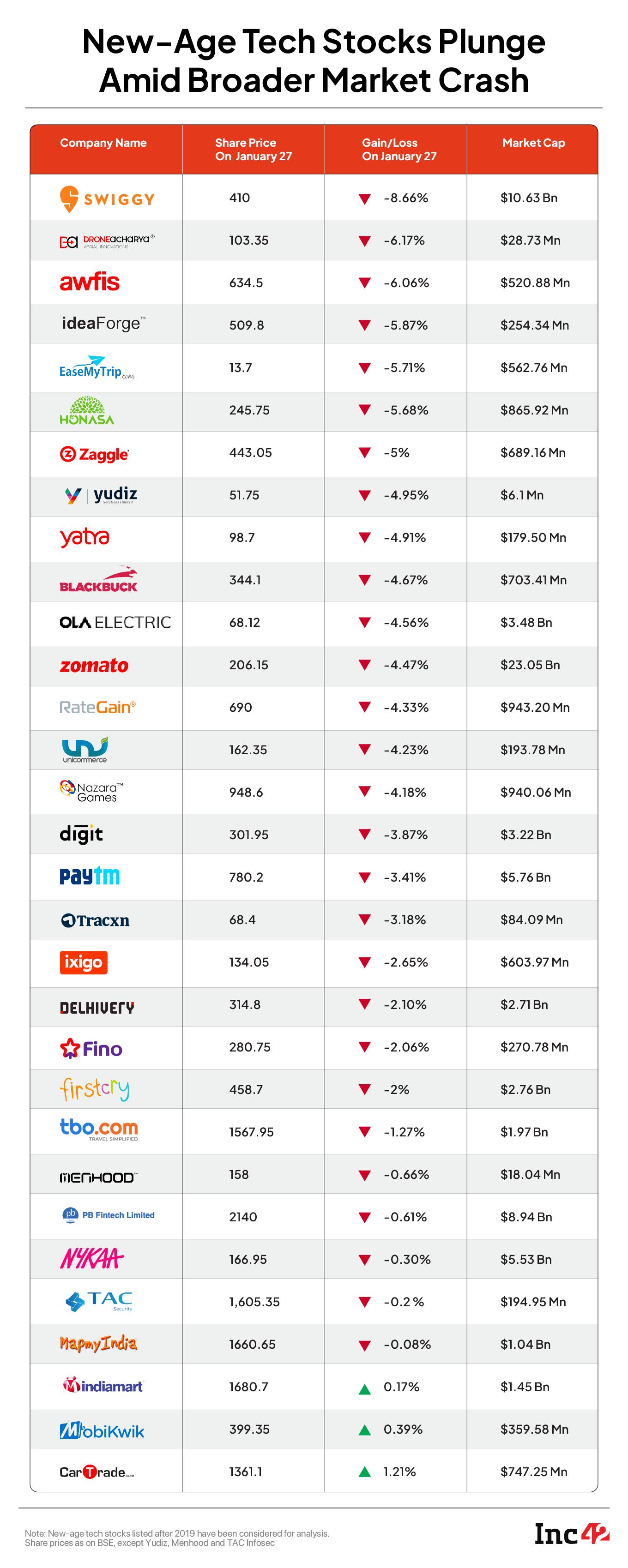

Barring IndiaMART InterMESH, MobiKwik and CarTrade, shares of 28 new-age tech stocks ended the day with losses in a range of 0.08% to just under 9%

The biggest loser today was foodtech major Swiggy, with its shares sliding 8.66% to end today’s trading session at INR 410

Two of the three gainers today, MobiKwik and IndiaMART, also touched fresh lows today before ending the day with gains

Continuing their free fall which began at the start of this month, new-age tech stocks under Inc42’s coverage ended up losing more than $3 Bn in market capitalisation in a single day of trade today.

Barring IndiaMART InterMESH, MobiKwik and CarTrade, shares of 28 new-age tech stocks ended the day with losses in a range of 0.08% to just under 9%. The biggest loser today was foodtech major Swiggy, with its shares sliding 8.66% to end today’s trading session at INR 410. Its archrival Zomato also continued to witness a bearish investor sentiment, with its shares plunging 4.47% to end the day at INR 206.15.

Meanwhile, dronetech company DroneAcharya, which announced entering into a merger agreement with competitor AITMC last Thursday, dipped 6.13% to end at INR 103.40. Shares of Awfis, ixigo, EaseMyTrip, Honasa, and Zaggle also fell in a range of 5-6%.

Besides, Delhivery

Two of the three gainers today, MobiKwik and IndiaMART, also touched fresh lows today before ending the day with gains. Shares of the fintech company touched an all-time low of INR 366.85 during the intraday trading, before recovering slightly to end the day 0.39% higher at INR 399.35 on the BSE.

Shares of IndiaMART, which touched fresh lows last week after weaker than expected financial results, dipped 1.76% during the intraday trading today to a fresh 52-week low of INR 2,045.80. The stock ended the day 0.17% higher at INR 2,086.70.

Overall, the total market capitalisation of the 31 new-age tech stocks stood at $78.7 Bn at the end of the trading today as against $81.98 at the end of Friday’s (January 24) trading.

At a broader level, Sensex ended the day 1.09% lower at 75,366.17 while Nifty 50 plunged 1.14% to end at 22,829.15. Given the bleak market conditions, Asit C. Mehta Investment Intermediates’ AVP of technical and derivatives research, Hrishikesh Yedve advised to “sell on rise”.

“From a technical perspective, Nifty formed a bearish red candle on the daily chart, indicating weakness. However, the index managed to hold above the trendline support near 22,780 levels. A breakdown and sustained trading below this level could push the index further down toward 22,500. Conversely, as long as the index sustains above 22,780, a short-term pullback rally toward 23,000 and 23,300 remains possible,” he said.

Multiple factors are driving this downward trend as of now, including concerns over weak Q3 numbers and the policies of the Donald Trump administration, and volatility ahead of the Union Budget.

Meanwhile, foreign institutional investors continued their selling spree today. They sold assets worth INR 14,504.03 Cr and bought assets worth INR 9,488.57 Cr today. Meanwhile, domestic institutional investors (DII) bought net assets worth INR 6,642.15 Cr.

“Broad-based selling across sectors plummeted the Indian market amidst tepid earnings and weak sentiments across the globe. FIIs are on a selling spree due to moderation in economic growth and INR depreciation. The weak sentiments were further exacerbated as the US trade confrontation continued, like with Colombia this time,” Vinod Nair, head of research at Geojit Financial Services, said.

Fintech

Fintech Travel Tech

Travel Tech Electric Vehicle

Electric Vehicle Health Tech

Health Tech Edtech

Edtech IT

IT Logistics

Logistics Retail

Retail Ecommerce

Ecommerce Startup Ecosystem

Startup Ecosystem Enterprise Tech

Enterprise Tech Clean Tech

Clean Tech Consumer Internet

Consumer Internet Agritech

Agritech