SUMMARY

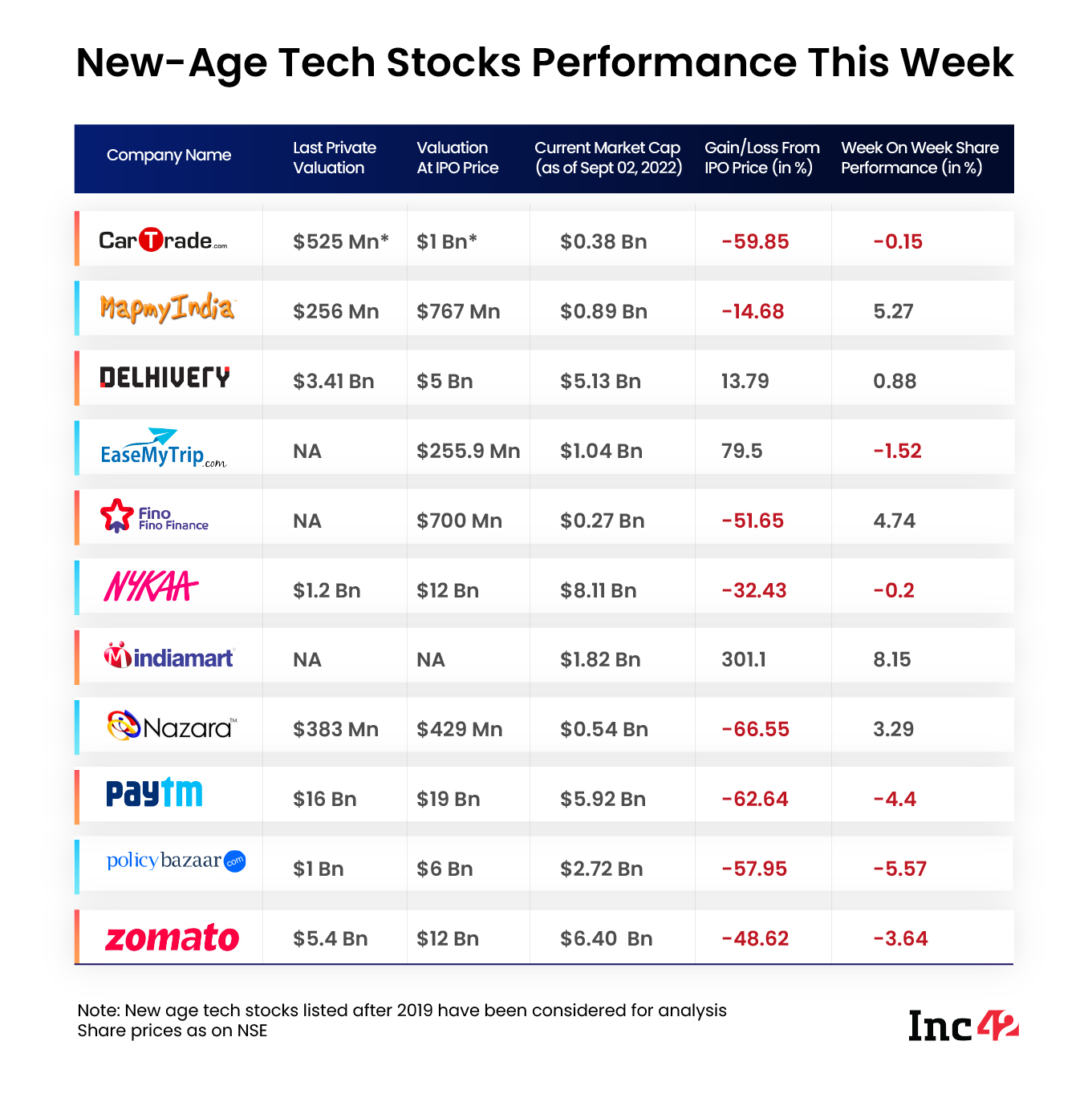

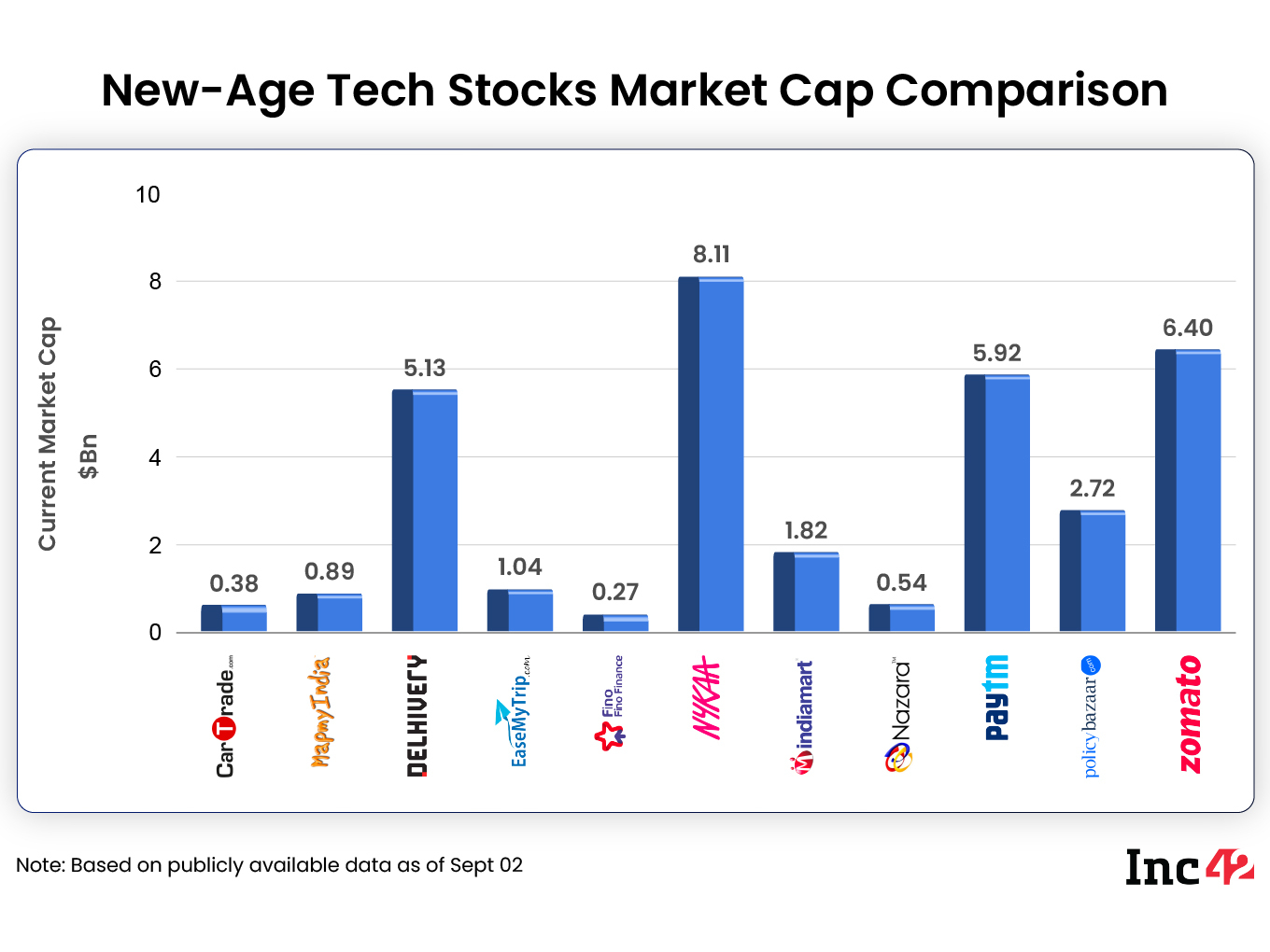

IndiaMart InterMESH emerged as the biggest winner among the new-age tech stocks this week, gaining over 8%, while MapmyIndia shares rose about 5%

Policybazaar was once again the biggest loser, with its shares declining 5.6% during the week, while Zomato also shed some of the recent gains

Overall, the equities market saw another volatile week, with benchmark indices NSE Nifty50 and BSE Sensex ending marginally lower

After two consecutive subdued weeks, the Indian stock market showed some signs of a recovery in another volatile week. Meanwhile, the new-age tech stocks saw mixed performances during the week.

IndiaMart InterMESH emerged as the biggest winner among the new-age tech stocks this week, gaining over 8% to settle at INR 4,756.2 on the BSE on Friday.

After falling significantly over the last three weeks, MapmyIndia also saw some respite as its shares surged in straight three sessions this week, settling at INR 1,343.1 on the BSE at the end of the week. Overall, MapmyIndia shares rose about 5% this week.

Nazara Technologies also witnessed some gains this week, while Zomato shed some of the gains it made in the past few weeks.

Policybazaar was once again the biggest loser, with its shares declining 5.6% this week to close at INR 483.05 on the BSE.

Meanwhile, the benchmark indices NSE Nifty50 and BSE Sensex saw a sharp fall on Monday following hawkish comments from Federal Reserve Chairman Jerome Powell. However, the indices made a recovery in the following sessions, ending marginally lower on a weekly basis. While Nifty50 settled at 17,539.45 points, Sensex closed at 58,803.33 points.

The Indian stock exchanges were closed on Wednesday on the occasion of Ganesh Chaturthi.

“While markets in the near-term may remain volatile in a broader range, we are positive on the mid to long-term perspective on the back of healthy domestic macros, strong fundamentals, earnings growth and upbeat festive season,” said Siddhartha Khemka, head of retail research at Motilal Oswal.

Now, let’s take a look at the weekly performance of the listed new-age tech stocks from the Indian startup ecosystem.

The 11 new-age tech stocks ended the week with a combined market cap of around $33.2 Bn versus $33.6 Bn last week.

Zomato’s Ups And Downs

After witnessing a significant recovery in its stock performance in the last two weeks, Zomato shares lost the upward movement momentum this week. The shares fell in the first two sessions, made a recovery in the third session, but ended the week in the red zone.

Zomato shares closed about 4.5% lower from Thursday’s close on Friday at INR 59.7 on the BSE. On a week-on-week basis, Zomato shares fell 3.5%.

Several updates came from Zomato this week and the startup also held its 12th AGM. Before delving deeper into the stock performance, let’s take a look at why Zomato made headlines this week.

In The News For:

- Zomato reappointed Info Edge cofounder Sanjeev Bikhchandani as the non-executive director on its board.

- The foodtech startup hinted during AGM about the possibilities of its business-to-business (B2B) supplies vertical Hyperpure emerging as a bigger or equally big business like its food delivery business.

- Zomato also issued a clarification this week pertaining to the rebranding of its larger organisation as Eternal and said that the change would not alter CEO Deepinder Goyal’s or anyone else’s role at the startup.

- It also confirmed launching intercity delivery.

- The National Restaurants Association of India (NRAI) asked restaurants to make an ‘informed decision’ on Zomato Pay and Swiggy Diner as these offerings can adversely impact the restaurant industry in the long run.

After the clarification on Eternal, and its AGM, Zomato shares jumped 7.7% on Thursday (September 1).

“The stock has formed a strong reversal formation but the medium-term structure of the stock is still on the weak side. For the bulls, 50-day Simple Moving Average (SMA) or INR 55 would be the important support level. If the stock manages to trade above the same, we could expect continuation of uptrend rally till 70-75,” said Amol Athawale, Deputy Vice President of technical research at Kotak Securities.

“On the flip side, below INR 55, it could slip till INR 53 and INR 50,” said Athawale, adding that the medium-term trend of the stock is still on the downside.

Nazara Rises After Another Acquisition

Shares of gaming startup Nazara Technologies rose in two straight sessions this week after it announced acquisition of 100% stake in the US-based gaming firm WildWorks in an all-cash deal.

After the acquisition announcement on Tuesday (July 30), the startup’s shares jumped about 4.5% to INR 658.9. It rose another 1.6% in the following session on Thursday (September 1).

However, the stock ended marginally lower at INR 665.85 on Friday. Overall, Nazara shares gained over 3.4% this week.

On August 1, Nazara shares hit the upper circuit of 20% on the BSE after it reported strong financial results for the June quarter of FY23. However, the shares started sliding after that.

“After a long correction, the stock again took the support near INR 475 and reversed, but post reversal the stock is hovering between INR 515 on the lower side and INR 700 on the higher side. On the daily charts, it has formed a higher bottom formation, which is broadly positive,” Athawale said.

He added that INR 618 is a crucial support level for the stock, and as long as it is trading above it, the uptrend is likely to continue. The stock can move up to INR 700, and with further upside, it might also reach INR 735.

“On the flip side, below 50-day SMA, I think the uptrend will be vulnerable,” said Athawale.

Nazara made a strong debut in the Indian stock market in March 2021. On BSE, the startup got listed at INR 1,971, representing a premium of 79.02% over its issue price. At the current levels, Nazara shares are trading over 66% lower from their debut price.

IndiaMart Touches Four-Month High

Shares of B2B marketplace IndiaMART InterMESH rose sharply this week touching their highest level since May 4 this year. The shares rose for six straight sessions starting from last week, and closed at INR 4,756.2 on the BSE on Friday.

On Friday, the shares rose 6% compared to Thursday’s close. Overall, IndiaMART shares gained 8.6% this week.

“On the daily and weekly charts, the stock is consistently forming a higher-high higher-low series formation, which supports further uptrend from the current level. In addition, on last Friday, the stock not only cleared the short-term resistance of INR 4,600 but succeeded to close above the same,” said Kotak Securities’ Athawale.

“A promising breakout formation and long bullish candle on daily and weekly charts suggests continuation of uptrend in the near future,” he added.

Listed in July 2019 at INR 1,180 on both NSE and BSE, IndiaMART shares are currently trading 300% higher than their debut price.