Of the 15 new-age tech startups under Inc42’s coverage, 10 fell in a range of 0.3% and over 5% this week, with Tracxn emerging as the biggest loser on the BSE

Shares of IndiaMART soared 10.6% this week, on the back of positive Q1 results and share buyback announcement, to emerge as the biggest winner among new-age tech stocks

Benchmark indices Sensex and Nifty 50 crashed over 1% each on Friday after touching new record highs earlier in the week

Indian new-age tech stocks saw sharp corrections this week as the broader equity market crashed on Friday, after trending higher throughout the week, following disappointing Q1 FY24 performances of tech major Infosys and Hindustan Unilever Limited (HUL).

Of the 15 new-age tech startups under Inc42’s coverage, 10 fell in a range of 0.3% and over 5% this week. Tracxn Technologies was the biggest loser (down 5.5%) on the BSE.

Meanwhile, Zomato and ideaForge fell 2.6% each, while Paytm and CarTrade Technologies declined over 0.9% each on the BSE. Nazara Technologies and Delhivery fell over 2% during the week, while shares of EaseMyTrip and DroneAcharya declined over 4% on the BSE.

Despite the overall downward trend, IndiaMART

Besides, Fino Payments Bank, MapmyIndia, PB Fintech, and RateGain also rose in a range of 0.9% to 6% this week.

Benchmark indices Sensex and Nifty 50 touched new record highs this week as they ended Thursday’s session at 67,571.9 and 19,975.15, respectively. However, Sensex fell 1.31% to 66,684.26 on Friday, while Nifty 50 crashed 1.17% to 19,745.

Overall, both Nifty50 and Sensex gained a little over 0.9% in the week.

“Overnight fall in tech-heavy Nasdaq triggered a wave of massive correction in local software stocks led by Infosys, which slashed the revenue growth guidance for the rest of the year due to sharp deterioration in discretionary spending by the clients. The record upsurge in the markets in such a quick time was already raising concerns of expensive valuations, and hence investors took this opportunity of weak US cues to prune their holdings, although India’s fundamentals remain on strong footing,” said Amol Athawale, vice president of technical research at Kotak Securities.

Arvinder Singh Nanda, senior vice president of Master Capital Services, opined that the markets will take further cues from the ongoing Q1 FY24 earnings season, domestic and global macroeconomic data, global market trends, crude oil prices, Foreign Institutional Investors (FII) and Domestic Institutional Investors (DII) activities.

Now, let’s dig deeper into understanding how the new-age tech stocks performed this week.

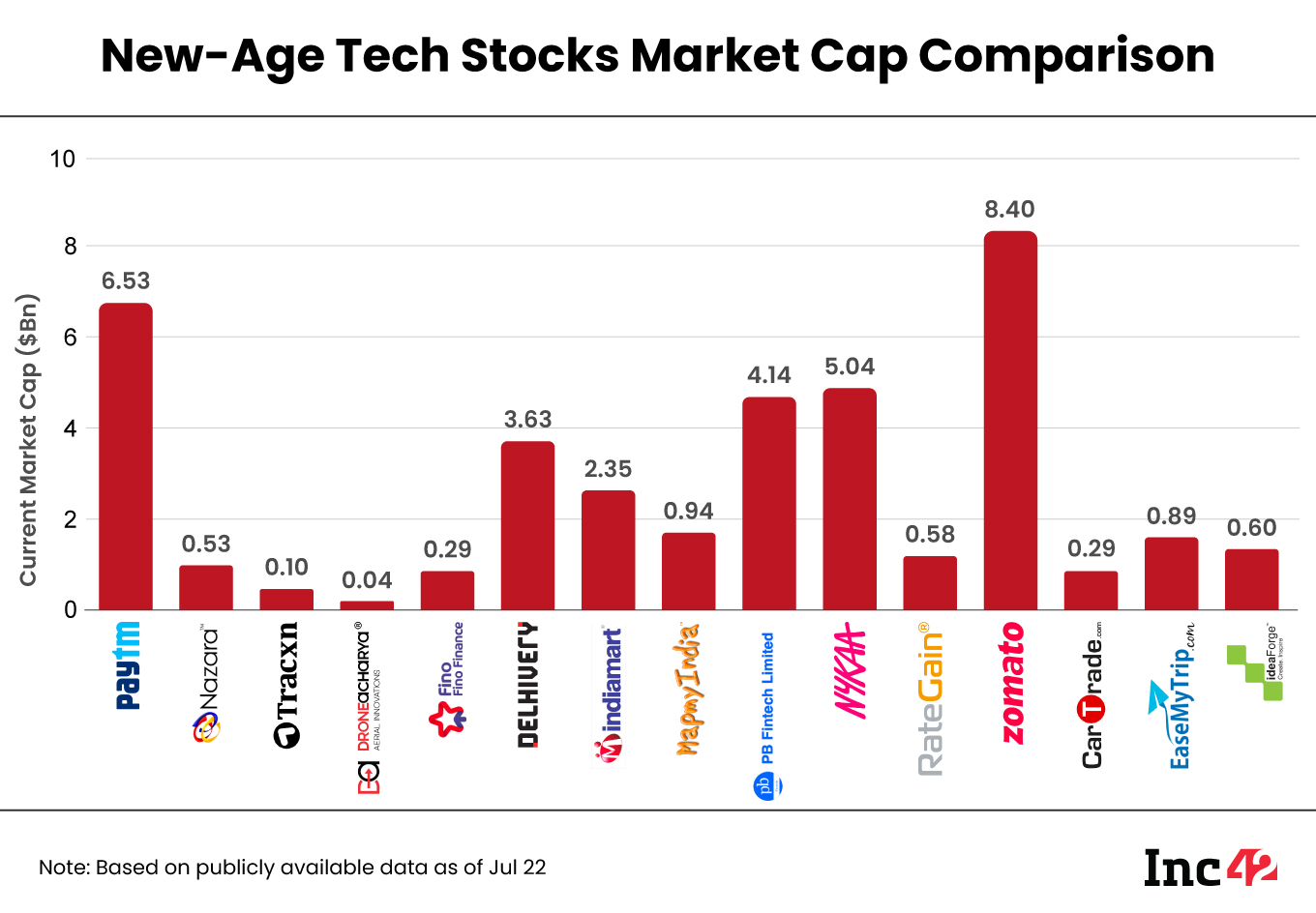

The 15 new-age tech stocks under Inc42’s coverage ended the week with a total market capitalisation of $34.35 as against $34.38 Bn last week.

IndiaMart Shines

Shares of IndiaMART InterMESH rose 10.6% this week to end Friday’s session at INR 3,152.1 on the BSE.

The stock also touched a fresh 52-week high of INR 3,205 during intraday trading on Friday after the B2B ecommerce major published its Q1 FY24 results on Thursday (July 20).

In the News For:

- IndiaMART reported a 77.9% year-on-year (YoY) jump in its net profit to INR 83.1 Cr in the June quarter of FY24 from INR 46.7 Cr posted in the corresponding quarter of the previous year. The startup’s operating revenue also grew 26% to INR 292 Cr during the quarter

- IndiaMART’s board also approved the proposal to buy back 12.5 Lakh shares for INR 4,000 each for up to INR 500 Cr.

Kotak Securities’ Athawale believes that after this week’s rally, INR 3,325-INR 3,330 is the immediate resistance for the stock. Meanwhile, INR 2,925 is the immediate support level.

“We have to wait for a breakout confirmation. If the stock starts consistently trading above INR 3,225, it will continue to rally in the near future. Otherwise, a range-bound activity will continue,” said Athawale.

Brokerage JM Financial said in a research note that it expects the stock to continue to trade at “punchy” valuations on the back of strong earnings visibility. “We also expect the market to cheer the company’s intention to return excess cash through the buyback route,” it said.

The company’s shares are trading 45.97% higher year to date (YTD), considering the lowered denomination post its recent bonus share issue.

Paytm’s Loss Widens Sequentially

After a significant rally last month, Paytm shares have seen a sideway movement so far this month. Ahead of its June quarter results, which were published on Friday, Paytm shares ended at INR 843.55 on the BSE. Overall, the stock fell 0.9% this week.

Before we analyse further, let’s understand what can affect Paytm’s shares next week.

In The News For:

- After market hours on Friday, Paytm reported a 44.5% YoY decline in its consolidated net loss to INR 358.4 Cr in Q1. However, the loss more than doubled on a sequential basis. The fintech giant’s operating revenue jumped 39% YoY to INR 2,342 Cr in the quarter.

- Despite ESOP costs continuing to be one of the major pain points for Paytm, as it strives to achieve net profitability, the startup announced an additional 1.7 Mn employee stock options this week.

The results, along with the broader market condition, will decide Paytm’s share movement in the coming week, although the stock’s texture is bullish, said Athawale.

“After a strong rally, the stock is consolidating. So, the range-bound texture is likely to continue. On the higher side, INR 875 would be the immediate resistance for the stock. On the lower side, INR 800 would be the immediate support,” he said.

However, if Paytm breaks the INR 875 level, there are chances that the stock can reach INR 900-INR 925 level, he added.

Zomato Tanks

Zomato is one of the new-age tech stocks that has been rallying since April this year. Last week, the shares of the foodtech major had touched a 52-week high of INR 84.5, as investor sentiment turned positive on new-age tech stocks.

However, the stock slumped in four straight sessions till Thursday this week, before recovering on Friday. Zomato ended Friday’s session up 3.4% at INR 80.31 on the BSE. Overall, the stock corrected 2.6% this week.

We must note that in its attempt to turn profitable, the startup has shut down several of its international businesses over the last few months. In continuation of these efforts, Zomato, in an exchange filing on Friday, said that Zomato Media Portugal, Unipessoal Lda (“ZM Portugal”), a wholly-owned subsidiary of the company situated in Portugal, has initiated the process of liquidation.

Commenting on the stock, Kotak Securities’ Athawale said it is showing a strong uptrend. The immediate support for the stock is around INR 77. If it sustains above that, then INR 85-INR 87 would be the immediate target, he added.

Fintech

Fintech Travel Tech

Travel Tech Electric Vehicle

Electric Vehicle Health Tech

Health Tech Edtech

Edtech IT

IT Logistics

Logistics Retail

Retail Ecommerce

Ecommerce Startup Ecosystem

Startup Ecosystem Enterprise Tech

Enterprise Tech Clean Tech

Clean Tech Consumer Internet

Consumer Internet Agritech

Agritech