Plea says that Facebook made “serial defensive acquisitions” to protect its dominant position in the market

This week Facebook agreed to pay $5Bn as part of settlement with US FTC over Cambridge Analytica scandal

Facebook made $16.9bn in the second quarter of 2019

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Some of you would have heard of the phrase “too big to fail” used widely while referring to the big banks before the financial crisis of 2008.

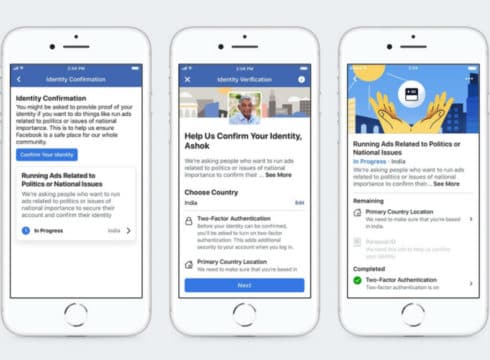

Opinions worldwide were aghast at the complacency shown by financial institutions and regulators. A similar thing happened after the Cambridge Analytica scandal and Russia meddling in the US election by targetting voters with Facebook ads, content, videos and more.

After a spate of controversial headlines, the public has started focussing their attention on the influence of social media giants. The big banks are slowly being replaced by social media as the target of public ire. And questions are being asked of tech giants like Google and Facebook about privacy, ethics and user rights, because at the end of the day they are becoming products for social media companies to sell.

The new questions that are being asked is if these companies are simply too big and if we need to break them up to level the playing field.

This is something that has been echoed by competitors and regulators in the past but more recently, Facebook cofounder Chris Hughes has joined efforts of two leading antitrust academics, Scott Hemphill of New York University and Tim Wu of Columbia University over a potential antitrust case against the company.

If you use social media, chances are that most of you use Facebook and this is not necessarily about the social media platform Facebook but the company Facebook, which owns Instagram and WhatsApp. Accounting for 2.41 Bn monthly active users, Facebook is the biggest social network worldwide.

In small quarters across the western world, concerns are being raised about whether the company has become a monopoly and what impact it could have on the consumers in the long run.

The trio has had meetings with the US Federal Trade Commission, the Justice Department and state attorneys general. For nearly a decade, they argue, Facebook has made “serial defensive acquisitions” to protect its dominant position in the market for social networks. Scooping up nascent rivals, they assert, can allow Facebook to charge advertisers higher prices and can give users worse experience, the New York Times (NYT) reported.

In an opinion piece for NYT in May, Hughes said that it is time to break up Facebook while describing the power held by force colleague and Facebook CEO Mark Zuckerberg as “unprecedented.”

At the US House antitrust subcommittee hearing last week, when asked to name its rivals, a Facebook executive hesitated and did not offer a list. Wu, who also testified, said, “Facebook can’t name its competitors because they bought them.”

Later in his written testimony, the executive, Matt Perault, director of public policy at Facebook, listed many competitors that included Snapchat, Telegram, Twitter and YouTube.

Apart from YouTube, the others mentioned in the list are not a big competition for Facebook, in terms of user or revenue; Facebook made $16.9bn in the second quarter of 2019 – a 28% increase over the second quarter of 2018.

The Federal Trade Commission (FTC) announced a fine for Facebook over the theft of user data in the Cambridge Analytica scandal. The sum of $5 Bn might appear big at first but one look at Facebook earnings is enough to state that the company can easily pay this sum without breaking a sweat.

It isn’t clear whether the FTC will pursue the monopoly argument and the company buying its way to domination. But according to NYT which spoke to antitrust experts, it may be the most promising target of inquiry, focussed on a handful of acquisitions rather than a broad review of the company’s conduct in general.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.