SUMMARY

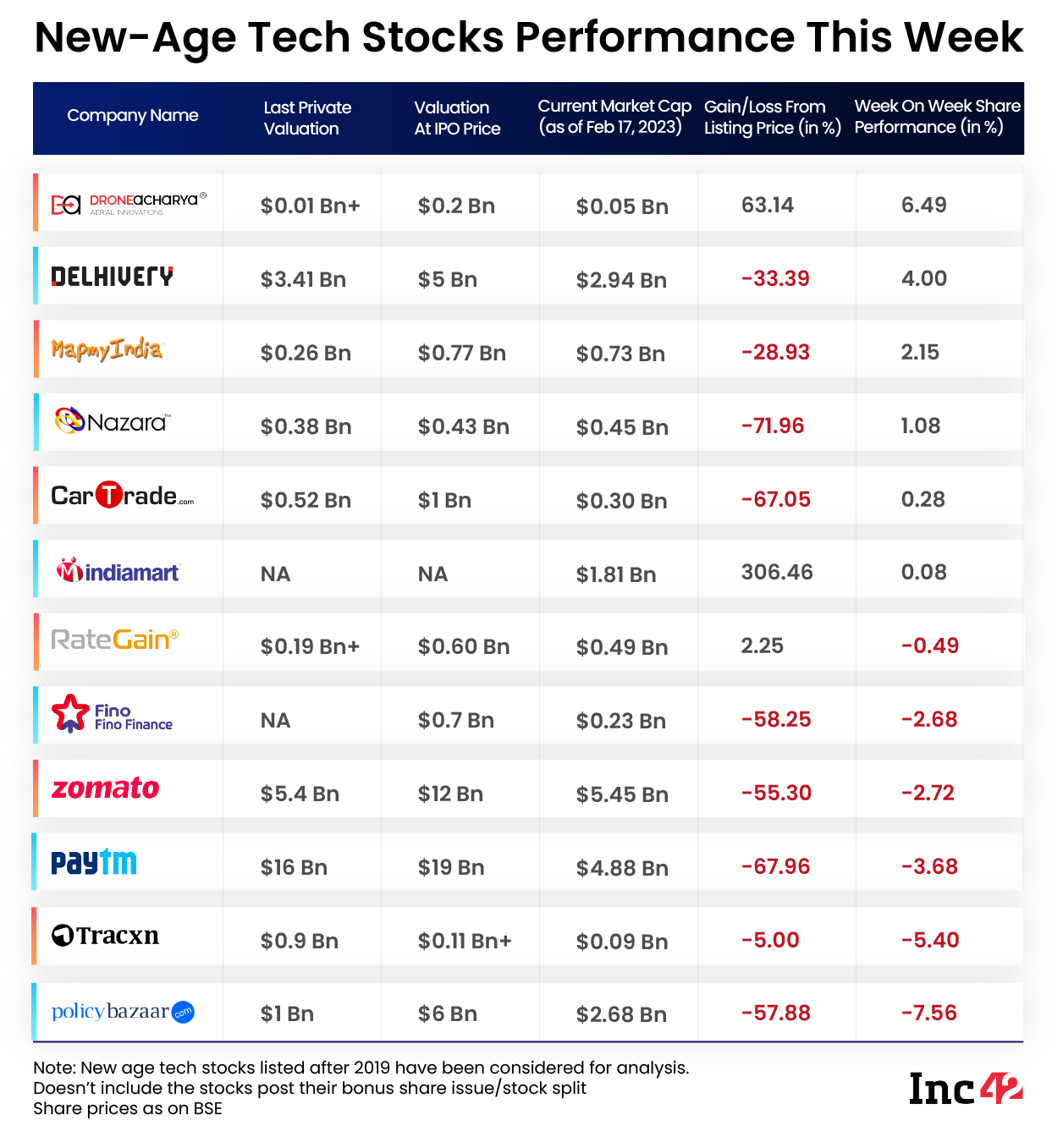

Out of the 14 new-age tech stocks under Inc42’s coverage, six gained this week in the range of 0.08%-6.5%, while the rest fell in the range of 0.5%-10%

DroneAcharya continued its rally to emerge as the biggest winner this week, gaining 6.5%, while Nykaa fell 9.9% on the BSE

Sensex and Nifty50 rose 0.5% each to 61,002.57 and 17,944.20, respectively, amid the continuing volatility in the broader equity market

With the Q3 FY23 earnings season coming to an end, the Indian new-age tech stocks witnessed a mixed week amid the continuing volatility in the broader Indian equity market.

Out of the 14 new-age tech stocks under Inc42’s coverage, six ended the week in green, gaining in the range of 0.08%-6.5%. The remaining stocks fell in the range of 0.5%-10%.

Nykaa turned out to be the biggest loser this week, falling almost 9.9% on the back of its December quarter results, shedding some of the last three week’s gain.

Meanwhile, shares of recently-listed DroneAcharya continued their rally and emerged as the biggest winner this week, gaining 6.5% on the BSE.

On the other hand, Paytm and PB Fintech, the two biggest gainers last week, slumped this week. While Paytm fell 3.7% to INR 626.3 on the BSE, PB Fintech declined 7.6% and ended Friday’s session at INR 484.4.

In the broader equity market, benchmark indices Sensex and Nifty50 rose 0.5% each to 61,002.57 and 17,944.20, respectively.

However, on Friday, both indices fell as markets witnessed turbulence on the back of weak global cues as investors booked profit in banking, IT, and telecom stocks, said Amol Athawale, deputy vice-president, technical research, at Kotak Securities.

Siddhartha Khemka, head, retail research at Motilal Oswal, said, “Higher US inflation data and lower jobless claim data led to hawkish commentaries by some of the US Fed officials which dented sentiments and led to renewed fear of aggressive rate hikes in the subsequent meets to combat sticky inflation.”

“On the domestic front, even the corporate earnings growth for 3QFY23 moderated led by weak demand environment and inflation-led margin pressure,” he added.

Now, let’s analyse the performance of some of the new-age tech stocks from the Indian startup ecosystem.

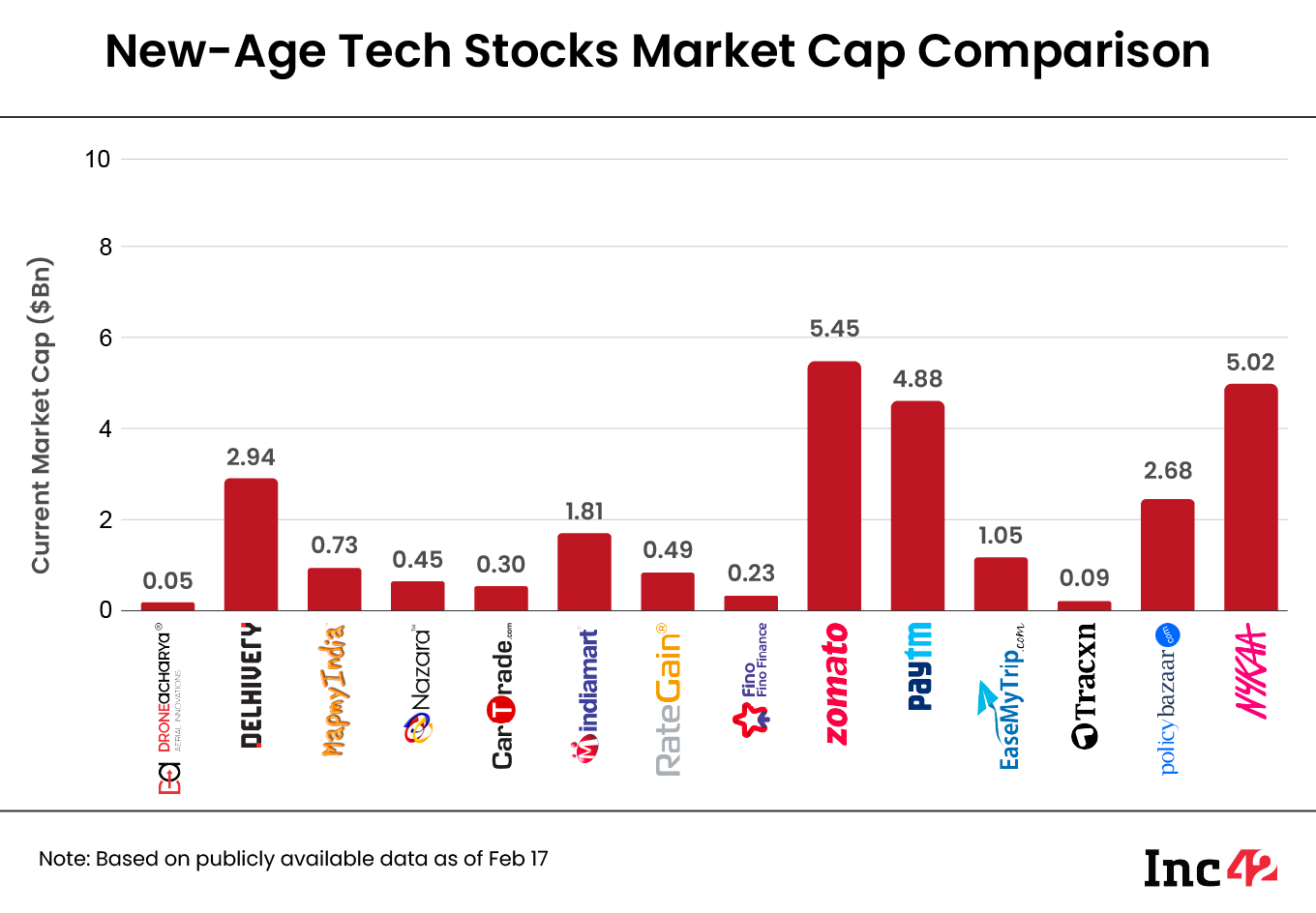

The 14 new-age tech stocks under our coverage ended the week with a total market capitalisation of $26.17 Bn as against $27.11 Bn last week.

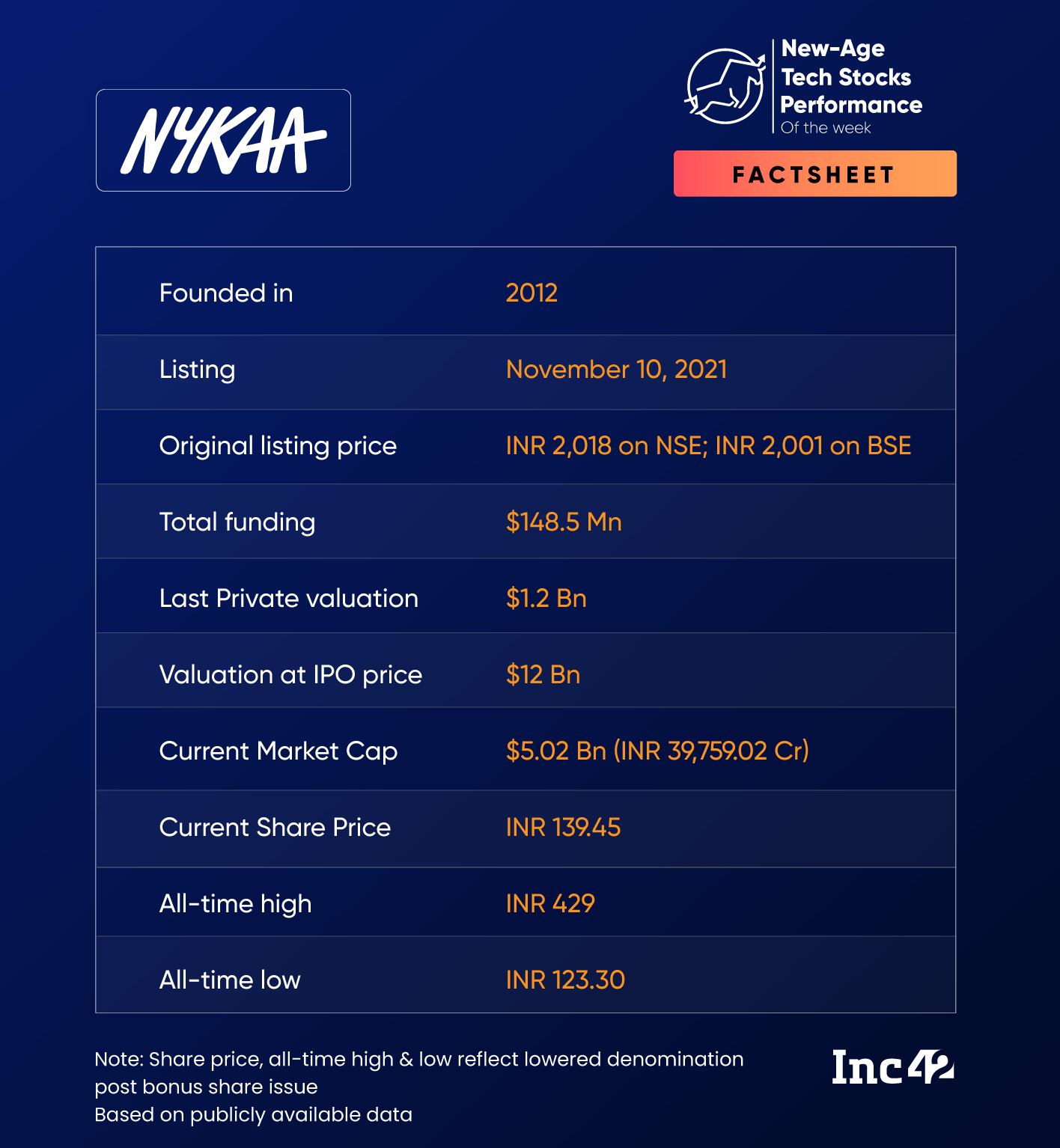

Nykaa The Biggest Loser

The beauty ecommerce giant’s shares slumped in four straight sessions this week on the back of its Q3 FY23 results as several of its metrics disappointed the Street.

Nykaa fell 9.9% this week, ending Friday’s session at INR 139.45, marginally higher than Thursday’s close.

In The News For:

- Nykaa reported an almost 71% year-on-year (YoY) decline in its consolidated net profit to INR 8.5 Cr in the December quarter, while its operating revenue grew 33.2% YoY to INR 1,462.8 Cr.

- Nykaa’s gross margin contracted 293 basis points (bps) YoY to 43.4% in Q3, while slower-than-expected growth in the beauty and personal care (BPC) vertical disappointed several analysts.

- GMV of the BPC segment rose 37% YoY to INR 2,796.5 Cr in the quarter under review, while the fashion segment saw a 50% YoY rise in GMV to INR 724.4 Cr. Nykaa’s executive chairperson, MD and CEO Falguni Nayar said weak consumer spending amid the global economic slowdown hurt Nykaa’s revenue and margin.

Competition Watch:

- Reliance Retail has forayed into the beauty ecommerce category with its platform Tira, which will offer dedicated products across skin and haircare, makeup, fragrances, men’s beauty, and luxury categories.

In a recent research note after the Q3 results, Jefferies said that Nykaa would need a pick-up in the BPC growth and lowered its FY23-26 EBITDA estimates on the startup by 1%-2%.

Meanwhile, Goldman Sachs also noted that there were hardly any clear signs of a near-term pick-up in Nykaa’s BPC growth. Moreover, with investments likely to continue in growth verticals, the brokerage lowered its FY23-25 revenue estimates by up to 4%, with EBITDA cuts of 14%-28%.

“Nykaa is currently at a support of INR 138-INR 139. If it sustains over INR 135, we may see a pullback till INR 155 in the coming days,” said Jigar S Patel, senior manager, technical research analyst, at Anand Rathi.

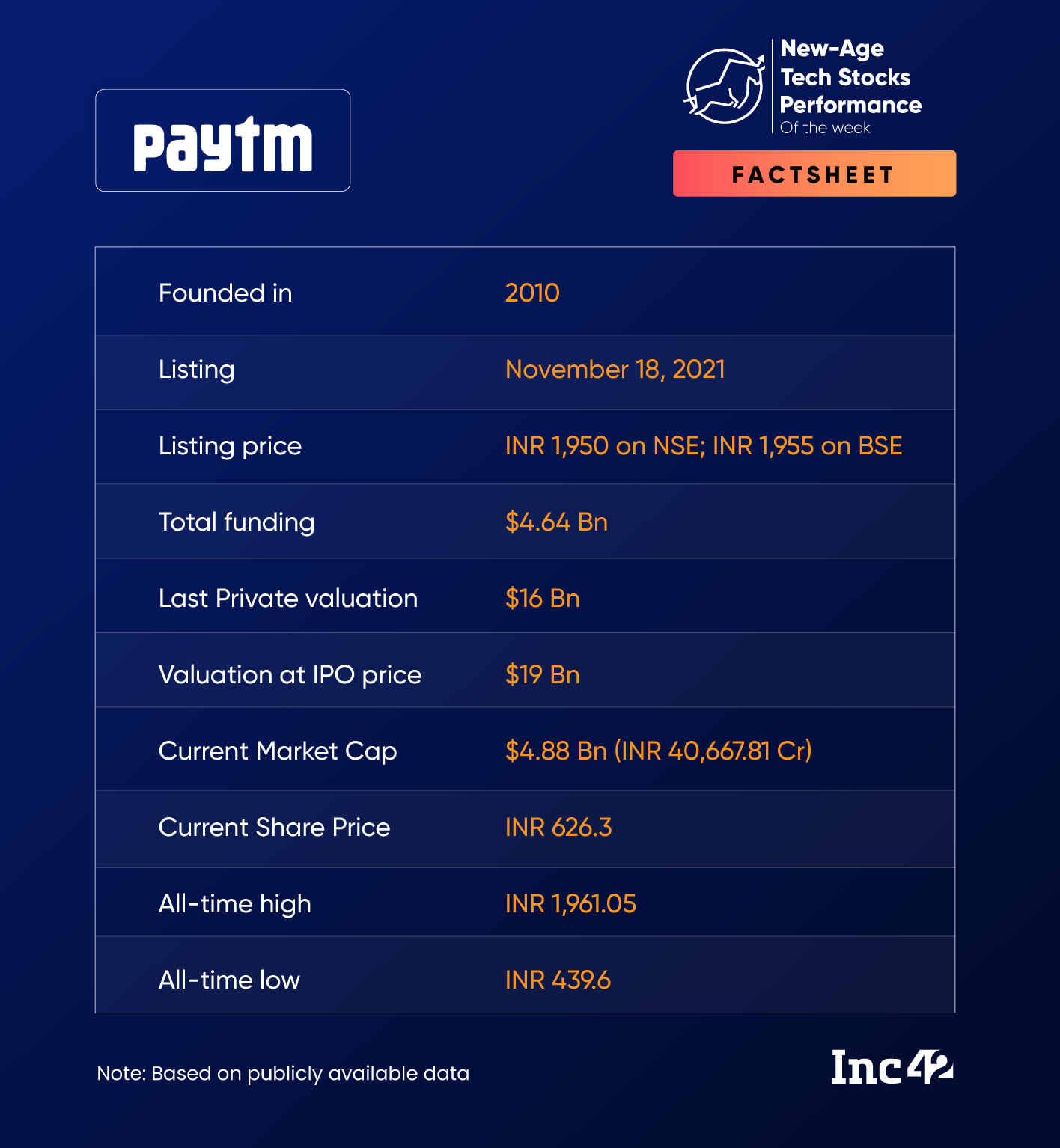

Paytm Completes Share Buyback

Earlier this week, Paytm said it completed its share buyback worth INR 849.83 Cr. The fintech giant bought back a total of 1.55 Cr equity shares at an average price of INR 545.93 per share.

Paytm’s board approved the share buyback plan on December 13, 2022.

Shares of Paytm witnessed a correction this week after a sharp rally last week that was driven by the company’s upbeat Q3 FY23 results. On February 3, Paytm reported its Q3 results, and said it was its first EBITDA-positive quarter before ESOP costs. The company’s net loss declined 50% YoY to INR 392.1 Cr in the quarter. However, its shares slumped last Friday after Alibaba sold 2.1 Cr remaining Paytm shares.

This week, Paytm shares fell almost 3.7%, ending Friday’s session at INR 626.3 on the BSE.

Currently, Paytm stocks are in a correction mode. If it comes to around INR 600 level, one can buy from there and the target would be INR 700, said Anand Rathi’s Patel.

The stock’s stop loss would be around INR 550, he added.

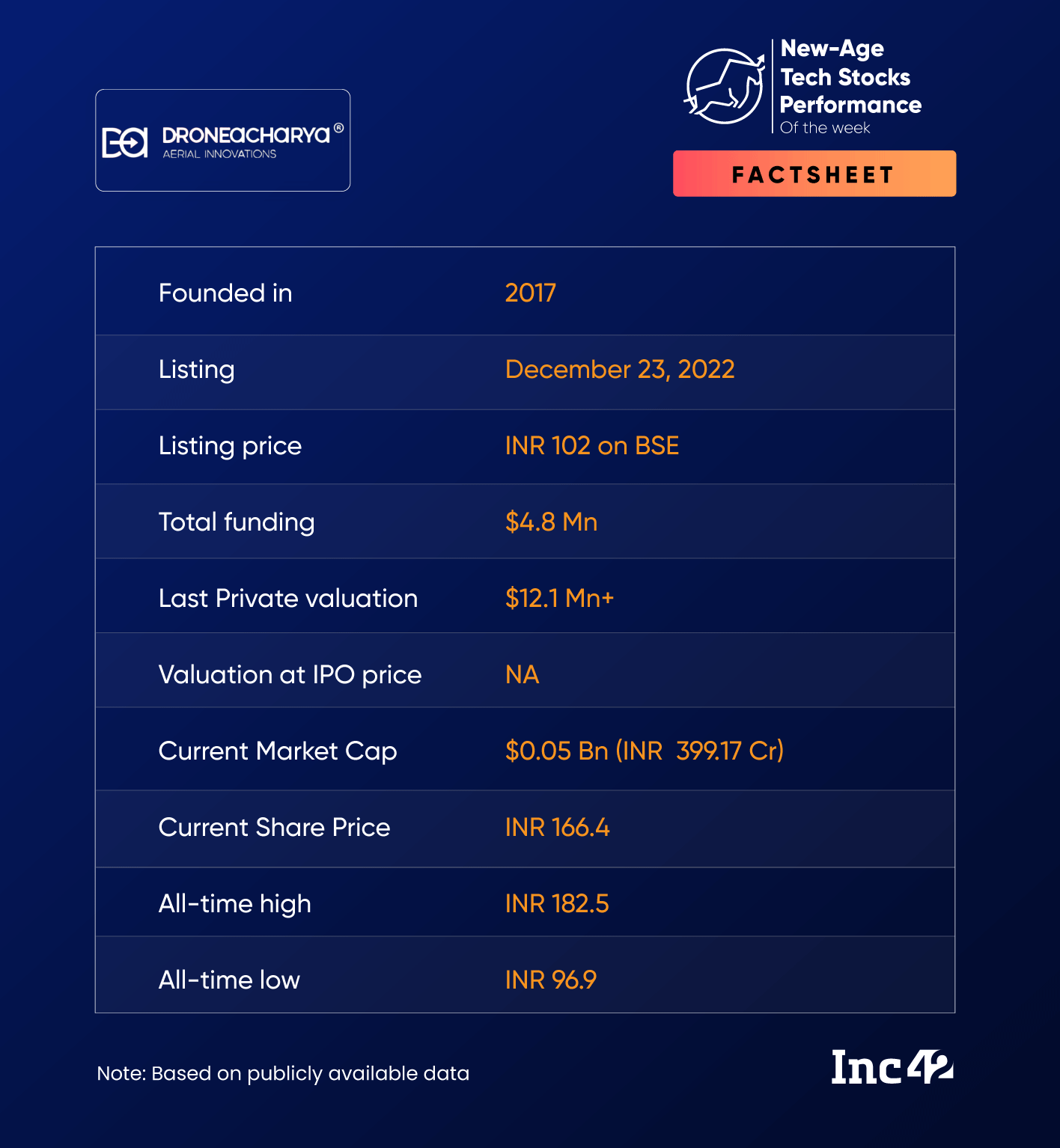

DroneAcharya Emerges As The Biggest Gainer

Shares of drone startup DroneAcharya have been on a steady upward journey since their listing on the stock exchanges, despite the volatility in the global tech stocks.

This week, the shares saw a sharp rally in the first three sessions. However, the stock shed some of the gains later in the week to end Friday’s session at INR 166.4, down over 3.8% from Thursday’s close.

Overall, the shares gained almost 6.5% this week on the BSE to emerge as the biggest winner among the new-age other tech stocks.

DroneAcharya got listed on the BSE SME platform in December last year at nearly a 90% premium to its issue price. At the current level, its shares are trading 63% higher than their listing price of INR 102.

Speaking to Inc42, DroneAcharya’s founder and MD Prateek Srivastava recently shared insights on the startup’s successful IPO despite the economic slowdown and spoke about its growth plans in the near future.

Largely focused on providing drone solutions and pilot training so far, DroneAcharya is now looking to foray into drone manufacturing.

In FY23, DroneAcharya expects to see a 300% YoY jump in revenue to about INR 10 Cr and a profit after tax of about 20%. The startup’s revenue stood at INR 3.58 Cr in FY22.

Its market cap currently stands at INR 399.17 Cr.