SUMMARY

Have Zomato and CarTrade given investors enough faith for upcoming IPOs?

Paytm employees get ready for IPO windfall and what Kunal Shah thinks of ESOP buybacks

The new rules for drone operations could revitalise the market

P2P lending is back, the drone sector could be ready to fly high in India and the club of IPO-bound tech companies continues to swell, despite CarTrade getting off to a slow beginning in the stock market and Zomato stock also on a decline. As the IPO train rolls on and funding continue to remain high, the biggest of startups are also creating wealth for their employees in various ways.

But before we go into the details, here’s a look at the top stories this week:

- Khatabook raised $100 Mn and will use $10 Mn of the funds to buy back stock from employees

- Kavin Bharti Mittal-led Hike is looking to bounce back after raising funds from some of the biggest angel investors and is betting again that Indian internet users will flock to its gaming and virtual hangouts platforms

- Early-stage VC Prime Venture Partners announced its fourth fund of $100 Mn. It will look to make at least 20 new investments with a ticket size of around $1 Mn – $2 Mn

The Big Debate

Two fintech unicorns — Cred and BharatPe — have entered the P2P (peer-to-peer) lending fray in the past week. While some lauded the duo on social media for tapping a new monetisation channel, a few others were not so impressed.

P2P (peer-to-peer) lending has never really taken off in India despite being the next-big-thing for the better part of a decade. The problem was that many lenders lost their money in the first wave of P2P loans in India around 2015-16 and never returned to the platforms. The hullabaloo they raised led the central bank to regulate the sector and cap the maximum amount a lender could disburse at INR 10 Lakh. That was in October 2017.

Investors thought that RBI’s purview would mean that lenders would flock once again to these platforms. So, a number of P2P loan startups raised early-stage rounds in the next year — such as LenDenClub, LiquiLoans, Faircent, Cashkumar, PaisaDukan and Anytime Loans to name a few.

But, lenders did not show up in droves. “People have not been able to trust borrowers on these platforms and that is not about to change soon. Even the central bank easing the cap on individual lending five-fold to INR 50 Lakh has not helped much,” said a partner at a top management consulting firm who did not want to be named.

Are the two fintech unicorns then entering a market that never gives? One has to recognise that none of the P2P NBFC players is as big as BharatPe (7 Mn users, $600 Mn funding) or Cred (5.9 Mn users, $442 Mn funding). This means they neither had the marketing muscle nor the data wherewithal to create a strong peer to peer lending ecosystem.

However, another thing to note is that both the companies are going into the P2P businesses with NBFC partners who themselves get a puny 1-3% cut of the loan amount as commissions. Is eking out a part of that small pie worth the effort?

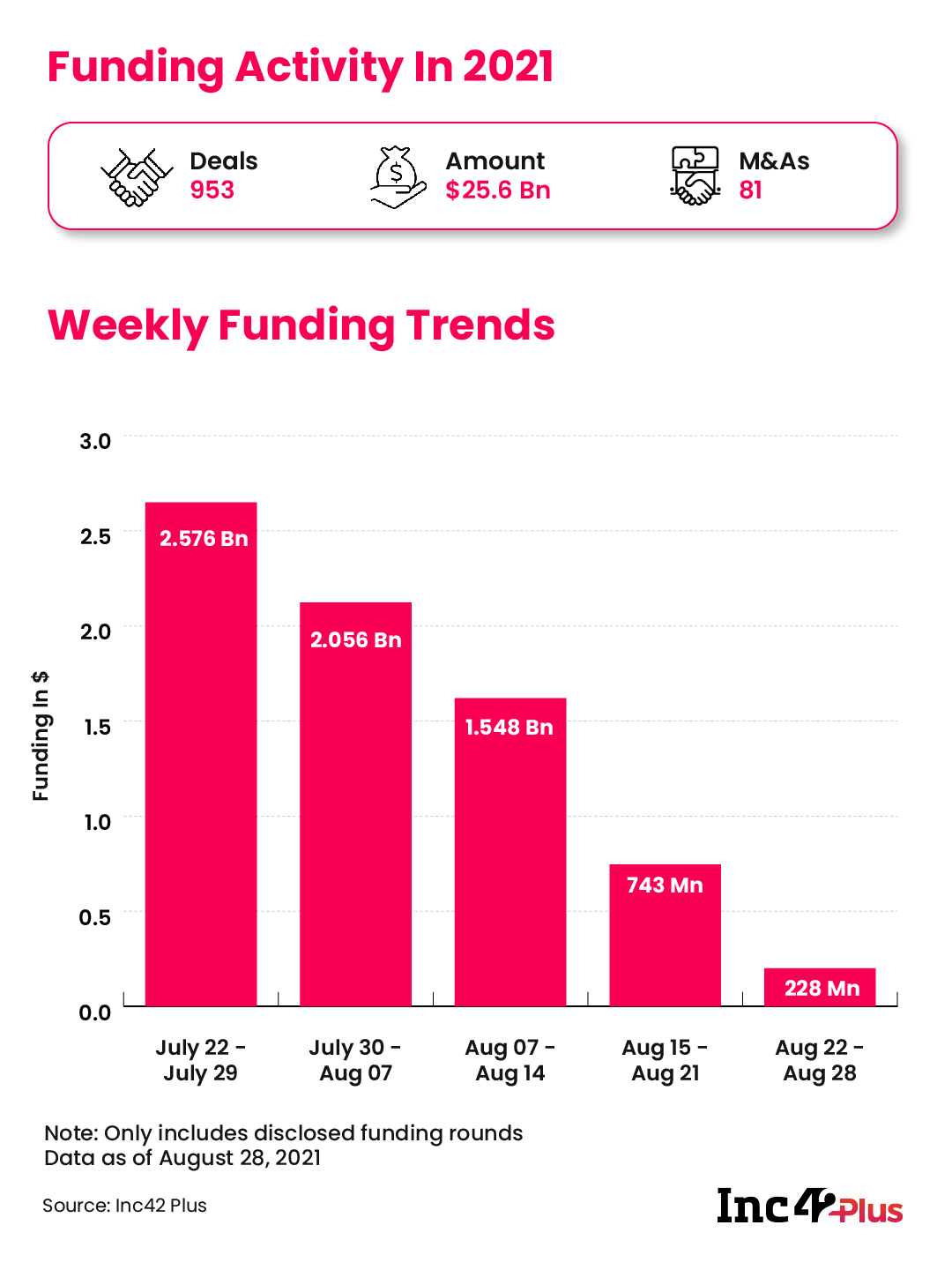

Indian Startup Funding Counter

D2C startups were the flavour of the week for investors, with furniture rental startup Furlenco raising $15 Mn debt, whereas Ankit Nagori-led Curefoods raised $13 Mn for acquiring digital food brands across geographies.

Overall $228 Mn was raised by Indian startups this week which also saw Delhivery acquiring Spoton and Nazara acquiring OpenPlay for INR 186.41 Cr.

Indian Startups’ IPO Corner

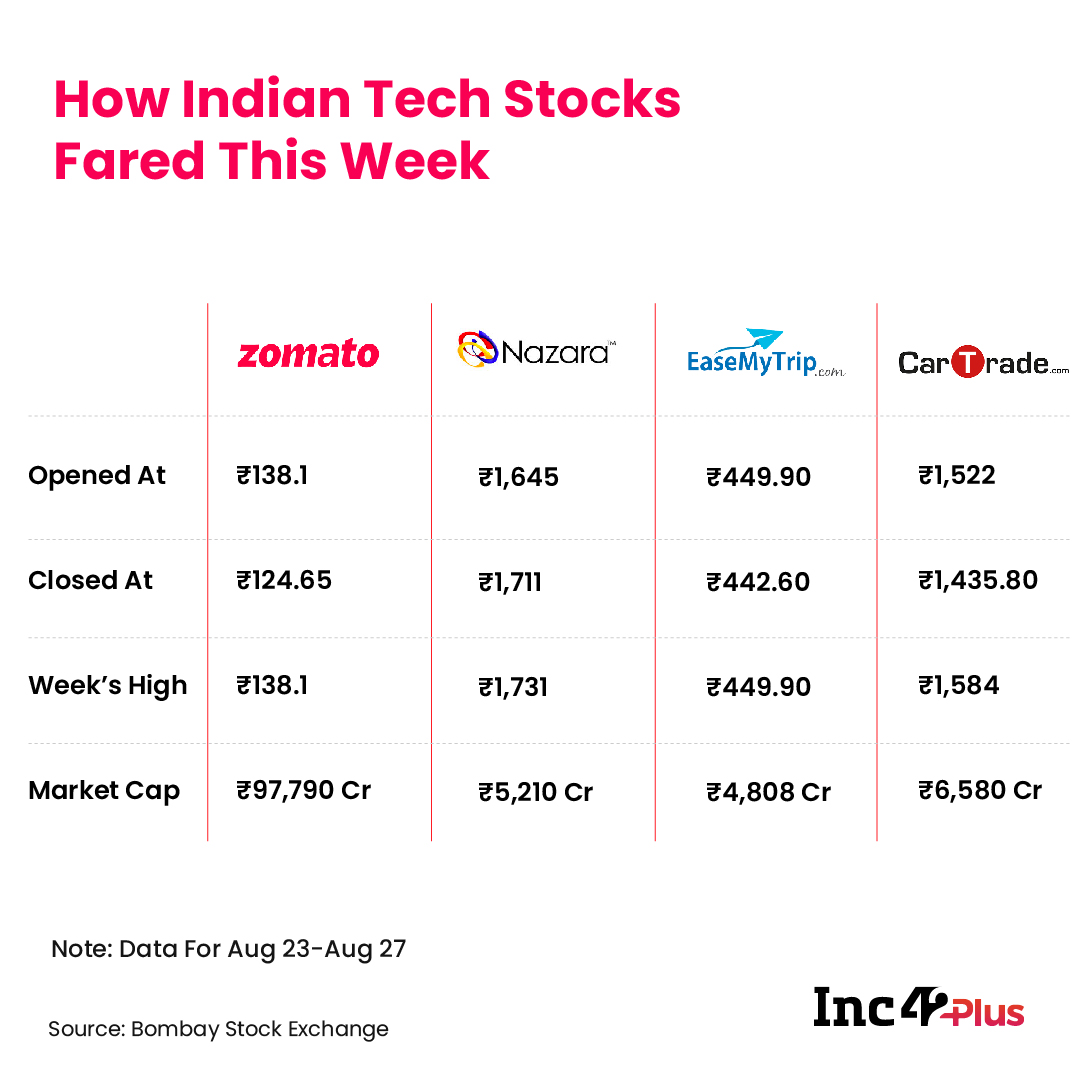

The week started with Zomato’s shares falling 9% on Monday (August 23), coinciding with the end of the 30-day lock-in period for anchor investors. Nevertheless, ICICI Securities is very bullish on the stock and has set a target of INR 220 on the stock, though Zomato’s closing price for the week of INR 124.95 is a far cry from that currently.

On the other side, CarTrade, which had a relatively weak listing, continued to slide all through the week and its share price dropped by INR 131 this week.

While there’s no telling how startup IPOs in India will pan out, the US market is starkly different. This week, enterprise tech unicorn Freshworks filed for an IPO in the US to raise $100 Mn.

Another company that’s being watched closely is BYJU’S, which has attracted the interest of some investment bankers who have pegged its valuation between $40 Bn – $50 Bn.

Meanwhile, here’s a look at this week’s performance of the startups which went IPO this year.

In Spotlight | India’s Liberal Drone Policy

Looking to drive India’s nascent but potentially massive drone sector, the Indian government released the amended draft of the Drones Rule 2021 this week. Under the new rules, drones will fall under the provisions of the Motor Vehicles Act, improving the potential for drone insurance as well as protection against damage caused by drones.

Besides this, the time frame for certifying drones has been shortened, with priority given to those drones with India-made components. Most of the changes address grievances that the drone industry had in the past.

But drone experts want the government to make good on the execution too, as the central government has fallen short on most of the promises in the past. Since 2018, the government has made assurances regarding the Digital Sky drone tracking platform and frameworks pertaining to drone delivery, but it is yet to meet its timeline on most of these.

Tweet Of The Week

The ESOPs reward for being with a startup from the very early days often materialises at a very late stage, if at all. Second-time entrepreneurs are looking to change that and over $100 Mn in ESOP buybacks have come this year alone.

CRED bought back employee stocks to spread the wealth twice in 2021, and founder Kunal Shah believes ESOP buybacks will become a key barometer for successful startup founders.

From The Unicorns’ Corner

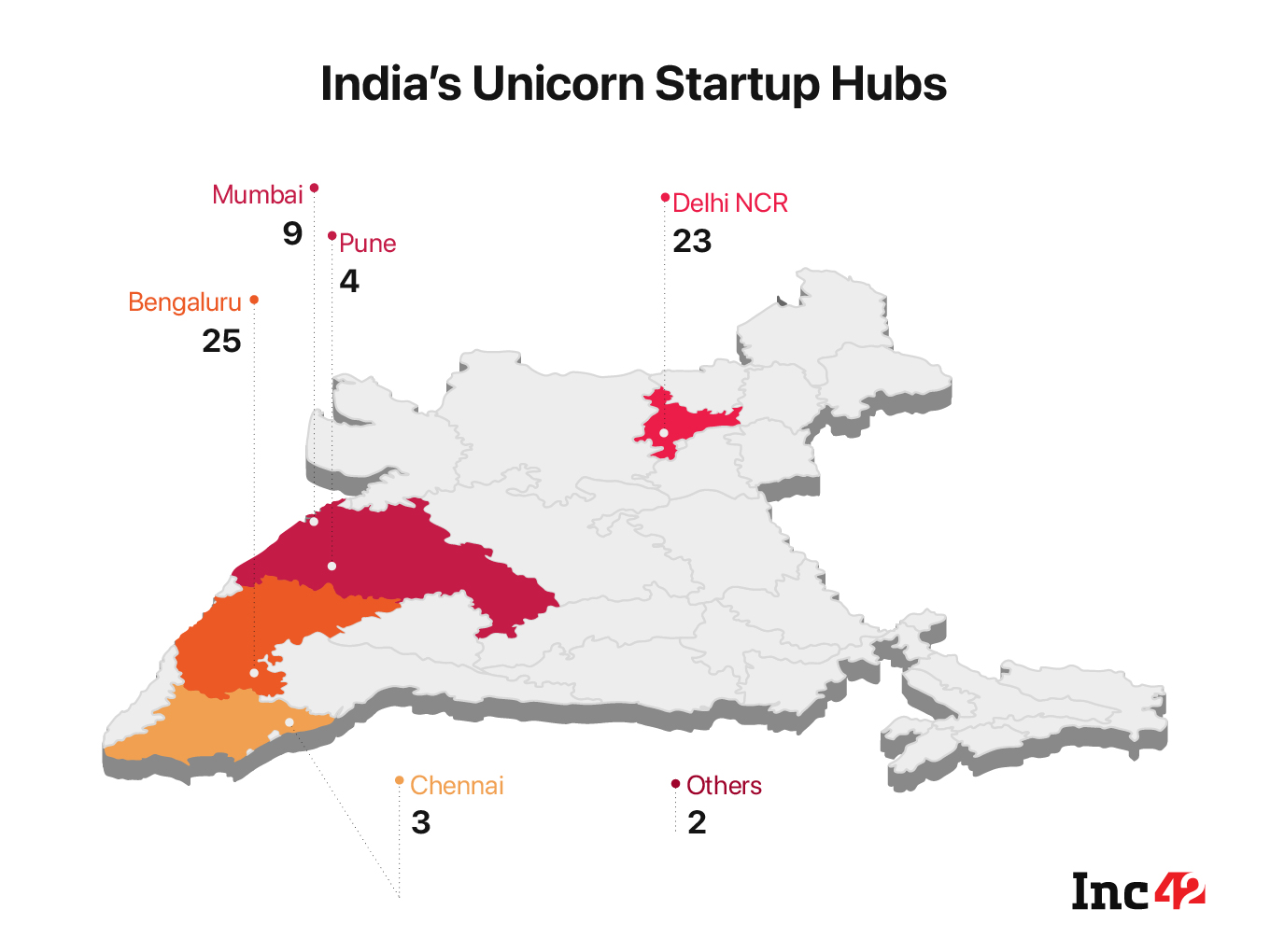

India’s unicorn club now has over 66 startups, as we witnessed the entry of the first healthtech, social commerce, epharmacy unicorns this year. Overall, 2021 has witnessed the entry of 24 startups in India’s unicorn club.

This week, we decided to look at which startup hubs are producing the most unicorns, here’s a quick look!

Top Stories

Here are the key stories of the week gone by:

- We are feeling very bullish about India’s creator economy and that’s why this week’s edition of The Outline looked at India’s open, diverse and massive creator economy as online platforms became the refuge away from home for everyone in the past 18 months.

- Milkbasket CEO Anant Goel stepped down from the company, as it’s increasingly looking like Reliance has acquired the company. Reliance is yet to make an official statement, but two of its executives joined Milkbasket as directors.

- Markets regulator SEBI and the NSE have raised a flag on the sale of digital gold. Investment platforms such as Groww, Upstoxx, Paytm Money have been asked to stop their operations related to digital gold by September 10.

- Some of Paytm’s former & current employees have converted ESOPs worth INR 182 Cr collectively to shares, ahead of the company’s much-awaited $2.2 Bn IPO

- The future is decentralised. From commerce to finance to even the internet, everything is going on the blockchain and towards a decentralised architecture. But does India have the talent pool to capitalise on this future or will we miss the blockchain bus? This week’s edition of India’s Crypto Economy dived on this.

- The Future Group is stepping up its fight against Amazon after filing a case against the US giant in the Supreme Court. Future Group claims if the deal with Reliance doesn’t go through, it would cause “unimaginable” damage, job losses for 35,575 employees, $3.81 Bn in unpaid dues in bank loans and debentures.

That’s all for this week. Watch out for a more data-packed newsletter every Sunday as we recap the week’s biggest stories and developments.

Till next week,

Team Inc42