SUMMARY

With This Funding, HighRadius Is looking To Tap $11 Bn Worth Global Integrated Receivables Market To Cater Demand For AI Based Finance Automation

AI-based fintech firm HighRadius, which provides cloud-based Integrated Receivables software, has raised $50 Mn in a growth funding. The investment was led by US-based PE firm Susquehanna Growth Equity. After 11 years of bootstrapping, this is the first investment raised by the US and Hyderabad-based firm.

For the neophytes in fintech, Integrated Receivables is a solution to optimise accounts receivable operations by integrating all receivable and payment modules to work as a unified business process. At the core of the Integrated Receivables platform are solutions for credit, collections, deductions, cash application, electronic billing and payment processing – covering the entire gamut from credit-to-cash.

The newly raised funding will be utilised by the company to fuel its growth. The funding will further be utilised towards global expansion, including, Americas, Europe and Asia.

“Susquehanna Growth Equity has a proven track record of backing leading financial technology companies, and is a perfect partner for our next stage of growth,” said HighRadius CEO, Sashi Narahari.

In conjunction with the investment, Amir Goldman and Ben Weinberg from Susquehanna Growth Equity will join the HighRadius board of directors.

As stated by Amir Goldman, Founder and Managing Director of Susquehanna Growth Equity, “Integrated Receivables is a $11 Bn market in the early stages of adoption. HighRadius is the clear leader in receivables-focused SaaS solutions for large enterprises and the only cloud-based platform that covers the full range of functions and processes. We love backing bootstrapped companies like HighRadius, which has never raised outside funding, has grown at a 70% CAGR, and continues to be cashflow positive.”

HighRadius: A Quick Glimpse

HighRadius is led by Sashi Narahari, an IIT alumnus and enterprise technology veteran. It is a fintech company, focused on executing its Receivables 2020 vision. This implies enabling receivables functions to achieve 80% electronic payment adoption and 80% process automation, reducing paper-based processes and manual work to just 20% each.

The fintech firm works with over 280 Global 2000 companies, including Adidas, Starbucks, Procter & Gamble, Reckitt Benckiser, Johnson & Johnson, Warner Bros, Danone, Sysco and Zurich. Recently, the firm also partnered with Bank of America Merrill Lynch, to implement its artificial intelligence (AI) solution to speed up receivables reconciliation for the bank’s large business clients.

HighRadius is currently growing at a CAGR of 70% and a year-on-year growth of 300%. It is headquartered in Houston, TX with major tech operations in India and sales offices in Europe and North America. The global firm currently employs over 500 people across the US, India, and Europe.

As shared by Bhanu Bobba, Managing Director, HighRadius India with Inc42, “ We believe in a work-hard, play hard culture. We are a performance-driven organisation and have been successfully grooming in-house talent to mid-management and senior management roles. We have an internal principle called – Highako – fail fast, learn fast, fix fast. This has enabled us to fast-track the time it takes for new people on our teams to hit the ground running in as less as two weeks. According to us, a great workplace is more about being surrounded by excellent colleagues than anything else – and we make sure to stay true to that.”

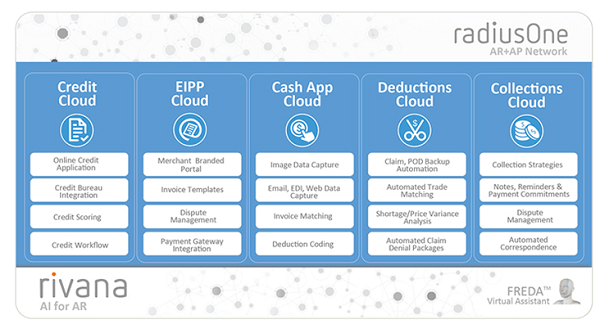

HighRadius: The Product Stack Offered By Fintech Saas Firm To The Global Clients

The HighRadius’ Integrated Receivables platform optimises cash flow through automation of receivables and payments processes across credit, collections, cash application, deductions, electronic billing and payment processing.

Powered by the RivanaTM Artificial Intelligence Engine, Integrated Receivables platform of HighRadius enables businesses as well as banks to leverage machine learning for accurate decision making and future outcomes. Another engine, the RadiusOne, B2B payment network allows suppliers to digitally connect with buyers, closing the loop from supplier receivable processes to buyer payable processes.

As said in a company statement, HighRadius solutions have a proven track record of optimising cash flow, reducing days sales outstanding (DSO) and bad debt, and increasing operational efficiency so that companies may achieve strong ROI in just a few months.

HighRadius team also claimed in an official statement that customers save as much as $6 Mn recurring working capital costs using the solutions provided by HighRadius.

Sashi Narahari, CEO of HighRadius said, “It is a learning experience every single day. As a company, we have always focused on core execution while consistently keeping an eye on the big picture. We have accomplished a lot of success with more than 350 clients across the world. Our focus on delivering value to the end-user and accounts receivable organisations has led us to continuously innovate and disrupt ahead of the market. Today, we are the only provider of a cloud-based platform for end-to-end Integrated Receivables.”

Integrated Receivables: A Global Opportunity In Fintech

As per a report by Integrated Receivables firm WAUSAU, “Companies of all sizes spend in excess of $100B each year on their receivables processes. At the same time, more than 65% cannot reach straight-through processing rates for payments greater than 20%.”

Another report published by Billentis marked that 90% of all invoices worldwide are still processed manually, and the amount of repetitive and time-consuming tasks in invoice handling is high. As stated by Patrik Sallner, CEO, OpusCapita, “We are moving towards a digital economy, where the focus shifts to procurement and cash management, and the functions related to accounts payables and accounts receivables are commoditised through, for instance, advances in next-generation technologies. Organisations need to focus more and more on the full digital transformation of their business processes.”

The adoption of Integrated Receivables technology is expected to match that of Accounts Payable automation by 2020 as per the analysts. “The opportunity is further supported by the size of the B2B payments market, which is five times larger than the B2C market, yet severely underserved today,” added Sashi.

Thus, payment automation and reduction in repetitive manual workflows is need of the hour. This is high time, businesses should start leveraging emerging technologies, such as blockchain, robotic process automation, machine learning, and advanced analytics to improve the degree of business process automation.

Also, this is certainly the right time for the fintech automation firms like HighRadius to expand their global footprint and scale ahead. However, with all the complexity surrounded around Integrated Receivables technology, keeping the platform simple and user-friendly for the end consumer, is still a challenge ahead for HighRadius. With the raised funding and amidst its global plans, the way HighRadius will maintain this simplicity will be worth watching.