You always have a choice.

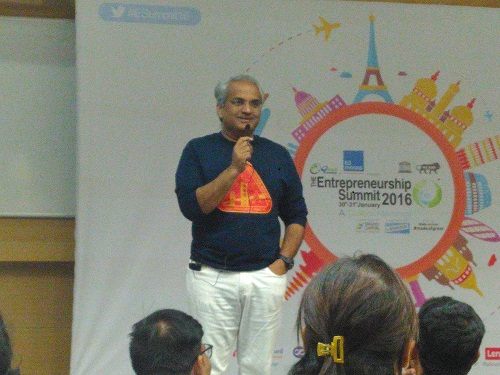

This in one line was the crux of Mahesh Murthy’s talk on ‘Money management lessons for startups’ at the E-cell Entrepreneurship Summit 2016 organised at IIT Mumbai recently. Mahesh spoke to budding entrepreneurs and starry eyed students from IIT on the dynamics of competition, the fault in skyrocketing valuations, big ass marketing budgets, and the hazards of falling for the lure of big ticket funding rounds. In his typical no-nonsense approach, he laid bare the truths behind building successful companies, without falling into the trap of billion dollar funding rounds.

The Rise Of Dominant Market Shares

Starting with the changing face of competition and dominance, Mahesh stated how instead of competition in the market, it’s actually dominance that has increased. Said Mahesh, “When I was growing up, I used to believe that competition is going to rise in the world. And proof of that was that market shares are very close to each other in any sector you looked at be it autos, pharma, cement. If we look at the world today, and business that have come up in the last 5-10 years, you see an interesting trend. For instance, in the energy drink business, Red Bull has 47% market share, Coke and Pepsi together have 11% market share. In luxury electric cars, Tesla has 98% market share, BMW has 1% and everyone else is 0.xx%. Similarly, if we take women brands, very few brands are close to each other. Zara’s business stands at $21 Bn in sales, almost 10 times larger than Calvin Klein which is $2 Bn. If you come to the digital world from the analog world, say search engines, then Google has 91% share, Bing has 3% and I don’t know who is number 3 and 4.”

He stressed that while once upon a time, one could easily name the top 10 pharma companies in the world or the top 10 auto companies but now it is difficult to even recall the number three search engine now. So, basically while everyone expected competition to go up, it’s in fact the opposite that has happened- dominance has gone up.

He added, “The world’s largest companies now have extraordinarily dominant market share. Say in micro blogging one company Twitter has 100% market share. There’s no rival to it. In mobile chatting, Whatsapp is at 75%, WeChat at 17%, and Viber at 2-3%. This is what I call the era of dominance of dominance.”

The Investor Conundrum

So while market shares now are following a logarithmic rule rather than linear, what does it spell for investors looking to invest in startups? Mahesh very aptly relayed the problem for investors in today’s era of dominance. He said, “10 years ago as an investor, one would be very happy to invest in the number four pharma firm, but now one can’t even invest in the number two search engine because they are not number one. This means that we have come from a point where the world was very forgiving and an entrepreneur could launch a copycat firm to a point where if he is not number 1 or number 2, he doesn’t count.”

He stressed that due to the license raj post 1947, India has seen a plethora of copy pastes. But now it’s no more possible to do succeed with that model in today’s internet world. He added, “Only that company will succeed in India which will not be a copy paste and has found an Indian problem to solve. For instance, the company we (Seedfund) invested in Redbus – doesn’t have an equivalent in the world. Similarly, Mydentist doesn’t have a copy in the world. Similarly, Voonik has no equivalent in the world. So, I am clear that if a company comes to me which has a US equivalent, I won’t invest in it because it will fail.”

Zero On Advertising, High On User Experience

Speaking on the secret ingredient of success of all super dominant companies, Mahesh stressed that all of them were brands who spent zero on advertising but were high on user experience. He said, “All these super dominant companies like Zara, Whatsapp, Facebook, Twitter, Redbull, Google and Gmail have become huge brands by spending zero on advertising. When did you see a Whatsapp add? When did you see a Zara add or a Twitter ad? You will notice that none of the number 1 and number 2 companies never advertise.”

He took a shot at those startups which were spending ludicrous amounts of money on advertising in the mass media. He joked,

“Every day when I open the paper and see another full page ad of a startup, I say Vineet Jain ( MD, BCCI) god bless you, keep on making more money. Dear startup, you are dead!”

Explaining the rationale behind why this was a terrible move, he stated that today the internet is larger than TV and cable. In this connected world that we live in, there are about 4-5 Bn people on the net around the world, so a startup entrepreneur could have a brilliant word of mouth as long as he had a story worth telling. While one has to pay for TV, internet allowed startups to reach millions for free-only if they had a story worth telling and retelling.

He aptly summed up the secret of business success as “Predominance, zero budget on advertising, having an amazing word of mouth which can only come from an incredible user experience that you deliver to your customer. So much so that your user can’t stop talking about it.”

He added that all brands like Twitter, Zara, Whatsapp and Tinder relied on word of mouth for gaining dominance. Additionally, he added that all these product wins were based on a simple insight-they all figured out a simple consumer insight out which would help them crack the market. So while Gmail figured it was the need for storage, Zara figured out that it was changing styles across all stores in a matter of weeks and creating artificial scarcity that got customers hooked on to make a purchase the moment they liked a product.

Here again, in his typical straightforward style, he took a shot at Flipkart and other over-funded companies saying that none of these brands had raised billions of funding of funding from Tiger! He said, “Most of big rounds of funding we have seen here,(taking a shot at Flipkart, Housing) are in products that have nothing to differentiate. If they have nothing which will make you go only to them and not their competitors, and are only relying on advertising to attract customers, mark my words, they will fail.”

Be Very Careful Before Taking A Lot Of Money

Finally, speaking against the current obsession of entrepreneurs with high valuations, Mahesh explained why it is a trap best avoided. Said Mahesh, “Startups get funded by foreign investors, don’t focus on building a product with a great word of mouth, but rather spend on advertising and buying the media. Normally investors in these cases have a liquidity preference wherein when the company liquidates; first preference is that of the investor when the company gets sold. Hence in such cases, founders are left with nothing even if they had raised money at crazy valuations.”

He also lambasted the trend of startups entrepreneurs who have just raised money, suddenly becoming angel investors encouraging entrepreneurs. He made fun of this breed of entrepreneurs stating that instead of making their own business successful, they are busy funding others!

Thus, he advised entrepreneurs to be very careful before they take a lot of money. He reiterated,

One has a choice and one can build a great company without raising external money. Take only as much money as you want with a small buffer. Don’t get trapped by high valuations. There is no point in saying I once used to own a unicorn. The lure of easy money will always will be there. There will be guys who will throw money at you. The word unicorn represents that you are extinct-unicorns don’t exist in real life.