Funding Revival Or Stagnation? Q1 2025 Gives Mixed Signals

With more Indian startups preparing for public debuts and investor exits back in focus, Q1 2025 brought early signs of stability to the funding landscape. Backed by a 41% YoY surge in capital, the ecosystem is slowly finding its footing — even as funding levels remain flat compared to previous quarters.

Let’s take a look at the overall numbers for startup funding in the quarter gone by.

$3.1 Bn Raised: According to Inc42’s latest Indian tech startup funding report, Indian startups raised $3.1 Bn across 232 deals between Jan 1 and Mar 26 — up from $2.2 Bn across 226 deals in the same period last year. The quarter also pushed total startup funding past the $161 Bn milestone.

Ecommerce, Fintech Still The Hottest: The two sectors continued to dominate India’s startup funding landscape in Q1 2025. Ecommerce topped the charts by deal volume (47 deals) across all stages, while fintech emerged as one of the most funded sectors ($739 Mn), especially at the growth and late stages.

Funding Uptick Across Stages: On the back of six mega deals, funding raised by late stage startups soared 80% YoY to $1.8 Bn in Q1 2025. While seed stage startups bagged $188 Mn, up 18% from the nearly $160 Mn raised in the year-ago quarter, growth stage startups managed $1 Bn in funding, up 7% YoY.

M&As See A Revival: After a slowdown in consolidation activity last year, the homegrown startup ecosystem made a big comeback on the M&A front in Q1 2025 — be it HUL’s acquisition of Minimalist or Everstone picking up a majority stake in Wingify.

With expectations for a stronger Q2, let’s dive right into what Q1 FY25 has to reveal in terms of Indian startup funding. Continue reading…

From The Editor’s Desk

Zomato Axes 600 Jobs: The foodtech major has laid off its employees due to performance issues and AI-led automation. This comes amid slowing growth in its food delivery vertical and rising competition in the quick commerce space.

Spinny Bags $131 Mn: The used car marketplace has raised the mega funding in a round led by Accel to fuel its newly floated NBFC arm. The fundraise pegs Spinny at a valuation of $1.7 Bn to $1.8 Bn on a post-money basis.

Boba Bhai’s Revenue Zooms 6X In FY25: The QSR chain saw its net revenue surge 500% to INR 30 Cr in FY25 from INR 5 Cr in the previous fiscal year. The startup offers bubble tea and serves Korean fusion burgers, ice cream, and fries.

OYO’s Q4 Revenue Outlook: The hospitality giant’s founder and CEO Ritesh Agarwal expects OYO’s revenues to zoom 60% YoY to INR 2,100 Cr in Q4 FY25. The company also projects the recently acquired G6 Hospitality to add INR 275 Cr to its coffers in Q4.

SEBI Greenlights IndiQube’s IPO: The coworking startup received an observation letter from the markets regulator on March 24, clearing all decks for its IPO. IndiQube’s public issue will comprise a fresh issue of shares worth INR 750 Cr and an OFS component of INR 100 Cr.

BorderPlus Acquires German Firm: upGrad cofounder Mayank Kumar’s talent mobility startup has bought healthcare recruitment firm Onea Care for an undisclosed amount. The company also plans to set aside $10 Mn to fuel its M&A playbook.

The Bear House Nets INR 50 Cr: The D2C menswear brand has secured around $5.8 Mn as part of its Series A round led by JM Financial Private Equity. The Bear House sells premium casual workwear via its website and other ecommerce platforms.

UPI At An All-Time High: The payments infrastructure clocked 1,830 Cr transactions in March 2025, up 13.6% from 1,611 Cr in the preceding month. Meanwhile, UPI processed transactions worth INR 24.77 Lakh Cr last month, up 12.8% MoM.

Inc42 Startup Spotlight

Can Neural Defend End The Deepfake Menace?

Sophisticated scammers are exploiting AI to create deepfake images and videos of prominent figures to promote fraudulent trading apps, leading to significant financial losses for individuals. Existing eKYC processes also struggle with these advanced manipulations.

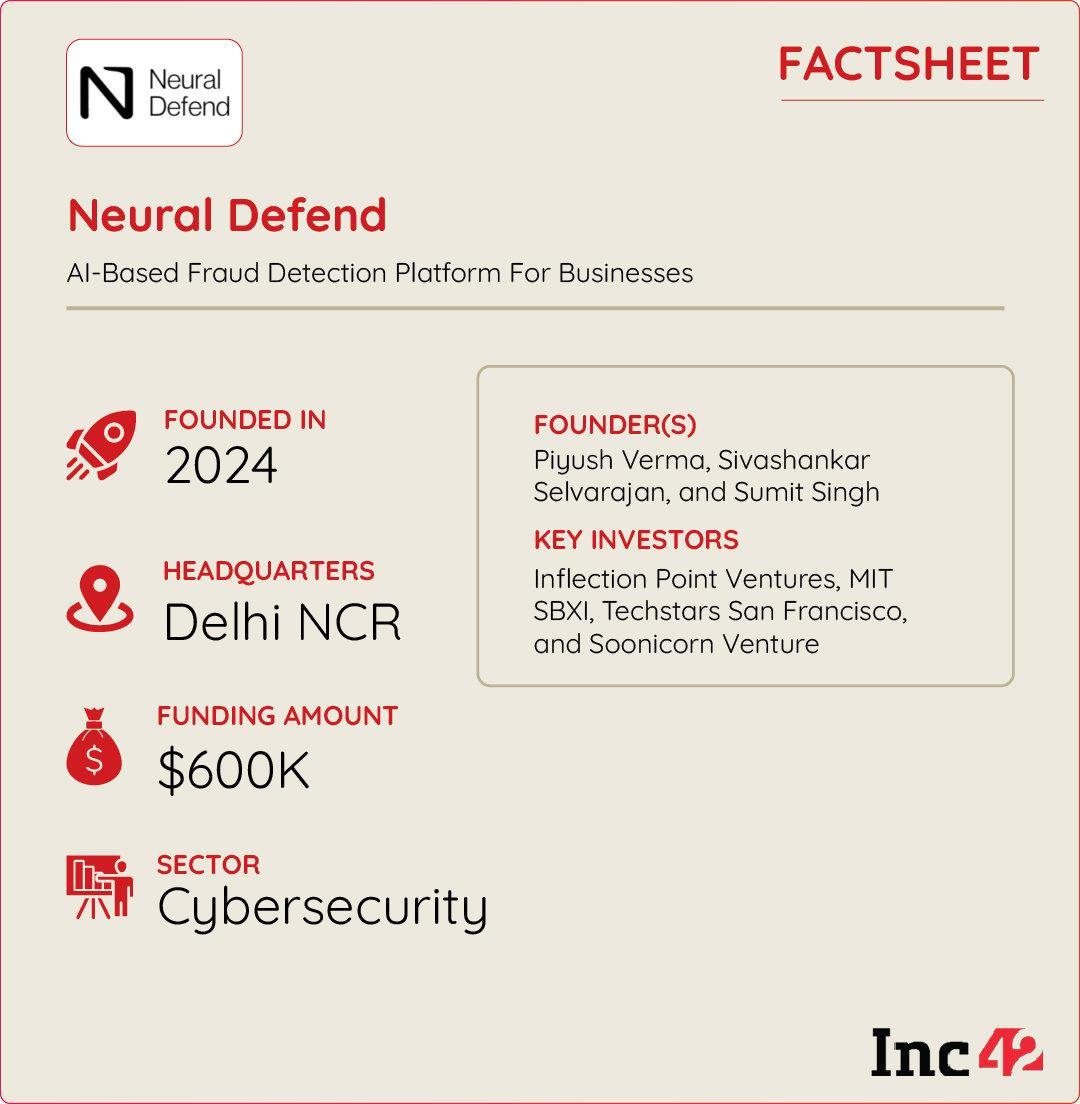

Realising that this was a major risk in the era of AI, Piyush Verma, Sivashankar Selvarajan, and Sumit Singh founded Neural Defend in 2024.

Combating Deepfakes With AI: The Delhi NCR-based startup’s proprietary algorithm leverages AI to analyse images, videos, and audio to identify deepfake manipulations. Neural Defend’s system is also designed for real-time analysis, which is crucial for applications like video conferencing security and eKYC verification where immediate detection is necessary.

Sitting On AI Gold Mine: As AI witnesses rapid adoption, the cybersecurity startup is looking to shield enterprises battling the deepfake menace. With its AI arsenal, it plans to capture a big pie of the global deepfake tool detection market, expected to breach the $4.1 Bn mark by 2030.

Next On The Cards? Neural Defend aims to secure at least 10 customers and reach $10 Mn in annual recurring revenue (ARR) within a year. It also plans to expand globally by tailoring its deepfake detection solutions for specific industries and ensuring seamless adoption across markets.

Nevertheless, with stiff competition from established giants like McAfee, which, too, has a deepfake detection service in India, can Neural Defend nib India’s deepfake menace in the bud?

Fintech

Fintech Travel Tech

Travel Tech Electric Vehicle

Electric Vehicle Health Tech

Health Tech Edtech

Edtech IT

IT Logistics

Logistics Retail

Retail Ecommerce

Ecommerce Startup Ecosystem

Startup Ecosystem Enterprise Tech

Enterprise Tech Clean Tech

Clean Tech Consumer Internet

Consumer Internet Agritech

Agritech