Valuations. Markdowns. Controversies. Firings and hirings. Layoffs. Shutdows. The alleged burst of the Indian startup bubble. And, of course, the great demonetisation drive!

2016 has seen it all. And we aren’t just talking about a heavenly gathering of all our favourite artists and entertainers. Over a twelve-month period, the startup ecosystem has grown in stature and stability by bearing the losses of once-promising verticals (ecommerce, hyperlocal) and seeing the rise of unexpected winners – fintech, edtech, healthtech, and even consolidations through mergers and acquisitions.

In short, this has been the year of the unexpected.

We have already presented a comprehensive view of the hundred plus acquisitions that took place, and the high-profile shutdowns as well as top fundings that made headlines. But what about news itself? News about startups, their foibles and goings on?

Keeping this in mind, we, at Inc42, have come up with a rundown of all the important newsmakers over the last 12 months. So, you don’t have to.

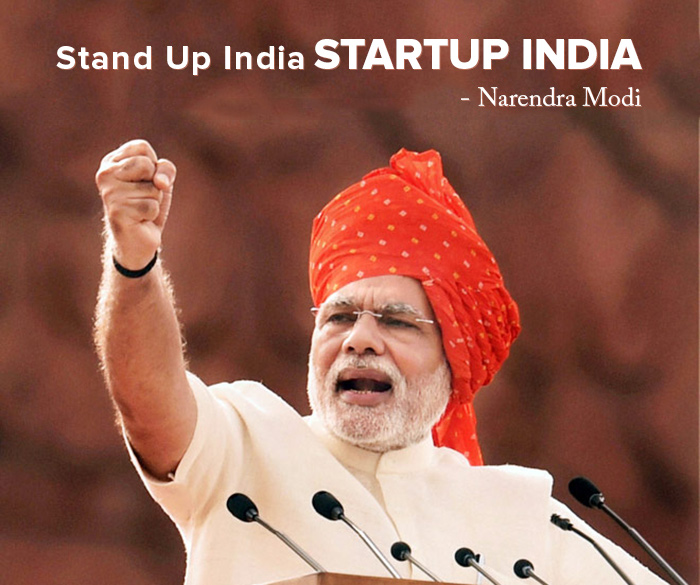

Narendra Modi

If there is one personality outside of the ecosystem who wielded the maximum influence in the goings on, it was none other than Prime Minister Narendra Modi. It was on Independence day last year that PM Modi coined a new slogan ‘Startup India, stand up India,’ declaring from the ramparts of the Red Fort of his government’s intention to set up a system to enable startups.

In January this year, with great fanfare, the government launched the Startup India Action Plan, which – among other things – promised to provide tax exemption to startups for three years, a compliance regime based on self certification, legal support and fast tracking of patent examinations at lower costs, a credit fund guarantee, and funding support through a fund of funds with a corpus of INR 10,000 Cr.

While in the first three months of the plan, out of 250 applications received, only one got clearance from the government to set up new business, it can’t be denied that if nothing else, the PM’s plan brought startups into the nation’s mainstream economic and political agenda.

But he made headlines like never before in November, when on November 8 , he demonetised INR 500 and INR 1000 notes, setting in motion an event whose impact will be felt for years to come. While politicians and the nation are divided on the benefits of the move which the PM advocates will remove black money, give an impetus to a cashless society, and digitisation, startups, especially wallet players,have been having a field day after the move.

As all of India lined up at ATMs and banks for the last two months of the year, most of the startups have welcomed the move, stating it might be painful in the short term but will be a major push towards a cashless Indian society in the long-term.

The Return And Exit Of Rahul Yadav

The bad boy of the Indian startup ecosystem, Rahul Yadav, ex-CEO of Housing.com has once again made it to the newsmaker charts in 2016. In September 2015, Rahul posted on Facebook that he was going to make a comeback in 2016 with his startup, ‘Intelligent Interfaces.’ There was a buzz that the startup had to do something with governance.

Founded by Rahul along with Azeem Zainulbhai, and Amit Das, another former Housing executive, the startup was backed by Sachin Bansal, Binny Bansal and Yuvraj Singh. As per RoC (Registrar of Companies) filings, besides the trio were two other investors – Sanjay Singh Mahida and Dotcom service India Private Limited, who also invested in the company.

There were also reports that Paytm’s Vijay Shekhar Sharma and Rahul Sharma of Micromax had also invested in the startup. The company announced that it has raised $1 Mn but the MCA documents accessed by Inc42 tell a different story. The company had raised just INR 3.1 Cr at a valuation of INR 170 Cr.

Within a few months of launching and raising investments, Rahul’s startup had already crashed & burned, both literally and figuratively. Out of the initial 15 member team of Intelligent Interfaces, only a handful of the team were left. Most of the team, who joined Rahul’s new journey, had already moved out, including one of the co-founders, leaving Rahul behind.

Not only this, the raised funding had depleted, and a few months later, Rahul again took to Facebook to announce the demise of the startup. It is said that Rahul is working on a couple of other companies and is expected to launch them anytime soon.

Nikesh Arora Stepping Down From SoftBank

Another big news of the year was President and rumoured successor to Masayoshi Son, Nikesh Arora announcing his resignation from SoftBank Group Corp Ltd, a Japanese multinational telecommunications and Internet corporation. Since he came on board , Nikesh has invested billions of dollars in Indian startups, such as Housing.com Snapdeal, Grofers, Ola, OYO Rooms and Paytm to name few. And the shocking part was that this announcement came barely a day after he was given a clean chit on the complaints filed against him.

Earlier this year, in a 11-page complaint, a group of investors had requested the board to investigate Nikesh Arora’s track record and qualifications as president and apparent heir to billionaire founder Masayoshi Son. The complaint outlined that Nikesh is a senior adviser in private equity firm Silver Lake. It also suggested that he was involved in past wrongdoings, poor business decisions, and a series of questionable transactions. Lastly, it highlighted the fact that SoftBank was paying him excessive compensation without sufficient disclosure.

Within an hour of announcing his stepping down from his post, his Twitter handle was filled with tweets from his admires, journalist and others who wanted to know about his next step.

Tweets like “A song that you feel like humming right now?”, “Do you know Japanese?” and “Are you happy in a way that the leash is gone?” went viral within hours. It has often been seen that high-ranking executives do not respond on social media.. But Nikesh went out of his way to chat with his well-wishers. He replied to each and every tweet sportingly, without getting offended.

From July 1, 2016, Nikesh has moved to an advisory role within the company. He joined SoftBank in the capacity of Vice Chairman in September 2014 and became its President and Chief Operating Officer in June 2015.

AskMe’s Shutdown – Still A Trending Headline

August 19, 2016. This was the date when online classifieds company AskMe finally announced the close down of operations. While everyday many companies get shut down, this news gained media attention due to the active involvement of its 4,000 employees, creditors, and vendors as well as the government in the pre- and post-shutdown scenario.

AskMe.com was founded in 2010 as a classifieds portal. In 2012, it came out with AskMebazaar as an online shopping portal focussing on small and medium enterprises (SMEs). Later in 2013, Getit Infoservices acquired AskMe from Network18. The portal claimed to be operating with over 120K merchants, in over 70 cities, including metros and Tier II cities as well. The news of the shutdown predated to the time when over 650 employees of the company resigned, in April 2016.

As per media reports, the website was forced to shut down due to the alleged unplanned exit of Astro Holdings, its principal investor. To date, Astro has pumped in $119 Mn (INR 800 Cr) into the company, according to filings with the Ministry of Corporate Affairs. Astro backed out from a supposed MBO (Management Buyout) scheduled at the end of July 2016, adding to the down slide.

The shutdown left more than 4,000 employees, vendors, and other creditors at AskMe and the investors, in a state of panic. Prior to the shutdown, employers also urged (threatened) Astro to at least pay their due salaries in an open letter.

While some threatened the company with a suicide note, some opted for a legal route to get their money back. There was even talk of Rajya Sabha member and BJP leader Subramanian Swamy involving the government in bailing out the company, in order to pay the beleaguered employees and vendors.

Most recently, the My Limo Trading Company, led by brothers Mukesh Kumar and Rahul Kumar, sent legal notices to the former directors of Getit Infoservices – Ashok Rajagopal, Sandeep Vats, and Prakash Mishra. My Limo alleged that Getit has not paid them despite receiving payments from the buyers and owed $219K (INR 1.5 Cr) to the company. However, Rajgopal has disputed this claim and appealed that he is a former, non-executive director of Getit and played no role in the day-to-day affairs of the company.

Flipkart Devaluation – From $15 Bn to $5 Bn In Less Than A Year

Global financial services firm, Morgan Stanley marked down Flipkart’s valuation four times in a row this year, fuelling speculation as to the health of the ecommerce sector in India. Morgan Stanley’s fund had first invested in the ecommerce marketplace when it raised $160 Mn in October 2013. The decrease in the valuation showdown for the ecommerce giant began in February 2016, when Morgan Stanley marked down Flipkart’s shares by 27%.

Later in May 2016, for the second time in a successive quarter, Morgan Stanley Mutual Fund Trust, lowered the value of its shares in Flipkart by 15.5%. It pegged Flipkart’s valuation at $9.39 Bn.

Morgan Stanley, as of September 2016, has marked the value of its Flipkart shares at $52.13 per share, as compared to $84.29 per share in June 2016. This slashed the value of its Flipkart shares by 38.2%, with Flipkart’s valuation pegged at $5.54 Bn, in November 2016.

Prior to this, in April 2016, a US-based mutual fund managed by T.Rowe Price also marked down its shares in by 15%. T Rowe Price had invested about $100 Mn in Flipkart in December 2014, when the firm raised $700 Mn in funding. Valic and Fidelity, too marked down Flipkart shares this year. Valic marked down the valuation of Flipkart shares from $108.04 (May end quarter) to $95.84 (August end quarter), a decrease of 11.3%. On the other hand, Fidelity has marked down the valuation of its Flipkart shares from $84.29 per share assigned to them at the end of May to $81.55 per share for the August-ended quarter.

As of now Flipkart’s valuation is at $5.54 Bn, almost a 63.5% drop from its all-time high of $15.2 Bn.

Binny Bansal Became CEO Of Flipkart

In January 2016, Flipkart made a major structural change in its company management when Binny Bansal, co-founder and COO was made the CEO of the company, replacing Sachin Bansal who was then appointed as the Executive Chairman.

The move came in as the result of a downfall in Flipkart’s sales when Sachin decided to focus on an ‘app-only’ strategy. This drove Flipkart’s potential desktop customers to other platforms.

The move also proved to be the bottom-line of all the hustle created due to the bulk layoff of non-performers in the company. In July 2016, Flipkart decided to lay off 700-1000 underperforming employees when it faced yet another downfall in its valuation by Morgan Stanley, T. Rowe and others. Earlier, in April this year, Flipkart had also curbed its discount pricing and placed a cap on salary increments.

During a monthly Town Hall meeting at Flipkart’s office, Sachin shut the rebellious employees’ mouth with just one sentence, “Look at the top level. Everyone has changed. Even I’m gone.”

In the words of an employee present at the meeting, “It was like a reminder of the Big Billion Day glitch in 2014 when Sachin and Binny both emailed and apologised to their customers. They are the kind of people who acknowledge things when they screw up.”

So far, the year has been a rollercoaster ride for Flipkart – with valuation markdowns, warnings from IITs for revoking placements, tension between employees and management, strategising against foreign rivals and even calling archrival Amazon a copycat, recently.

The Curious Case Of Praveen Sinha And Jabong

While startups getting into legal tangles became a normal affair this year, Jabong had no excuse for the same.

A forensic audit commissioned by German ecommerce investor Rocket Internet revealed several apparent corporate governance violations by former top executives at its fashion portal Jabong.

The entire issue came to light in June 2016, with a tweet from ‘Unicon Baba’, known for his candid comments on the Indian startup ecosystem. The tweet, which was later deleted by Unicon Baba, read: “Rocket Internet to pursue case against @sinha_praveen for siphoning off 100 cr+ in last two years.”

Several allegations were made on Jabong’s former MD Praveen Sinha, the company’s ex-CEO Arun Chandra Mohan and former Rocket Internet India MD Heavent Malhotra, including “conflict of interest” on the part of Sinha in one of the main aspects of the investigation, mainly the alleged fraudulent transfer of Jabong’s logistics unit GoJavas to an entity controlled by Sinha.

On his part, Sinha denied any wrongdoing and had also apparently told Mint that he had filed a legal case against the Twitter account holder who posted the damaging tweets. He also said in an emailed response that he had never been informed by Jabong’s investors of any PwC report ad and got to know of the same through a media query.

While the true story is still under wraps, what happened next made Indian startup history. A company, which was valued at $1.2 Bn just two years back, was sold for exactly $70 Mn to Flipkart’s Myntra, in a deal that took only three days to come together.

As angel investor Ajeet Khurana aptly stated, “Flipkart’s acquisition of Jabong is one of those deals that no one could have predicted, but after it has fructified, everyone says, “I knew this would happen!”

GoJavas – The Controversy Still Continues

GoJavas, the Snapdeal-backed logistics firm faced a lot of heat this year, be it the decision to shut down temporarily, rumours of getting acquired, or allegations of Jabong’s co-founder Praveen Sinha making personal gains out of the company.

Founded in 2013 by Vijay Ghadge, GoJavas began as an arm of fashion retailer Jabong, and was made an independent company in 2013. It is co-owned by Snapdeal and a group of promoters including Praveen Sinha, Ashish Choudhary, and Randhir Singh.

Amidst cash crunch and loss of interest from investors, GoJavas started its search for potential buyers, after a bid by Snapdeal for a complete buyout fell through. GoJavas also suffered a setback in business after Jabong, one of GoJavas’ major clients was sold to Flipkart in July. Snapdeal and Jabong together accounted for more than 80% of GoJavas’ business.

To add to GoJavas’ share of troubles, a report alleged that Jabong co-founder and former CEO Praveen Sinha had made personal gains out of the company. The report found “conflict of interest” on Sinha’s part and alleged fraudulent transfer of Jabong’s logistics unit GoJavas to an entity controlled by Sinha.

GoJavas is now still in talks with companies like Pigeon Express, Trackon Couriers Pvt. Ltd and Snapdeal for acquisition.

Nutanix IPO – The Game Is On For Enterprise Cloud Startups

In a first-day jump that hasn’t been since 2014, enterprise cloud platform Nutanix Inc’s shares showed a 130% jump at close of business on Nasdaq. It was the best first day pop for a tech startup since Castlight Health Inc. gained 149% in June 2014, and overall the largest since Seres Therapeutics gained 186% in June 2015, with their respective IPOs.

The California-based company priced its share offering at $16 per share to raise about $238 Mn on September 30, 2016. The per-share offering was slightly elevated than the expected range. Nutanix initially set the price range at $11-$13 and upped it to $13-$15, a move that could have placed its market capitalisation at a lower share than its $2 Bn valuation.

Founded by Dheeraj Pandey, Ajeet Singh and Mohit Aron, it is backed by LightSpeed Venture Partners, which owned the biggest stake before the IPO. Other investors include Khosla Ventures, Blumberg Capital II, and Riverwood Capital Partners.

The company further plans to make “box companies vanish,” and to do development work in areas such as automation, machine learning, software, and security.

Mu Sigma Fiasco

Mu Sigma was the one B2B unicorn which made headlines, not because of its products but its legal affairs this year. First, Aon Corp. founder, Patrick G. Ryan filed a lawsuit against Mu Sigma and its founder, Dhiraj Rajaram in March.

In the lawsuit, Mu Sigma and its founder were accused of “grossly misleading” the investors six years ago, to redeem 17.5% ownership of the data-analytics outsourcing startup. The allegations stated that Ryan’s investment firm Walworth ventured $1.5 Mn in 2006 in Mu Sigma, when it was new and desperate for capital. Later, in 2010, the Ryan family agreed to accept $9.3 Mn from the IT firm to buy back those private shares.

Walworth has since legally demanded Mu Sigma to return the 7.76 Mn shares from the 2010 buyback or to pay damages equal to their relative value including interest. The decision to the case is still pending.

In yet another dramatic turn, Dhiraj acquired a majority stake of 51.6% in the data analytics firm by buying out his estranged wife and CEO Ambiga Subramanian’s holdings, and taking over as the CEO. Ambiga was made CEO as recently as March,and the couple divorced in May 2016.

Mu Sigma has been backed by investors such as General Atlantic, Sequoia Capital. Also, there is speculation that Ambiga might be starting her own venture, and denying rumours of a ‘non-compete clause.’

Y Combinator’s First Visit To India – A Proud Moment

YC, which is one of the top three accelerators in the world also visited India, during its 11-country tour in September. This was Y Combinator’s first visit,where it met founders in Bengaluru and Delhi and gathered insights right from the ground up about the Indian startup ecosystem. The accelerator invests $120K in startups for a 7% equity stake in selected startups. It normally takes in a large number of startups (107 this year) and has funded over 1,000 startups since 2005. The selected startups then move to the Silicon Valley for three months, where it also helps them pitch to investors. Its portfolio includes companies like Airbnb, Dropbox, and Instakart.

This year’s summer batch of YC included three startups from India – co-working space Innov8, self-drive car rental app JustRide, and Meesho, an app for sellers on Facebook and WhatsApp.(bq)

One of the common things about all the Indian companies that YC has backed are that they are ones who are building products specifically for the domestic market such as – ClearTax, an online tax return filer, and payments gateway RazorPay.

A stated by Sam Altman, president of YC, “Each of the founders from India in the current batch has personal experience with the problems they are solving, which gives them unique insights into the market they operate in. India is now only second to the US, in terms of applications received from a country, higher than Canada or the UK.”

The visit is just a culmination of YC’s focus on broadening its investment areas and expanded into emerging markets like India, after Altman took over in 2014 from the co-founder Paul Graham. The accelerator is now diversifying actively to fund the very best companies in the world. Over the past two years, it has been also diversifying geographically to fund startups from India, China and South America, particularly those which are solving local and global problems.

MakeMyTrip And Ibibo Merger – Seen As The Definitive Change Makers Of Online Travel

The end of the year saw a major merger take place in the field of online travel, leaving the media stunned. This was the Ibibo Group acquisition by MakeMyTrip to consolidate the two businesses into one single entity.

The two traveltech giants – who, less than a year ago, were preparing for a showdown by fuelling up on investor money – suddenly realised that probably the battle for supremacy comes at too much cost, too much cash burn, and too many bitter discounts and promotion wars.

So, rather than fight a tooth and nail battle for number one, they joined forces to create a more scalable business – a mega entity that will control a fifth of the lucrative airline booking market and also have significant shares in the bus and hotel bookings, and ride-sharing spaces.

Not to mention, giving rivals Cleartrip.com, Yatra, Booking.com, Expedia, and hotel aggregators such as Softbank-backed OYO a hell of a tough time.

The deal brought together a bouquet of consumer travel brands – including MakeMyTrip, goibibo, redBus, Ryde, and Rightstay, which together claimed to have processed 34.1 Mn transactions during FY2016.

The Ibibo group, owned by Naspers (91% stake) and Tencent (9% stake) was sold in full, in consideration of issuance of new shares by MakeMyTrip, with Naspers and Tencent being the largest shareholders in the resulting company with a combined 40% stake. Also, MakeMyTrip’s founder Deep Kalra continued as Group CEO and Executive Chairman of MakeMyTrip and co-founder Rajesh Magow as CEO India of MakeMyTrip. Founder and CEO of ibibo Group, Ashish Kashyap, on the other hand, join MakeMyTrip’s executive team as a co-founder and President of the organization.

Additionally, prior to closing, the $180 Mn in 5 year convertible notes issued by MakeMyTrip Limited to Ctrip.com International, Ltd. (“Ctrip”) (NASDAQ: CTRP) in January 2016 were also converted into common equity, resulting in Ctrip having approximately 10% stake in the combined entity. The deal is expected to be closed at an estimated value of $720 Mn at a resultant valuation of $1.8 Bn.

Snapdeal’s Alleged Acquisition By Alibaba – Mystery Continues Into 2017

2016 could not be more exciting with rumours flying in the last month of year of ecommerce portal Snapdeal getting acquired by Alibaba. Although a Reuters report significantly denied any chances of a deal, the spark of a possibility has not died down (even Inc42 sources confirmed the acquisition news). If these sources are to be believed, Alibaba has agreed to take up Snapdeal for about $2.2 Bn.

Furthermore, as per documents filed with the RoC, Snapdeal co-founders Kunal Bahl and Rohit Bansal together own less than 6.5% share in the company. In November 2016, Softbank Group Corp, which has the highest holding in Snapdeal (about 32%) had marked down close to $555 Mn in two of its Indian investments, including Snapdeal, as per its six monthly earnings report, ending September 2016. This actually strengthens the possibility of a flag down for Snapdeal.

It all started on Twitter, when anonymous handle Unicon Baba struck again and tweeted about Alibaba buying Snapdeal for a reported $2 Bn. Responding to these reports, Snapdeal co-founder Kunal Bahl took to social media and expressed his opinion about the buzz going on in town.

Alibaba, who is looking for merging the marketplace of Paytm, with another ecommerce entity, to firm up against global rival Amazon – seems to have another target with Snapdeal, after reported to being in talks with Flipkart and Shopclues, earlier.

Snapdeal has had a relatively quiet 2016 and came up with an important milestone for the $5 Bn company -$30 Mn to launch its new brand identity, “Unbox Zindagi” and changed its logo. The new logo, with two arrows forming a box, claims to convey Snapdeal’s journey as partners and enablers, indicating progress – onwards and upwards. However, controversy abounded for the unicorn as logistics startupsLogiNext claimed similarities with its logo and chided Snapdeal for using it – making it somewhat of a mixed bag year for Snapdeal.

Editor’s Note

Ring out the old, ring in the new.

These newsmakers have always been the fuel of media platforms and everything they do and say has come under the kind of minute scrutiny that is usually reserved for film stars or politicians. While the year in itself, has had a lot of ups and downs as compared to the year before, it cannot be denied that the Indian startup ecosystem will only benefit from these newsmakers claiming their share of the headlines.

Startups, on the other hand, have learnt the hard way that expectations have to managed and stronger business models that aim for profitability over inflated valuations, are the way to go. The Indian government too is taking drastic steps to bring about a change in the average India’s mindset by forcing them to go digital while establishing the country’s presence in the global ecosystem.

Yes, startups in certain sectors will definitely profit from this move (and all others) and all profit brings growth. And we hope that 2017 also brings about a change in the way the ecosystem itself operates – bringing together a harmonious community of startups, investors, stakeholders, and consumers. And, of course, more newsmakers to headline our stories in a positive and encouraging manner.

This is part of our special series, In Focus: 2016 In Review, in which we showcase the highlights of 2016 and what’s to come next year in the Indian Tech Ecosystem. Stay tuned for more.

This is part of our special series, In Focus: 2016 In Review, in which we showcase the highlights of 2016 and what’s to come next year in the Indian Tech Ecosystem. Stay tuned for more.