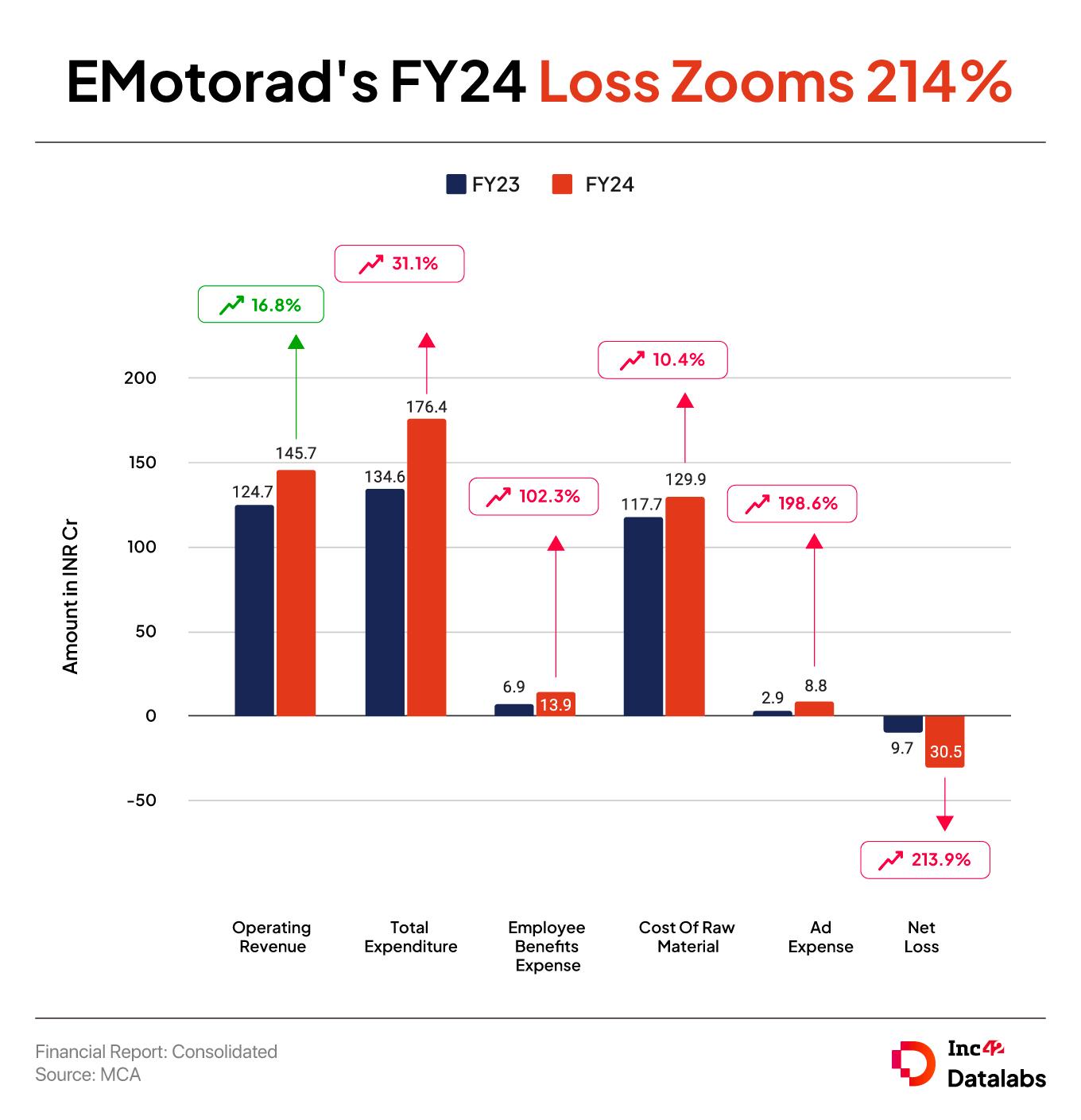

Despite the increase in top line, net loss widened 214% YoY to INR 30.54 Cr in FY24 on rising expenses

EMotorad’s total expenditure surged 31% YoY to INR 176.42 Cr during the year under review

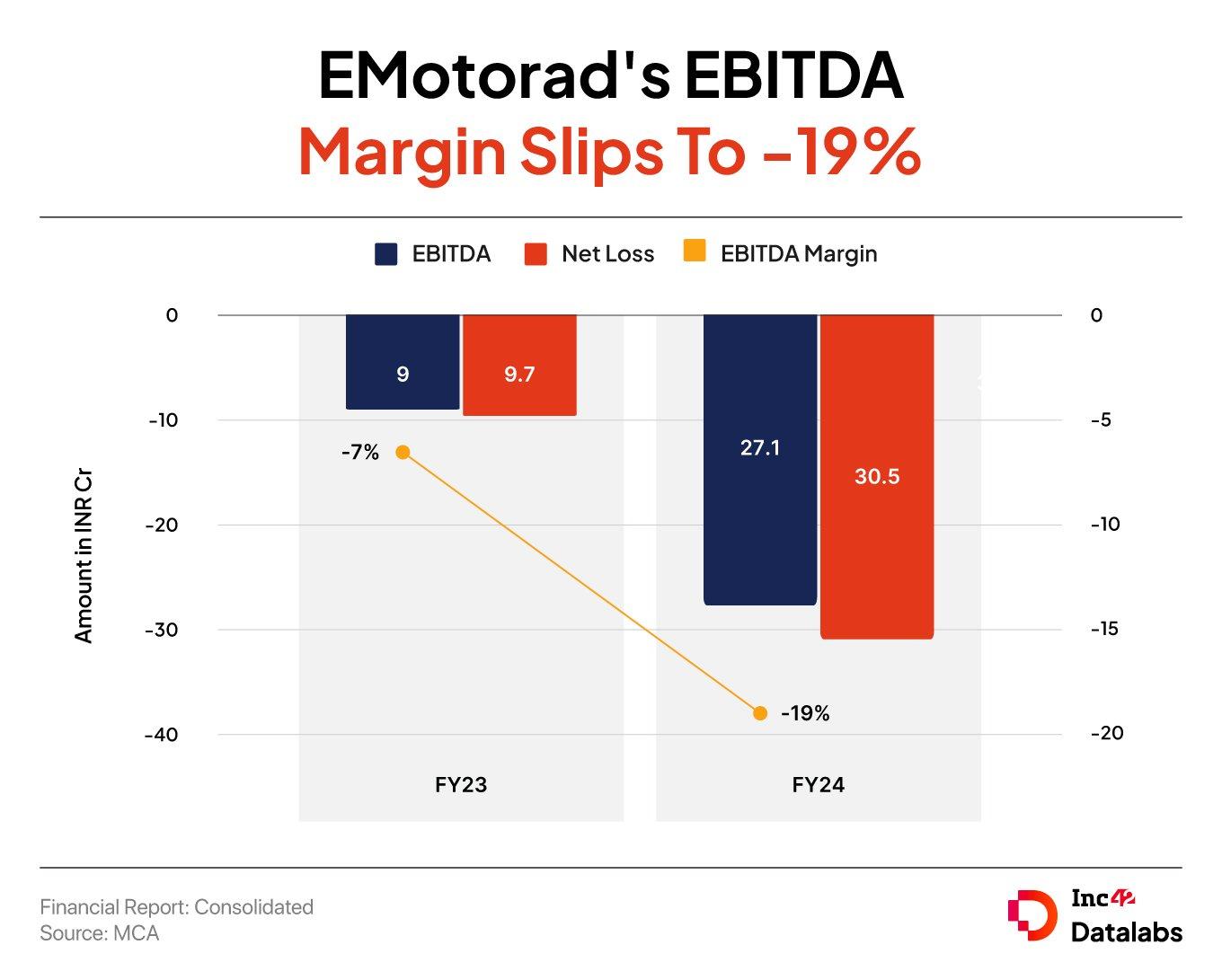

EBITDA loss grew threefold to INR 27.10 Cr in FY24 from INR 9 Cr in the previous fiscal year

Mahendra Singh Dhoni-backed electric bicycle (e-bike) startup EMotorad’s consolidated net loss widened 214% to INR 30.54 Cr in the fiscal year 2023-24 (FY24) from INR 9.73 Cr in the previous fiscal year, hurt by rising expenses.

The Pune-based e-bike manufacturer witnessed a strong top line growth during the year under review. Its operating revenue surged nearly 17% to INR 143.59 Cr in FY24 from INR 124.51 Cr in FY23.

Founded in 2020 by Kunal Gupta, Rajib Gangopadhyay, Aditya Oza and Sumedh Battewar, EMotorad sells premium e-cycles. The startup claims to have produced 97K electric cycles in FY24 and aims to triple this number in FY25.

In May 2024, EMotorad said it was setting up what it claimed would be the world’s largest electric cycle gigafactory in India. Overall, the startup’s annual production capacity will be 550K units once this gigafactory is up and running.

Its EBITDA loss grew threefold to INR 27.10 Cr in the year ended March 2024 from INR 9 Cr in the previous fiscal year. This caused its EBITDA margin to slip 12 percentage points to -19% in FY24 from -7% in FY23.

Including other income of INR 2.08 Cr, total revenue stood at INR 145.68 Cr during the year under review as against INR 124.67 Cr in FY23.

Besides selling its electric cycles in India, the startup exports them and their components to countries such as Spain, Australia, Japan, the UAE and Nepal. EMotorad also has a B2B presence in 30 countries, with the US accounting for the lion’s share of revenue.

EMotorad cofounder Gangopadhyay told Inc42 previously that 70% of its revenue came from local and B2B partnerships in FY24. The startup currently offers its e-bikes across two major categories at different price points — X Factor (INR 25-35K) and Desire (INR 35K and above).

In 2023, the startup bagged $20 Mn in its Series B funding round led by Panthera Growth Partners. Overall, it has raised nearly $26 Mn to date and counts the likes of Alteria Capital, LetsVenture, Green Frontier Capital and Ivy Growth among its investors.

A Look At EMotorad’s Expenses

The rise in expenditure outpaced the growth in revenue for the startup. Total expenses zoomed 31% to INR 176.42 Cr from INR 134.58 Cr in FY23.

This implies that the startup spent INR 1.22 to earn every rupee in FY24.

Cost Of Raw Material: This was the biggest expense head for the e-bike manufacturer. The spending under this bucket rose to INR 129.88 Cr during the year under review from INR 117.67 Cr in FY23.

Employee Benefit Expenses: EMotorad spent INR 13.90 Cr towards employees’ remuneration and other benefits in FY24, about 102% higher than the INR 6.87 Cr it spent in this bracket last year. Of this, it spent INR 1.60 Cr on employee stock option plan (ESOPs) and ESOP buybacks during the year ended March 2024.

The sharp increase in employee cost indicates that the startup might have grown its headcount during the year under review.

Advertising Promotional Expenses: The startup’s spending under this head grew nearly threefold to INR 8.78 Cr during the year under review from INR 2.94 Cr in FY23.

Fintech

Fintech Travel Tech

Travel Tech Electric Vehicle

Electric Vehicle Health Tech

Health Tech Edtech

Edtech IT

IT Logistics

Logistics Retail

Retail Ecommerce

Ecommerce Startup Ecosystem

Startup Ecosystem Enterprise Tech

Enterprise Tech Clean Tech

Clean Tech Consumer Internet

Consumer Internet Agritech

Agritech