24.42 Bn last week.

Paytm The Biggest Gainer Despite Alibaba’s Stake Sale

Basking in the glory of achieving adjusted EBITDA profitability three quarters ahead of its projection, Paytm shares rose sharply in the first four sessions of the week, gaining 35.7%.

However, the shares slumped 8.7% on Friday to end at INR 650.2 after Alibaba.Com Singapore E-Commerce Private Limited exited the company by selling its remaining 3.31% stake in a block deal worth INR 1,377.5 Cr. Overall, the fintech giant’s shares rose 23.6% this week.

In the News For:

- Alibaba sold 2.1 Cr Paytm shares, while Morgan Stanley Asia bought 54 Lakh shares

- Paytm disbursed 38.65 Lakh loans worth INR 3,928 Cr in January 2023, up 103% and 327% YoY, respectively

- The fintech major said Q3 was its first EBITDA profitable quarter before ESOP costs, while net loss declined 50% YoY to INR 392.1 Cr during the quarter

Several brokerages, including Citigroup, Goldman Sachs, and CLSA, raised their price targets on the company this week, with Macquarie double upgrading the stock to an ‘outperform’ rating.

Analysts largely believe that Paytm’s profitability would only improve in the forthcoming quarters.

After a long time, the stock surpassed the 200-day simple moving average this week. “The short-term texture is strong but mildly overbought. Further correction is possible, but the overall texture of the stock is still on the positive side,” said Amol Athawale, deputy vice president, technical analyst at Kotak Securities.

Athawale sees INR 620 and INR 610 as the immediate support level for the stock, while its immediate resistance is at INR 740-INR 750 price range.

“Buying on corrections and selling on rallies would be the ideal strategy for the traders,” he added.

Zomato Reports Lacklustre Q3

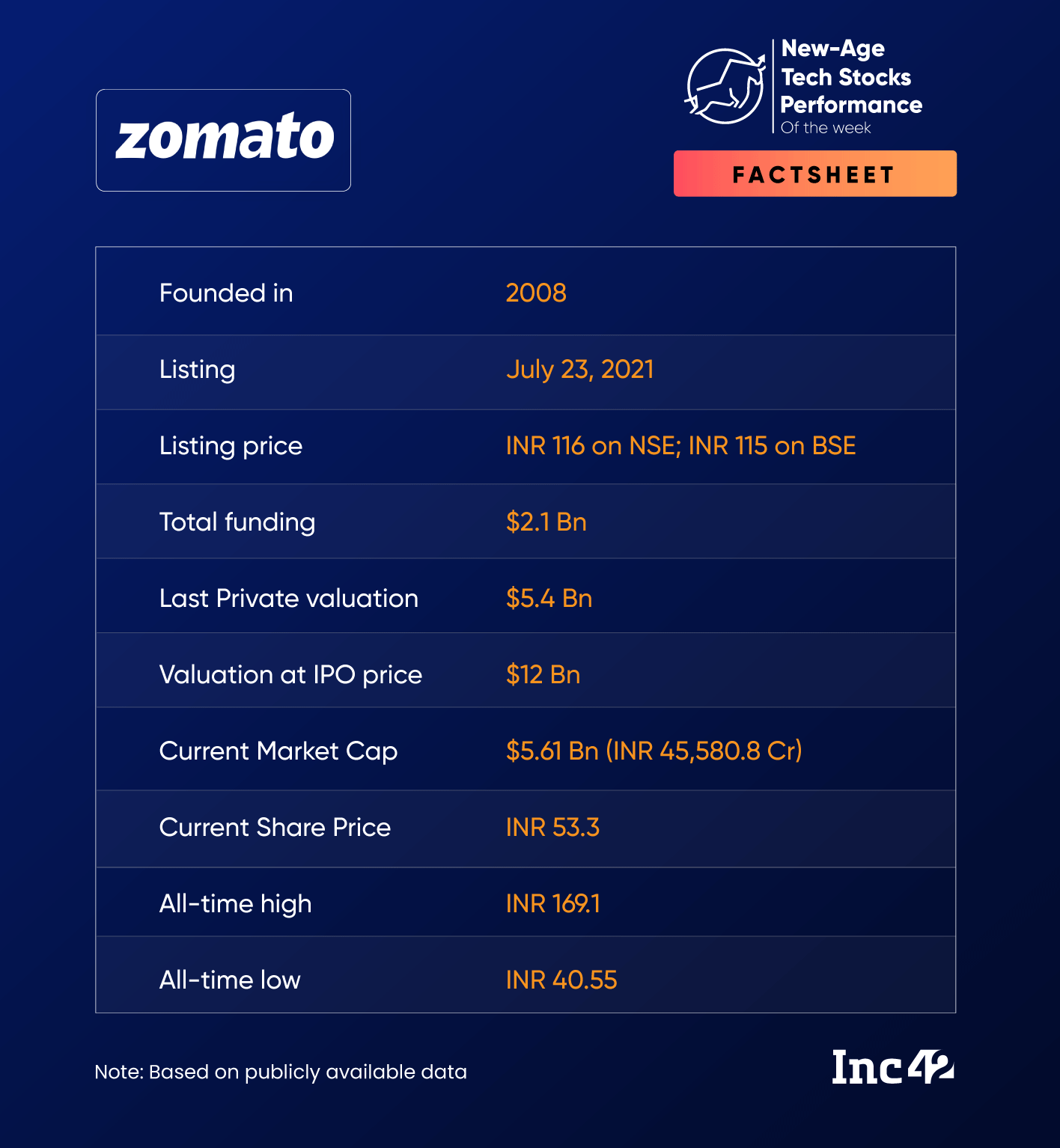

Paytm achieving its EBITDA profitability goal ahead of its estimate perhaps worked in favour of Zomato, which is also aggressively chasing profitability, as the stock rallied 11.47% in the first four sessions of the week, ahead of its Q3 FY23 earnings announcement.

After Zomato reported a widened net loss during the quarter on Thursday, its shares fell over 2% to INR 53.3 on the BSE on Friday.

In the News For:

- Zomato’s loss widened on both a YoY and QoQ basis to INR 346.6 Cr. However, the foodtech giant’s adjusted EBITDA, including its quick commerce business Blinkit, reduced to INR 265 Cr in the quarter from INR 272 Cr in Q3 FY22

- The company said that the Zomato Gold programme has added over 900K customers since its launch in late January. Zomato also announced that its Zomato Instant service will be rebranded and remodelled to Zomato Everyday, under which it will provide customers with home-style cooked meals

- Alibaba-backed Ant Group’s senior vice president Douglas Feagin resigned from the board of Zomato

Brokerage Bernstein, which retained Zomato as the top pick in its internet coverage, called the company’s Q3 performance a mixed bag.

“Despite the current cyclical slow down… the long term drivers of growth are intact. Core business continues on its path to profitability,” Bernstein said.

On the technical charts, the stock is trading above its 20-day simple moving average. “I am expecting a range-bound movement in Zomato with a positive bias,” said Kotak Securities’ Athawale.

He believes the immediate support for the stock is at INR 50 and INR 49, while its immediate resistance is at INR 58 and INR 60.

“Some consolidation is possible, but the overall texture of the stock is still positive as long as the stock is trading above INR 50,” added Athawale.

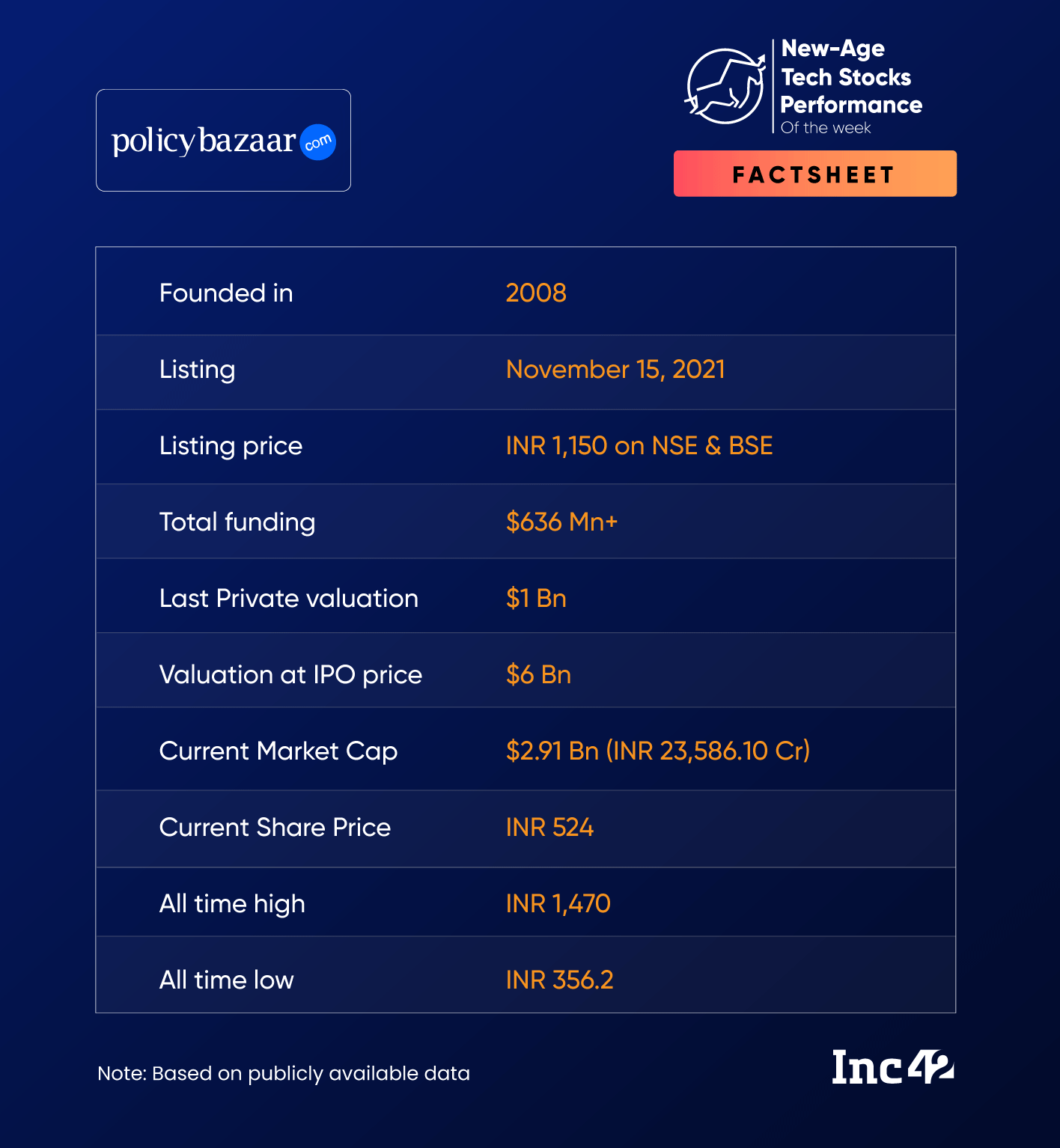

PB Fintech’s Paisabazaar Turns Adj EBITDA Positive

Shares of PB Fintech surged almost 22.5% this week, gaining in all five sessions, ahead of its Q3 FY23 results. The fintech major ended the week at INR 524 on the BSE and announced the Q3 results after market hours.

The company, which operates insurtech platform Policybazaar, reported a 70.6% YoY decline in its net loss to INR 87.6 Cr during the quarter.

Meanwhile, it said that its lending platform Paisabazaar turned adjusted EBITDA positive in Q3, and reiterated that it would be overall adjusted EBITDA positive by Q4. The company also expects to deliver the first full year of positive profit after tax in 2023-24.

Led by growth across businesses, its operating revenue jumped 66% to INR 610 Cr in Q3.

Speaking about the stock, Athawale said that like Paytm, PB Fintech has also surpassed the 200-day simple moving average and has formed a long bullish candle on the weekly chart.

“The texture is positive but it is in a temporary overbought condition. We could see some profit booking at a higher level—around INR 560, INR 550 that could be the immediate resistance area for the bulls,” he said.

Athawale sees INR 480 and INR 475 as the immediate support level for the stocks.