SUMMARY

In February 2022, 5.3% of total UPI transaction values (worth INR 8.26 Lakh Cr) were under INR 500 as opposed to 67% (303 Cr) of the total UPI transaction volume (452 Cr)

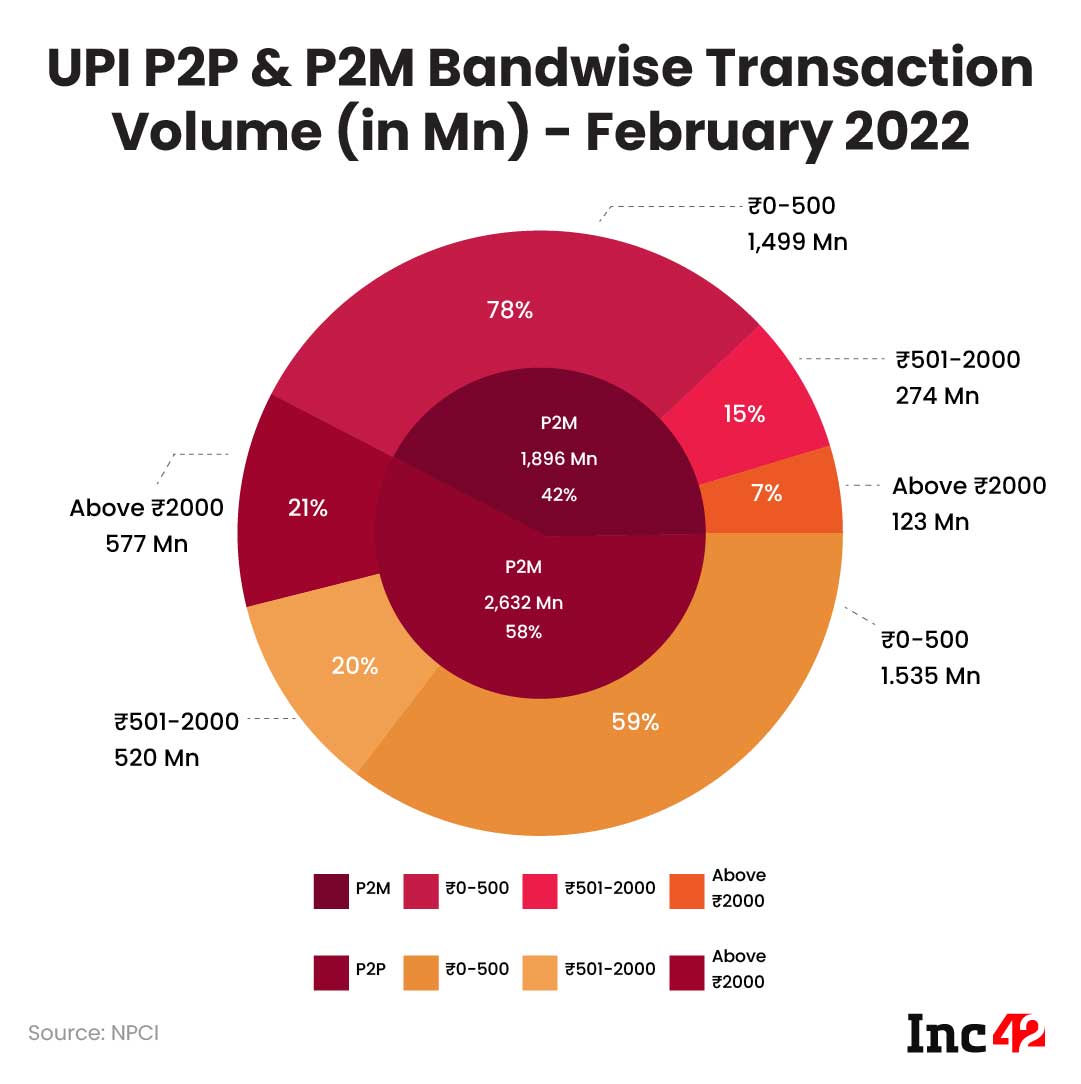

P2P payments constituted 58% of the total transaction volume (i.e. number of transactions) and the rest 42% were P2M transactions

Low-value transactions signify that UPI is quite the go-to digital feature but it consumes significant system capacity; hence RBI has piloted small value payments feature in offline mode

UPI had recorded 452 Cr transactions in February 2022 worth INR 8.26 Lakh Cr ($107.52 Bn). But for the first time, the National Payments Corporation of India (NPCI) has announced detailed transactions volume and value in the bands of INR 0-500, INR 501-2,000 and above INR 2,000 for peer-to-peer (P2P) and peer-to-merchants (P2M) payments for January as well as February 2022.

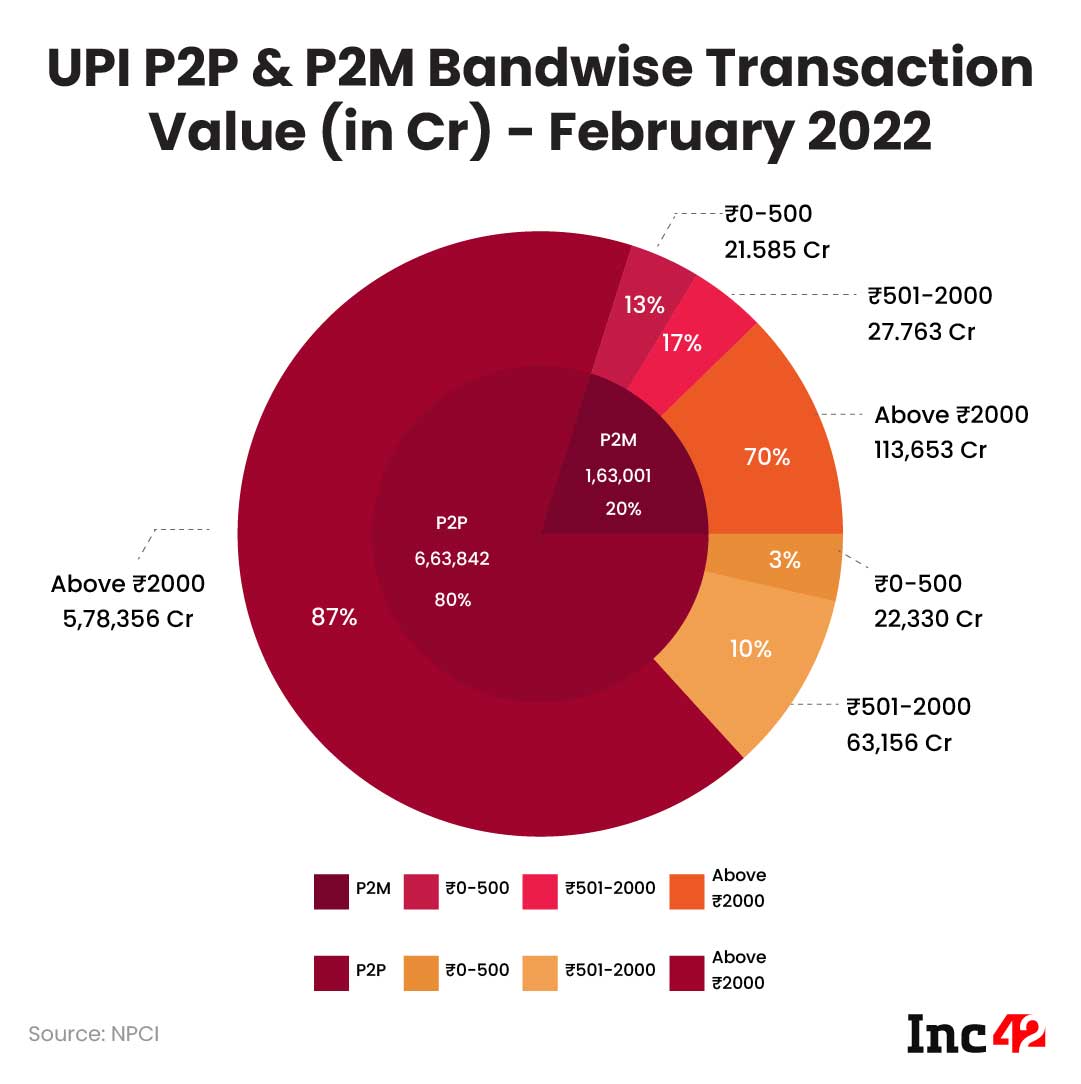

According to the NPCI, in February 2022, P2P payments constituted 80% of the total transaction value and the rest 20% were P2M transactions. Alternately, P2P payments constituted 58% of the total transaction volume (i.e. number of transactions) and the rest 42% were P2M transactions.

Further, 78% of P2M and 59% of P2P transaction volumes were INR 0-500, clearly showcasing that a large number of Indians paid small value bills via UPI; UPI also had 15% of P2M and 20% of P2P transaction consumers between INR 501 – INR 2,000 and transaction count above INR 2,000 were just 7% of the total P2M and 21% of the total P2P volumes.

In terms of value (i.e. worth of transactions), transactions over INR 2,000 constituted 70% of the total P2M values and 87% of the total P2P value; transactions between INR 501 and INR 2,000 make up 15% of P2M and 20% of P2P volumes.

Under INR 500 transactions are just 13% of P2M and 3% of P2P volumes, hinting that 5.3% of total UPI transaction values worth INR 8.26 Lakh Cr was under INR 500, au contraire the 67% of UPI transaction count of 452 Cr.

Since the value of payments is small, the overall percentage of transactions value under INR 500 is bound to be small. Yet, a 67% share in the total transaction volume signifies that Indians are easily adopting UPI for small transactions.

Hinting a similar trend, January 2022 recorded 78% of the total P2M transaction volume (186 Cr) under INR 500, 15% between INR 501 and INR 2,000 and 7% over INR 2,000, as opposed to 59% of the total P2P transaction volume (275.8 Cr) under INR 500, 20% between INR 501 and INR 2,000 and 21% over INR 2,000.

January 2022 also recorded 13% of the total P2M transaction value worth INR 1.64 Lakh Cr under INR 500, 17% between INR 501 and INR 2,000 and 70% over INR 2,000, as opposed to 4% of the total P2P transaction value worth INR 6.67 Lakh Cr under INR 500, 10% between INR 501 and INR 2,000 and 87% over INR 2,000.

Small Value Payments & UPI On Feature Payments

Owing to a large number of small transactions happening on UPI, the RBI is bringing UPI on feature phones to accelerate UPI’s growth story as well as bring financial inclusion and digital penetration.

Only this week, RBI announced the offline version of UPI – UPI123Pay – which will allow feature phone users to access the payment service without an internet connection. RBI Governor Shaktikanta Das said, “It’s called UPI123Pay because broadly there are three steps, which will take a user to the completion of a transaction.”

Here’s how the tech will work:

- RBI plans to issue a standard Interactive Voice Response (IVR) number which will allow customers to register their number and create a UPI PIN.

- A user will just have to dial the yet-to-be-issued IVR number on their phone, enter their debit card number and the expiry date of the said card.

- After the automated system processes the information, it will prompt the user to create a UPI PIN.

- To make payment, the IVR system will first present several options to the user, including money transfer, LPG gas refill, mobile recharge, FASTag recharge, EMI repayment, and balance check.

- The user needs to select an option and the IVR system will prompt the user to enter the UPI-linked mobile number of the entity they want to send money to.

For instance, if a user wants to recharge their phones, they will have to enter the mobile number, select the operator and then select the recharge plan. Afterwards, the system will ask the user to enter the amount to be transferred (in case of just sending money to someone), and the UPI PIN to complete the transaction.

The IVR number can also be used to complete payments via a missed call.

As previously suggested by RBI, with another feature in the pipeline, users will be able to make small transactions (within INR 200) offline through a wallet-like instrument. Consumers can ‘recharge/replenish’ the wallet when they are online up to INR 2,000, and make payments even without internet.

The Need For Small Value Payments In Offline Mode

RBI has previously maintained that 50% of the transactions through UPI were below INR 200. While the use of UPI for low-value transactions signifies that the real-time payments service is quite the go-to digital feature for Indians, it consumes significant system capacity and bank resources. It also leads to customer inconvenience due to transaction failures because of issues related to connectivity.

In a bid to ease the process of small value transactions, RBI had piloted a simpler process for these transactions between September 2020 and July 2021. Through an ‘on-device’ wallet in the UPI app, the apex bank proposed to increase the adoption and boost the success rate of low-value UPI transactions that otherwise utilise network bandwidth.

That is, it aimed to conserve banks’ system resources, without any change in the transaction experience for the user — quite similar to a wallet system that Paytm, Amazon Pay and PhonePe offer — but in an offline setup.