SUMMARY

Reports surfaced that Ola has suspended Foodpanda’s business

Company is scaling down ops to focus on cloud kitchen model

Foodpanda cut marketing and customer acquisition costs by two-thirds in January

Ola-owned food delivery business Foodpanda is said to be going through yet another pivot in its business plans. A Mint report has said that Ola has suspended the company’s food delivery business, laid off about 40 mid- to entry-level employees and terminated the contracts of most of its 1,500 food delivery executives.

However, an Ola spokesperson strongly refuted the report when responding to Inc42’s queries. The spokesperson said that as part of the company’s ongoing business repurposing initiatives, it is “focussed on building a portfolio of food brands and curated food offerings through its fast expanding network of kitchens.”

Ola shifting its focus on in-house brands and cloud kitchens— The Khichdi Experiment, FLRT and HolaChef— has been the gist of many reports since January. The company has continued to say that it will invest in expanding its facilities and kitchens, as well as its portfolio of food offerings for customers.

People aware of the company’s plans told Inc42 that the company has been scaling down operations to focus on cloud kitchen and in-house brands model. It makes sense for the company to avoid burning millions just to pursue success in the competitive foodtech sector against leading players with huge cash burn potential.

As a business model, the cloud kitchens don’t require much upfront costs when compared to a classic dine-in or takeaway restaurants. This can be leveraged by budding restaurateurs as an opportunity to test out their brand and customer base before opening a premise in a low-risk environment. Some reports are saying that with continued losses and cash burn for Foodpanda, Ola has now decided to scale down the operations and focus on cloud kitchens.

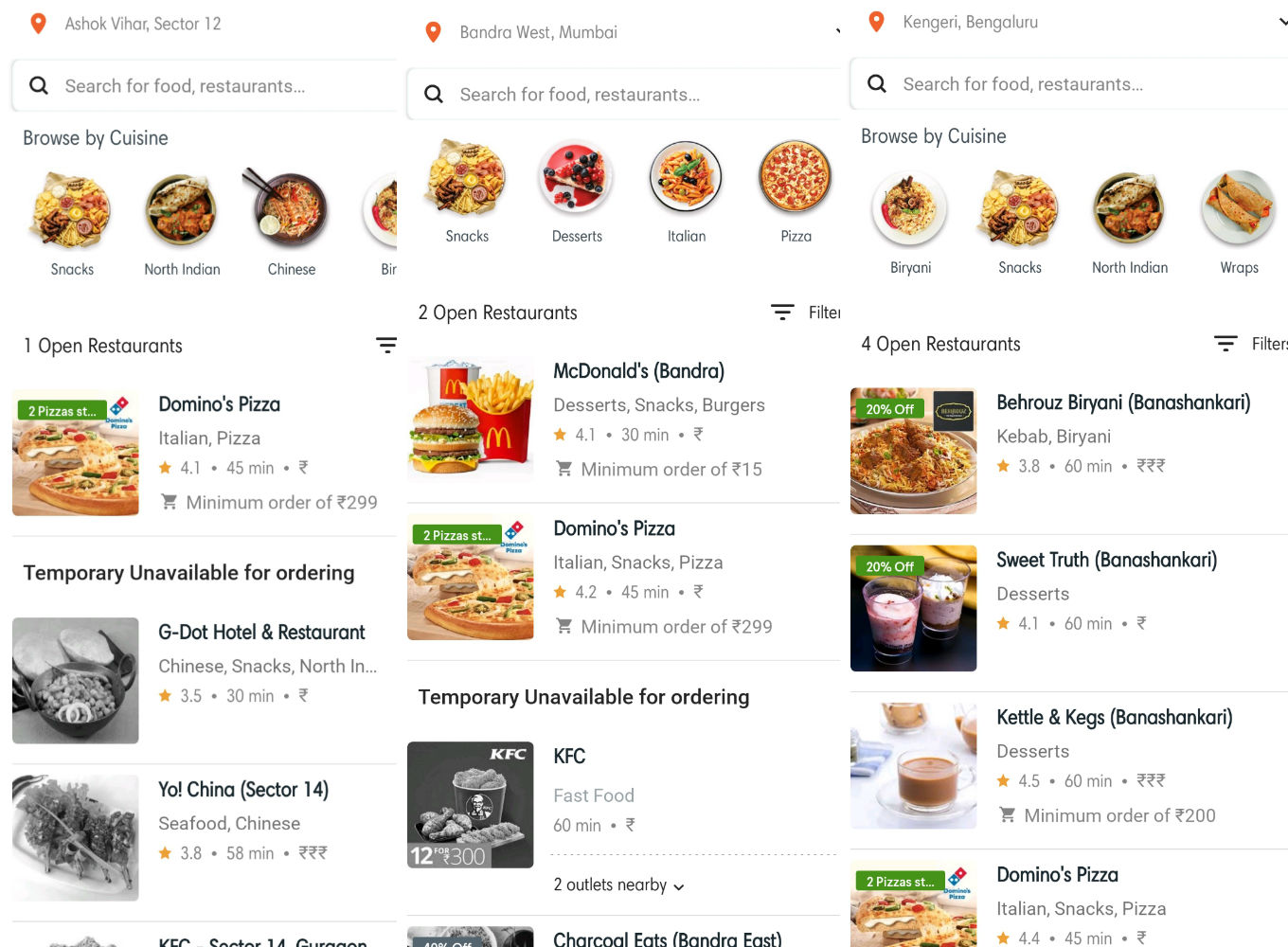

When Inc42 tried to browse and order food from the Foodpanda app and through the Ola app, across locations such as Delhi, Gurugram, Bengaluru and Mumbai, only a select few restaurants were listed as active. These include the likes of Dominos and Foodpand’s cloud kitchens with the rest unavailable for delivery.

Further, reports have claimed that Foodpanda is hiring people with culinary experience. However, there are no such jobs or any job openings on the official website.

In January, Foodpanda cut marketing and customer acquisition costs by two-thirds in keeping with Ola’s de-prioritisation plan for the business. The company expected orders to fall by 60% but business will grow more efficiently.

It is to be further noted that Foodpanda hit its peak in August 2018, when supported by deep discounts and cashbacks, it got 200K orders per day. However, at present, it is competing against Zomato and Swiggy which are recording more a million orders a day with just 5K daily orders.

According to a 2019 report by research and consulting company RedSeer, the foodtech sector posted triple-digit growth for the third-year running and players in the space expanded their footprint like never before. As Ola looks to take Foodpanda towards the cloud kitchen model, it is also looking to open offline stores.

From a presence in just around 15 cities a year back, foodtech platforms expanded to over 100 cities in 2018 and about 30% of their orders now come from non-core markets. The RedSeer FoodTech Leadership Index (FLI) ranked Swiggy at the top place with a total score of 96 in the fourth quarter of 2018. Its arch-rival Zomato came in second with a score of 82. In third place is UberEats, followed by Foodpanda.