SUMMARY

After Coinbase announced that it would support UPI, NPCI said it is “not aware of any crypto exchange using UPI”

Soon after many exchanges disabled INR deposits via UPI

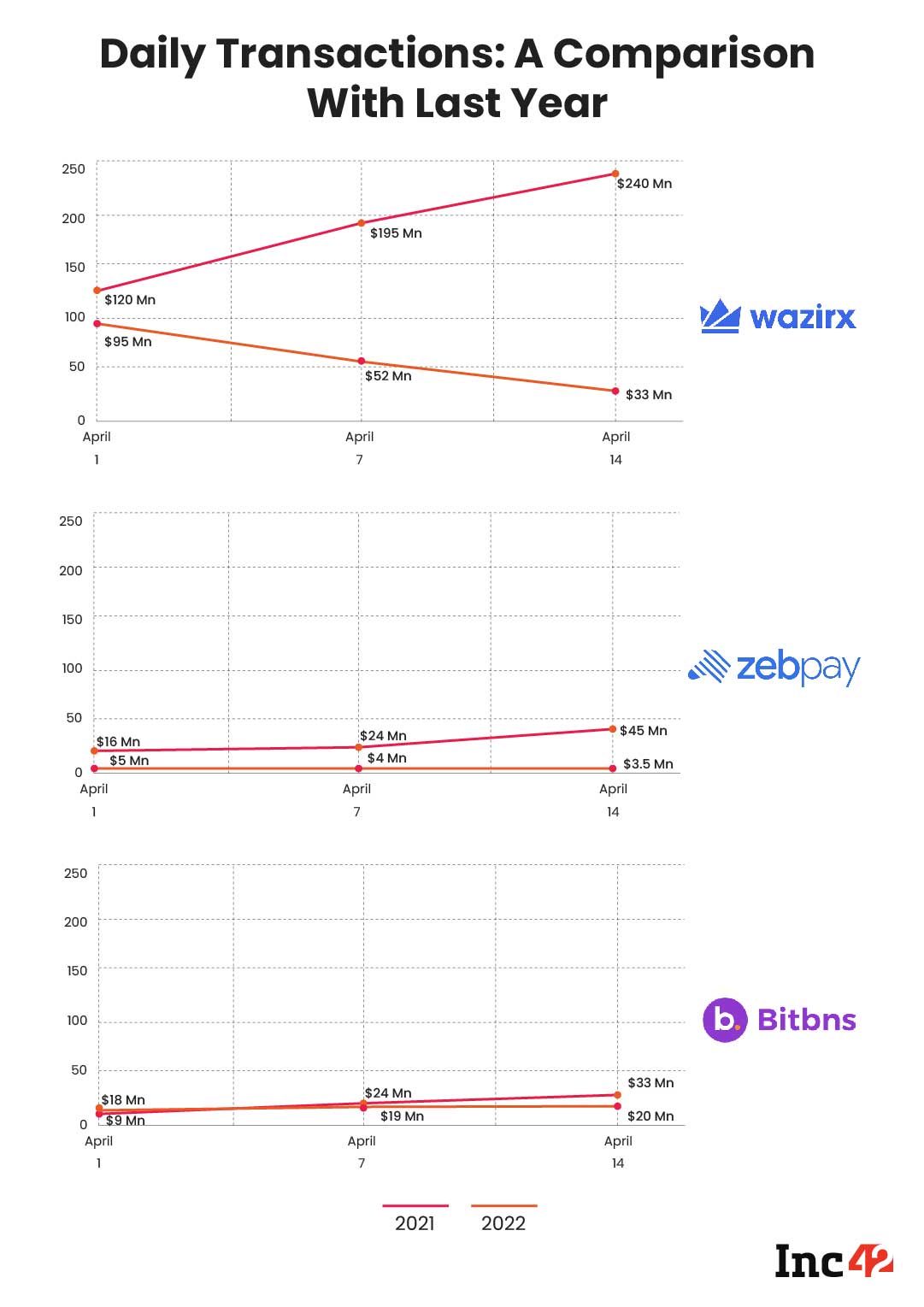

The recent developments have impacted crypto trading volumes drastically

The 2022 Budget session brought a great wave of optimism to the Indian cryptocurrency industry. As Finance Minister Nirmala Sitharaman proposed a 30% tax on the transaction of virtual digital assets (VDAs) and 1% TDS on such transactions, the crypto industry perceived it as official recognition. However, with time passing, the industry is facing new challenges almost everyday.

With the new tax rules coming into effect on April 1, the crypto exchanges in India witnessed a massive downfall in trading volumes. But it was just the tip of the iceberg for the troubles that the crypto industry was awaiting. After a Coinbase executive announced that the global crypto exchange would allow users in India to use UPI payment to purchase cryptocurrencies, the crypto exchanges came under the scanner of the National Payments Corporation of India (NPCI).

NPCI soon issued a clarification statement saying, “With reference to some media reports around the purchase of Cryptocurrencies using UPI, NPCI would like to clarify that we are not aware of any crypto exchange using UPI.”

Since then, not only Coinbase, but several other crypto exchanges in India have disabled INR deposits via UPI to avoid any conflict with NPCI. Moreover, major Indian banks have also reportedly stopped providing their services for crypto trades.

According to crypto investors, Coinswitch Kuber has disabled all INR deposit services including UPI and bank transfers via NEFT, RTGS, and IMPS at the moment. On the other hand, another major exchange WazirX has also disabled UPI payment options but it is allowing netbanking options with a very limited list of supporting banks. When contacted, both Coinswitch Kuber and WazirX did not respond at the time of publishing the article.

“There has been no fresh Reserve Bank of India directive asking banks to stay away from cryptos. But senior supervisory managers (of RBI) are telling some banks to exercise caution on cryptos till there is regulatory and legal clarity,” a bank official said as quoted by ET in a recent report.

While the freezing of netbanking options has also impacted the exchanges, the limitation to UPI options appears to be more damaging for them. In the last few years, UPI has become the lifeline of digital transactions in India. According to a CLSA report, UPI comprises 60% of total payments by volume, and digital payments have risen from $61 Bn in FY16 to $300 Bn as of FY21.

The development has multiplied the challenges that these exchanges were facing. Daily trading volumes of the exchanges have plummeted drastically. In the last 15 days, the volume of transactions on various leading exchanges have reduced by 50% to 70%, in comparison to pre-tax days, Inc42 reported recently. At this moment, the crypto investors are only left with the option of peer-to-peer (P2P) transactions to buy the virtual currencies.

As the developments have raised questions in the industry such as why payment options are being disabled without any official circular, some of the industry experts are of the view that the government and the regulatory bodies are trying to make it difficult for investors to purchase crypto.

As the developments have raised questions in the industry such as why payment options are being disabled without any official circular, some of the industry experts are of the view that the government and the regulatory bodies are trying to make it difficult for investors to purchase crypto.

“The idea is to limit the reach of crypto until the Crypto Bill gets enacted by the Parliament. This is not just the RBI’s view but I think the Indian government’s view too,” a Ministry of Finance official said Inc42 recently.