SUMMARY

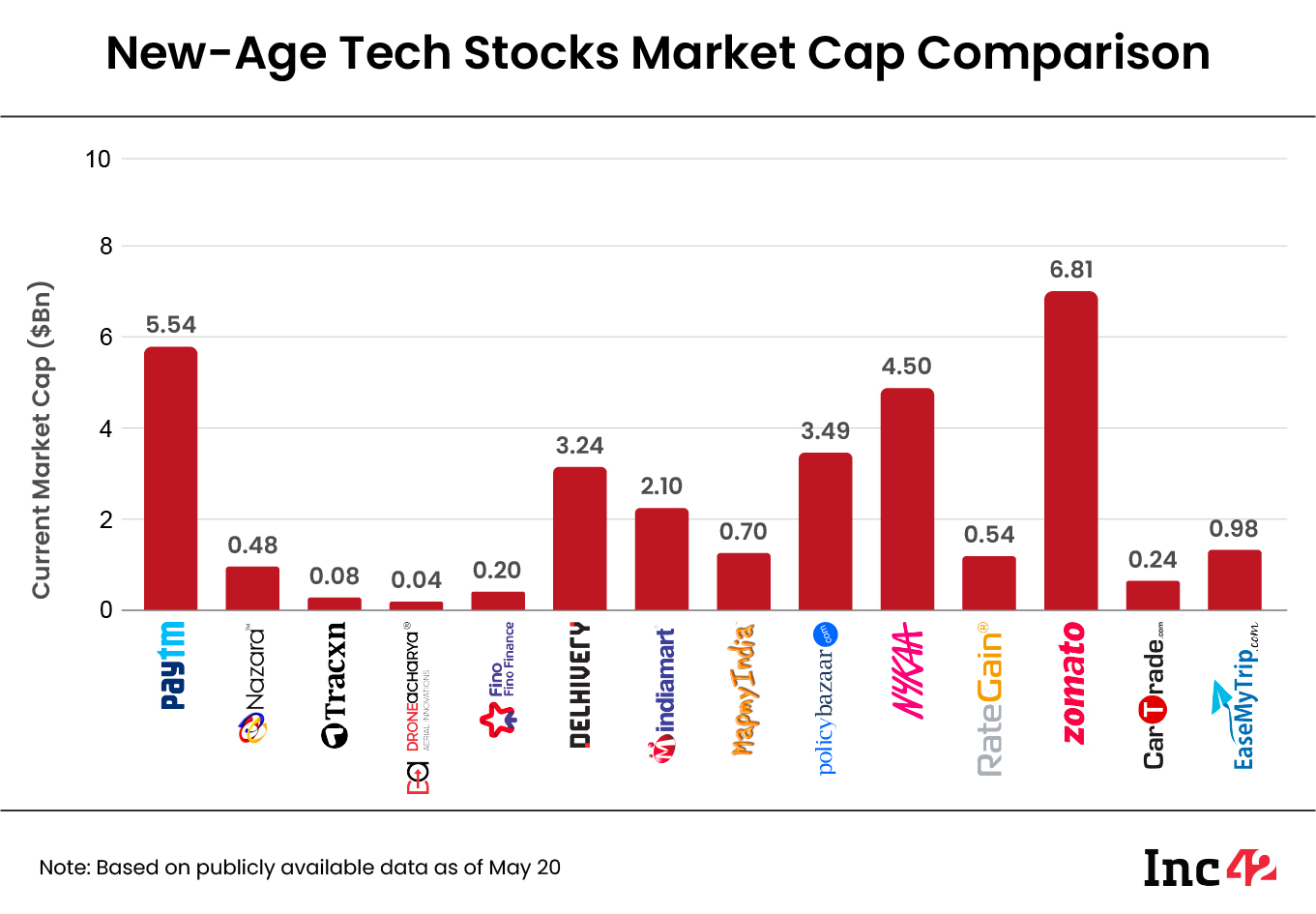

Eight out of 14 stocks under Inc42’s coverage, including Nazara Technologies, Nykaa, CarTrade Technologies, Paytm, RateGain, gained in the range of 0.3% to 7% this week

Delhivery, EaseMyTrip, Tracxn, DroneAcharya, IndiaMart InterMESH, and Fino Payments Bank were among the new-age tech stocks which declined this week

Benchmark indices Sensex and Nifty50 reversed their three-session losing streak on Friday. However, the indices ended in the red on a weekly basis

New-age tech stocks witnessed another week of mixed performance as the broader IT, tech, and banking stocks witnessed heavy buying during the week’s last session on Friday, which also helped the overall equity market reverse its three-session losing streak.

Amid the ongoing Q4 FY23 earnings season, which has largely been positive for most of the listed new-age Indian tech startups that have reported the results so far, eight out of the 14 tech startup stocks under Inc42’s coverage made a northbound journey this week.

Nazara Technologies, which also emerged as the biggest winner, Nykaa, CarTrade Technologies, Paytm, RateGain, PB Fintech, MapmyIndia, and Zomato gained this week in the range of 0.3% to about 7% on the BSE.

After a sharp rally last week, shares of RateGain rose about 3% on Friday alone after the startup reported strong Q4 FY23 results, with its profit after tax growing 191% year-on-year (YoY) to INR 33.8 Cr in the quarter.

Overall, RateGain gained 3.5% this week, ending Friday’s session at INR 412.95 on the BSE.

On the other hand, shares of Delhivery, EaseMyTrip, Tracxn, DroneAcharya, IndiaMart InterMESH, and Fino Payments Bank declined in the range of 0.2% to 8% this week.

In the broader equity market, benchmark indices Sensex and Nifty50 ended lower this week. While Sensex declined 0.5% to 61,729.68, Nifty50 slipped 0.6% to 18,203.4. However, the indices ended Friday’s session higher, with Nifty50 gaining 0.5% and Sensex rising 0.4% from Thursday’s close.

“Nifty prices experienced a decline from a five-month high… This correctional fall can be attributed to mounting global headwinds, particularly concerns surrounding the US debt ceiling,” said Arvinder Singh Nanda, senior vice president of Master Capital Services. However, he added that the broader market sentiments look firm on the technical charts.

Siddhartha Khemka, head of retail research at Motilal Oswal, said that positive global cues, a healthy earnings season, and consistent FII buying have been providing support to the market. He expects the market to resume its upward journey after this week’s pause.

It also remains to be seen how the Reserve Bank of India’s (RBI) announcement on Friday to withdraw INR 2,000 denomination notes from circulation impacts the equity markets.

Now, let’s take a deeper look at the performance of some of the new-age tech stocks this week.

The 14 new-age tech stocks under Inc42’s coverage ended the week with a total market capitalisation of $28.94 Bn versus $28.49 Bn last week.

Zomato Reports Better-Than-Expected Q4

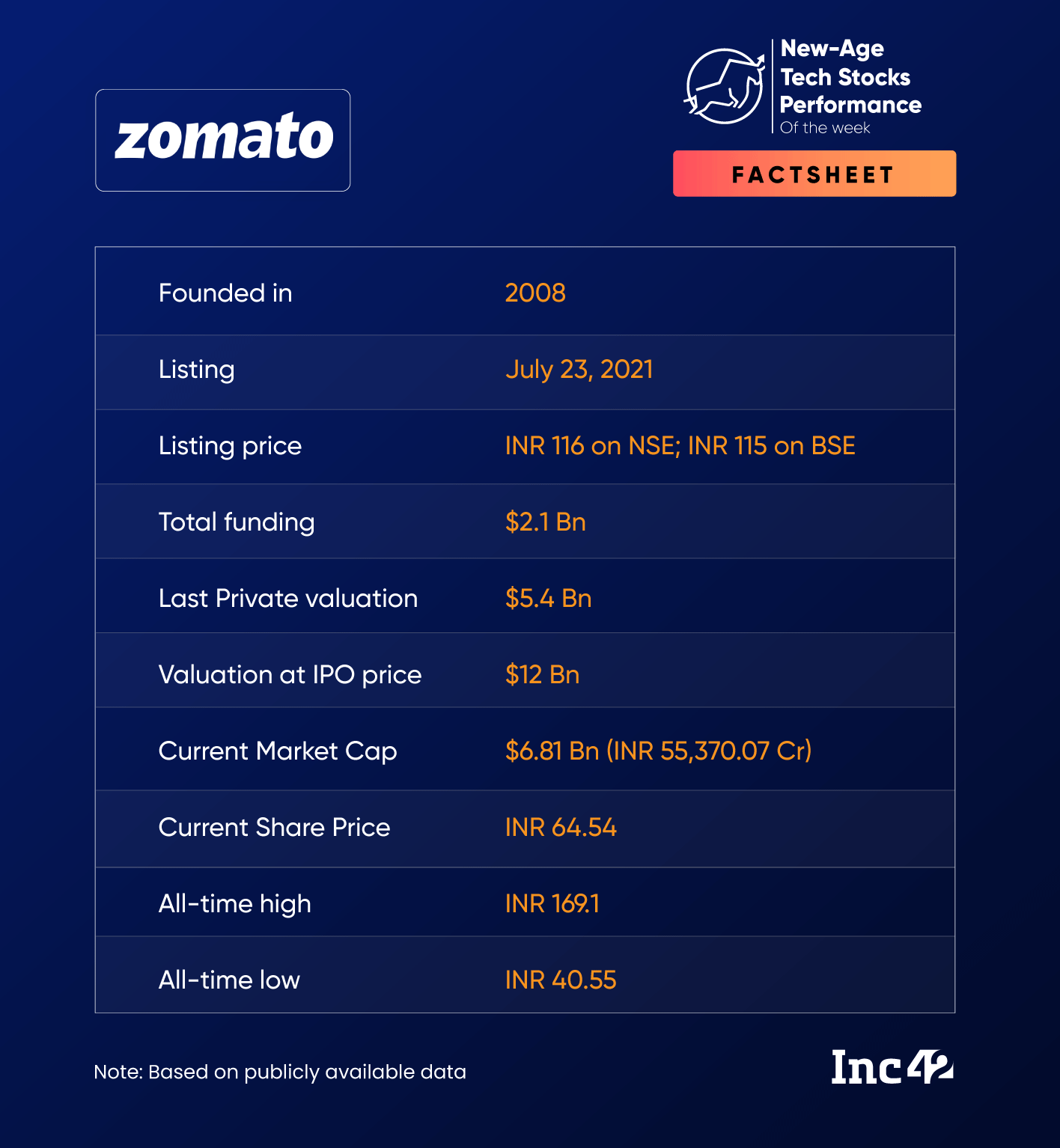

Foodtech major Zomato reported its quarterly and fiscal year results for 2023 on Friday, after market hours. Its Q4 results were also better than consensus estimates of the Street as its loss declined to INR 187.6 Cr and operating revenues jumped to INR 2,056 Cr in the reported quarter.

Shares of Zomato were largely range bound since last week amid debates and discussions about increasing market competition with the advent of the Open Network For Digital Commerce (ONDC) and various anticipations pertaining to its Q4 results.

This week, Zomato gained a little over 3%, ending Friday’s session at INR 64.54 on the BSE.

Let’s see what can drive Zomato’s stock movement in the coming week.

In The News For

- Besides a decline of over 45% in its loss on both YoY and quarter-on-quarter (QoQ) basis, Zomato also claimed to have achieved adjusted EBITDA profitability, excluding its quick-commerce vertical Blinkit, in Q4.

- It managed to trim its loss largely by sharp expense cuts and some improvement in Blinkit and Hyperpure businesses. However, growth of the food delivery business remained muted.

- After the exodus of multiple senior-level executives from the company since last year, Zomato announced the appointment of new bosses for its food delivery and B2B Hyperlocal businesses.

- Speaking on the competition from ONDC, Zomato said it will continue to watch the ONDC progress closely and learn from it.

- Zomato CEO Deepinder Goyal confirmed that Zomato is looking to enter the Urban Company-like at-home services space via its quick commerce vertical.

After declining over 56% last year, shares of Zomato have made a slight recovery this year. Currently, the shares are trading 8.7% higher year-to-date (YTD). Of the 26 brokerages covering the stock, 20 of them have a ‘buy’ or above rating on it, with an average price target (PT) of INR 75.6 currently.

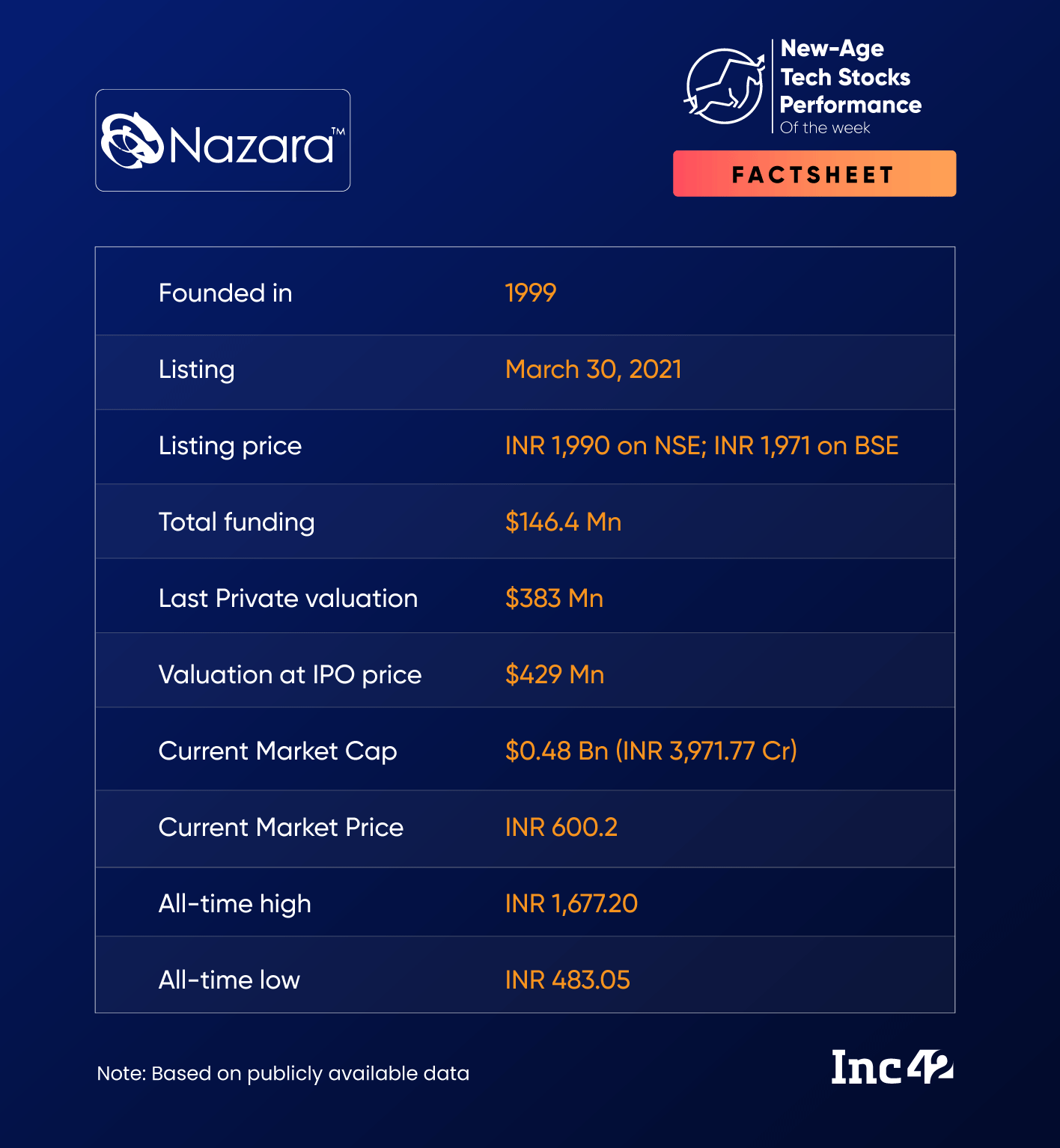

Nazara Closes At A Four-Month High

Shares of Nazara Technologies rallied almost 7% this week, becoming the biggest gainer among the new-age tech stocks. After a significant decline in the last two months, the shares also touched a four-month high level this week.

Nazara ended Friday’s close at INR 600.2, a level last seen in January-end.

In The News For:

- The gaming company’s shares rallied in two consecutive sessions on Thursday and Friday after its esports subsidiary NODWIN Gaming revealed plans to raise $28 Mn (INR 232 Cr) as part of a strategic funding round. Nazara, Krafton, and JetSynthesys, among others, will participate in the round, which will help NODWIN expand and incubate new IPs.

- Last week, Nazara saw a muted performance in the equity market after it reported a net profit of INR 9.4 Cr in Q4 FY23. While its profit rose on a YoY basis, it declined sequentially. However, revenue from esports vertical NODWIN Gaming continued to grow significantly, rising 84% YoY during the quarter.

- Last week, Nazara also picked an additional 19.5% stake in its subsidiary Next Wave Multimedia in an all-cash deal of INR 15.5 Cr.

After plummeting 50% in 2022, shares of Nazara are trading around 3.5% higher YTD. However, regulatory uncertainties around the gaming industry continue to be an issue.

Delhivery Grows Sequentially

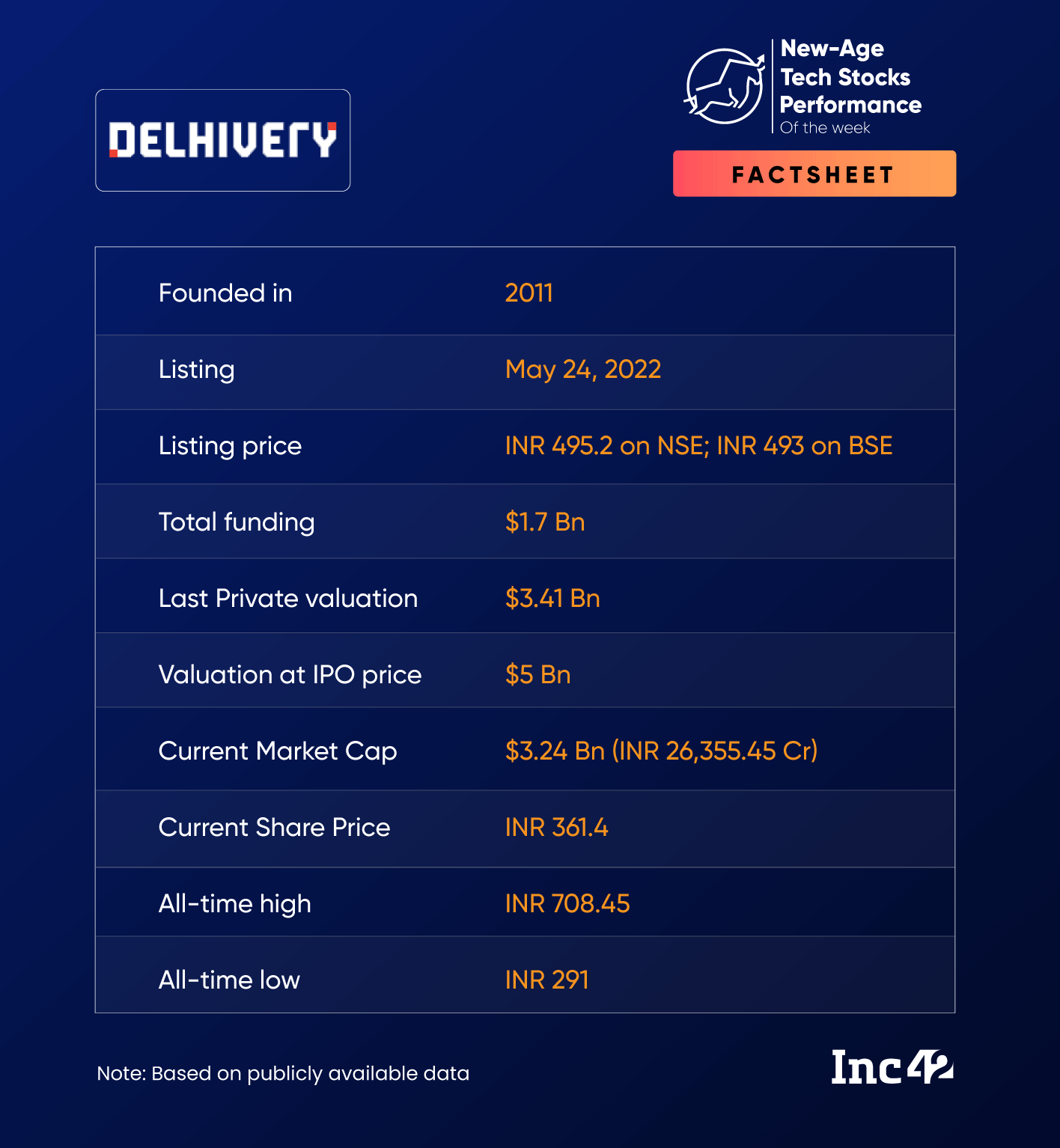

Shares of Delhivery, which have largely remained range bound over the last one month, declined marginally this week ahead of its Q4 FY23 results, ending Friday’s session at INR 361.4 on the BSE.

Post the market close, the logistics unicorn reported a 32% YoY widened loss of INR 158.6 in Q4 FY23. However, net loss narrowed 19% QoQ. On the operating revenue front, the startup’s growth reported a marginal growth sequentially at INR 1,859.6 Cr. However, revenue from operations declined 10% YoY as growth wasn’t uniform across verticals.

While Delhivery reported robust growth in its core truckload and supply chain services businesses, its cross-border services business saw a revenue decline of about INR 9 Cr. The company attributed the decline to falling global yields in both air and ocean freight and volume impact due to the Chinese new year holidays.

Delhivery said it also turned adjusted EBITDA positive in Q4.

Meanwhile, on Saturday, the company also announced making a strategic investment in SaaS omnichannel software provider Vinculum to strengthen its D2C offerings.

After falling almost 40% last year since its listing in May 2022, Delhivery shares are currently trading 9% higher YTD.