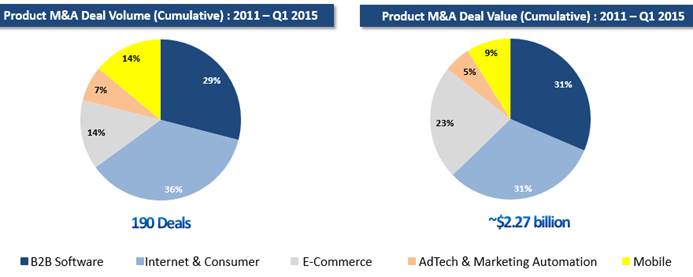

We all know that there has been a lot of hustle and bustle in the startup ecosystem but did you know that all that India had 190 product Merger and Acquisition deals inbound where domestic transactions totalled to a huge $2.3Bn from 2011-2015. Not only this, Internet & Consumer and Ecommerce both accounted for 60% of those 190 deals followed by B2B software.

All these statistics are revealed by The Next Roundtable Report – 2015 India technology Product M&A Industry Monitor Report released by iSPIRT, Signal Hill and Microsoft Ventures.

It prophesies that technology majors as well as other Indian ‘Unicorns’ will continue their M&A spree to fill technological gaps as well as talent requirements.

On this Ravi Narayan, Microsoft Ventures India Director said, “The M&A space, despite growing at 56% YoY (2013-14), had been relying on anecdotal information to make business decisions. The Think Next Roundtable Report has now become the handbook to the investors and corporates and regularly provides them with data and insights into M&A space”

- The report made it advent that ecommerce has been and will continue with an exponential growth rate. The report stated that investment in ecommerce and Internet & Consumer has grown by 38X between 2010-2014.

- The growth is also accentuated by the fact that $4.2Bn was invested in this sector last year alone with the two ecommerce biggies(Flipkart and Snapdeal) accounting for more than 50%. A total of 60% of the said amount was invested in 6 companies alone namely, Flipkart, Snapdeal, Ola, Quikr, Housing and Freecharge.

- The report indicates that a generation of entrepreneurs is coming up in India, looking to build deep-tech companies in the country. Where B2B software companies are aiming at serving the global market, the internet & ecommerce businesses are focusing on India.

- The report also includes a ranking of acquisitions, with Snapdeal-Freecharge acquisition topped the list with a deal value of $400Mn followed by AdIQuity being acquired by Flipkart.

- Apart from mentioned Domestic acquisitions various global technology majors have also eyed India for technology and talent acquisitions. For instance, Twitter acquiring Zipdial, Yahoo acquiring bookpad, Facebook acquiring little eye labs and more.

- There has been a 100% increase in Mobile sector in terms of transaction volume between 2013 and 2014, whereas B2B experience more than 100% growth and Internet & Consumer experience 44% growth in the same period.

Apart from all these figures and statistics the report also made some predictions which are as follows.

- The aggressive strategic acquisitions to enhance their market dominance as well as fortify their growth areas will continue to be at this rate.

- Internet of Things will receive the boost it deserves and significant interest from VCs and large acquirers as vital sectors including healthcare, enterprise,wearables and industries depend on the same.

- Technology Product Merger and Acquisitions will continue to increase rapidly. B2B software M&As will continue to dominate transaction volumes and values whereas in ecommerce and Internet & Consumer, domestic side will dominate.

- Significant VC/PE funds will continue to flow into ecommerce and Consumer Internet sectors, as new alternative investors continue to enter the market.