SUMMARY

Startups Also Complained About The 18% GST And 6% Equalisation Levy Over The Final Invoice

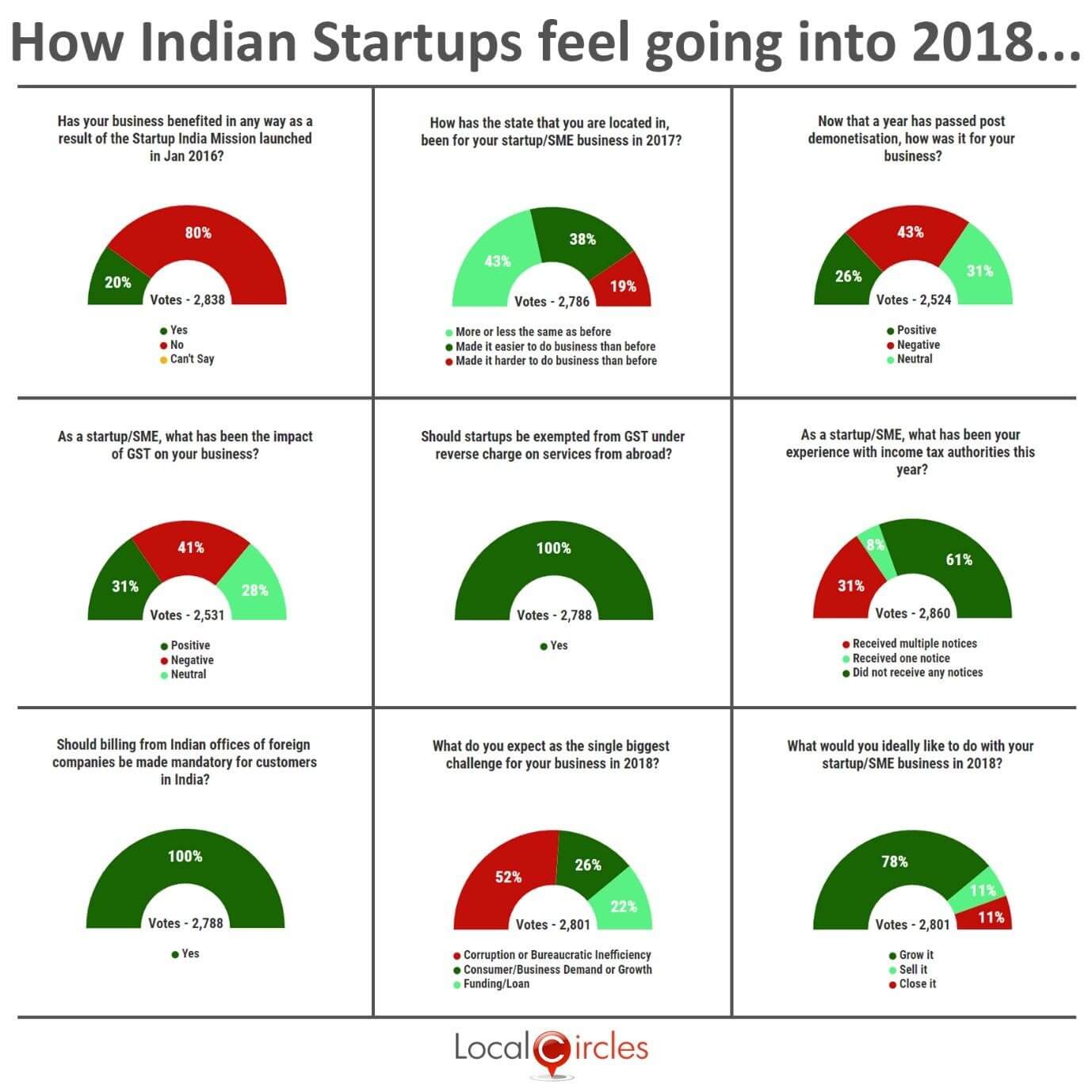

Though demonetisation and GST have been the buzzwords of 2017, however, a recent survey revealed that the two have affected startups adversely.

Social media platform LocalCircles recently conducted a survey amongst 33K startups and entrepreneurs on from different parts of India to find out how the Startup India Mission was going for them and the different roadblocks they were facing in making their company successful.

Out of 24K respondents, 43% revealed that the demonetisation impacted their startups adversely, and 41% of the respondents revealed GST is having a negative impact on their startups.

While just 26% and 31% of the respondents stated that demonetisation and GST had a positive impact on their companies respectively.

Startup India Survey: Highlights

- 20% startups benefited from the Startup India mission since its launch, two years ago.

- 38% respondents said that their state had made it easier to do business than before and 43% said the situation was more or less the same as before. 19% said their state had made it harder to do business than before.

- Impact of demonetisation: 43% said it was negative. 26% said it was positive and 31% said it was neutral for them.

- GST impact: 41% startups and SMEs said that GST has had a negative impact on their business while 31% said that the effect was negative. 28% said there was no effect.

- Indian technology startups in many cases have to go to overseas suppliers to procure new technologies, services and expertise and these transactions are currently taxed at 18% GST (under Reverse Charge Mechanism) putting Indian startups at a disadvantage against their global counterparts. All the respondents agreed that the government must exempt the taxes.

- 100% startups and SMEs agreed that the Indian government should make billing from Indian offices of these foreign companies mandatory for customers in India so the companies don’t end up paying double taxes.

- On their experience with tax authorities, 31% said that they had received multiple notices, 8% said they had received just one notice and 61% said they did not receive any notice.

- On the biggest challenge in 2018, 52% said it would be corruption and bureaucratic inefficiency, 26% said it will be consumer/business demand or growth and 22% said it would be finding new loans and funding.

- On their future probabilities, 78% said they would like to grow it, 11% said they would sell and 11% said they would in all probability, close their business.

After the highs of 2015, the mushrooming ‘rate’ of startups have come to a halt for the last one and half years. Under the Startup India Mission, the Indian government has taken a host of initiatives such as fund of funds, Atal incubation centres, IP funding and more.

As Indian companies are going global, and in many cases even local companies use digital advertising services from global companies like Google, Facebook, Twitter, the startups have to pay 6% equalisation levy on top of the invoice value as their billing entity is not registered in India.

The startups trading abroad have to pay 18% GST under reverse charge. In the LocalCircles’ survey, startups clearly had mixed responses over the Startup India and states’ startup policies.

One of the major issues that the companies have voiced quite openly is that most of these policies, states’ in particular, are not transparent. For instance, Karnataka’s Elevate 100 incubation programme where 112 startups were selected instead of the announced target of 100 startups was hugely criticised. As voiced in the startup India survey regarding GST, demonetisation and double taxes, the Govt. of India has already indicated that it might exempt startup taxes in the upcoming general budget.