They say that it’s the citizens and communities of a country – which give a country its unique characteristics.

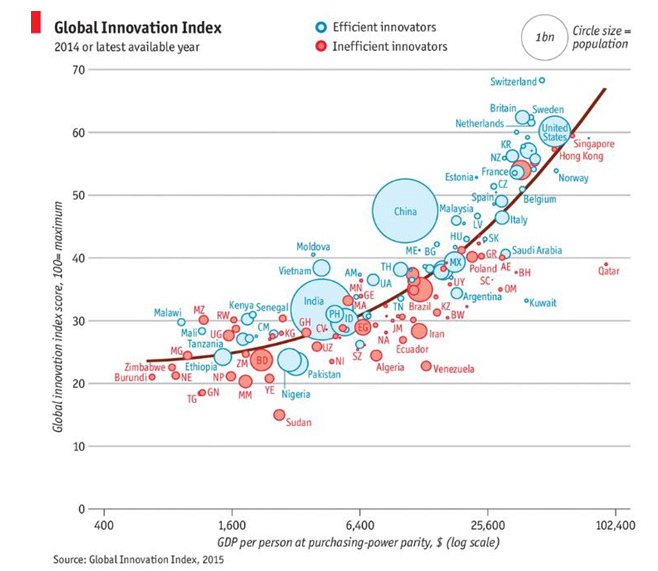

The other day, I was just looking at Global Innovation Index 2015 – which attempts to measure scale of effective innovation across all key global countries and indexes it to a scale from 0 to 100.

This establishes that despite its huge population and talent advantage – India still lacks behind its innovation capability as compared to markets like Europe, USA or even China.

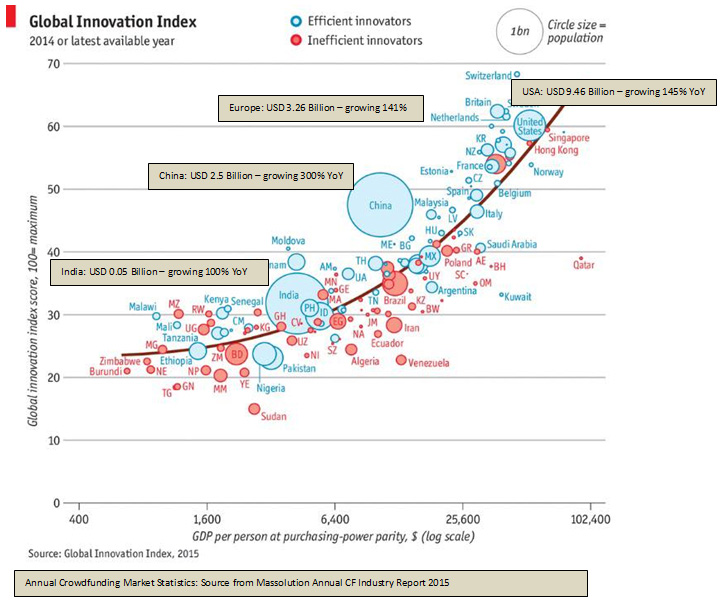

This further prodded me to compare this chart to the growth of crowdfunding in these respective countries and here are the broad numbers:

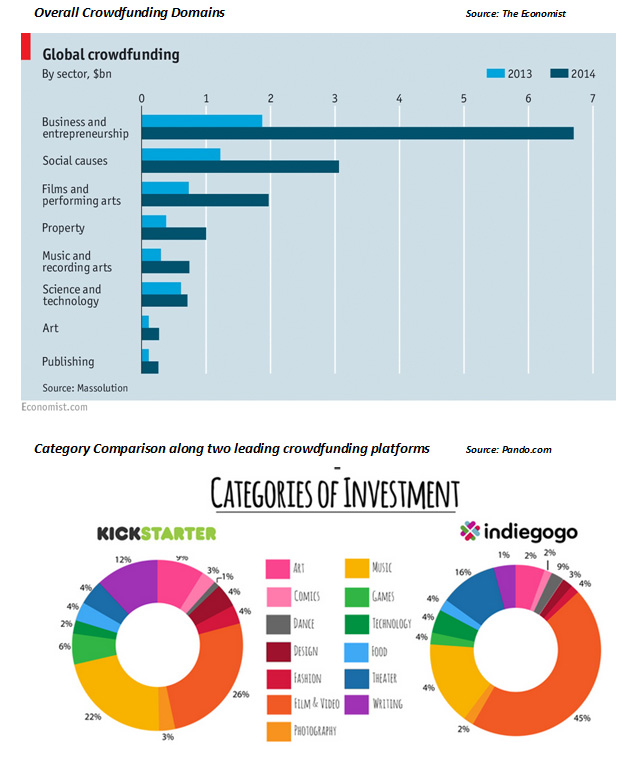

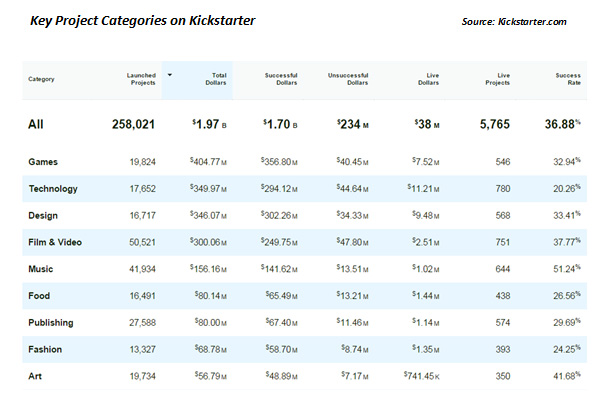

Also, lets have a look at key sectors which are gaining crowdfunding dollars.

So, what does all this implies?

The above data metrics do point to some of the following implications:

- Communities are driving innovation at root level: As you might all agree, innovation is any country is driven essentially by three constituents including the Government, the large business houses and investors and finally the citizens. While a pro-innovation policy framework in all leading countries on the Innovation map is a given, the rapid emergence and adoption of crowdfunding exhibits that innovation has gone beyond depending on just few investor hands – and there is active interest amongst both idea creators as well as citizens at large, to together keep pushing the envelope and driving innovation to daily newer levels.

Implications for India: Yes, we are on an innovation high! The government, lead by a visionary Prime Minister, who is seemingly leaving no stone unturned to drive up India’s innovation quotient – seem to be making right noises with campaigns such as Digital India and Make in India. The signals are also being caught by all eager investors and entrepreneurial ecosystem developers. What is left, perhaps, is Indian citizens to now start coming forward and engage with young Indian ideas, beyond just the lip service and crowdfunding could thus be one possible route to see this happening.

- Financial Regulatory Innovation: If today we look at vast financial regulatory regime changes, that are sweeping past markets such as Europe (UK being the leader), USA or even China. All these markets are today openly welcoming community-lead innovation-funding models. So be it crowdfunding, peer-to-peer lending, real estate crowdfunding, mini-bonds, opening up of public solicitation of funds through JOBS Act. These economies have understood that traditional control-based funding models may have lived their age and opening up ideas & access to innovation to larger community participation may be the next future of funding.

Implications for India: Though Indian regulators are showing early signs of opening up to innovative financial structures, the issuance of Payment Banks licenses and SEBI issuing white-paper on Equity Crowdfunding being some encouraging examples. They now need to move fast. China, for example, has already opened up security-based crowdfunding and is seeing more than 200% Y-o-Y annual growth and other south-east Asian economies are all in race to quickly catch up with Malaysia already opening up this domain and Singapore expected to open this up before end of current year. This could be a landmark opportunity for Indian financial regulators to really boost innovation funding and establish its leadership in evolving Asian market, where crowdfunding is expected to grow more than 300% Y-o-Y as per industry estimates.

- Community support beyond just the Social causes: As the above statistics reflect, crowdfunding today has gone beyond just as being a support mechanism for social/charitable causes. Kickstarter, a leading US based crowdfunding platform is estimated to receive more than 30 new product-based/technology innovations every day and more than thousands of aggressive innovation backers open up the platform each day to lap these up. Thus reflecting at how ‘Innovation’ today has become community-lead and not just policy-lead or funding-lead.

Implications for India: While in last two years, India has embraced crowdfunding, more than 80% of funds so raised through various crowdfunding platforms have been towards support of social & charitable causes. While this forms the basis foundation of crowdfunding in any economy, its time for the various platforms to together up the ante and start pushing a more focused functional innovation agenda through them.

So perhaps, this is the time when India should also come forward to together make a new innovative India.

Catapoolt has recently announced launch of Live Crowdfunding Pitch events.