Over the past few quarters, we have been digesting commentary, or, in case of founders, dealing with the uphill task of fund-raising and wallowing in a ton of advice from various sources on how to deal with the situation.

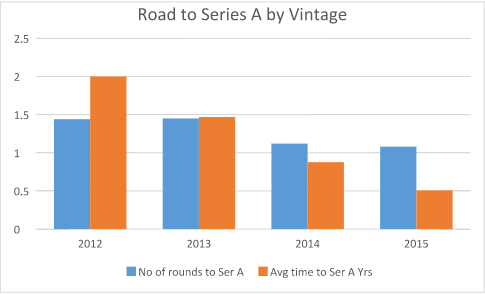

I believe we are essentially at a place which is the old normal, hyphenated with an exuberant period between 2014 and the first half of 2015. Using Venture Intelligence data for the vintage years 2012 through 2015, I looked at the financing steps needed for a company to get to Series A.

For those of us in the market at the time, one may recall that 2012 was quite a tough year for venture financing. Then we had the “bull-run” of 2014 and part of 2015. So what was it like to raise Series A financing if you got seeded in 2012. On average, it took you two years and 1.4x rounds of seed funding to get to Ser A (defined as a round >$2M). In 2013, the time taken to get to Ser A fell to about 1.5 years with a similar number of average rounds to Ser A as in 2012. Things of course, turned a lot better for the 2014 and 15 vintages, where it took much less than 12 months to get to Ser A from seed and correspondingly the vast majority of companies that got to Series A did it with just one seed round injection.

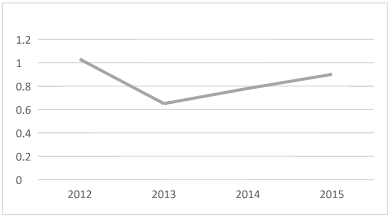

The quantum of funding needed to get to Ser A, while somewhat variable, was not nearly as volatile as the time to get to the milestone. The range for this number is $650K to $1.03M.

I don’t know if we are exactly in the mode of how things are in 2012-13 but it does seem that 2014-15 was an aberration and the direction of the data points gives us some lessons to draw from. So what can we learn?

- You need to be doubly sure about the idea you are pursuing and the fundability of the team. Just the first seed round does not mean a lot in terms of the success of the business. Also, you probably need something north of INR 4 crores to get to Series A regardless of the market, so be looking out to raise the second seed if your first raise was modest.

- In case of an angel round, one needs to ensure that the lead investor is truly committed and understands the company’s business, has the ability to rally folks to fund a second time prior to Series A.

- Founders need to invest time and energy keeping all investors on board with the Company’s progress all along, else its hard to re-engage when the time comes for a second dip.

- Frugality is a trait that needs to be in the DNA of the company. Need to spend money in drip fashion until signs of product-market fit are getting abundantly clear. Over-hiring is probably not the best idea at the seed stage.

Some of the breakout companies such as Urban Ladder, Grey Orange Robotics and E-com Express were seeded during these tough years and there will be invariably many more to follow. One has to be up to the battle against the odds…