I dont subscribe to the meme that says you have only one “story” as a startup. I think you need different stories based on your audience. I want to talk about one particular case based on a real world example and share how the stories might differ, the messages might change, and the positioning might be different as well.

I had a friend who is building a hardware company. Or, so he thought. The hardware unit would sit in a car and monitor driving behavior. Since it was focused on a niche (but large) use case, he was able to confidently show a large market (over $1 B) in a bottoms up market research study.

He had also done some initial customer development and spoken to over 50 of his target customers who were all willing to buy and pay for the solution, talked to 5 potential distributors who were willing to stock and sell the product and also had talked to manufacturers who could build at scale. Armed with this information, he felt he could raise a $500K round, since he had a strong team of 3 folks with him.

To build the hardware he estimated 3 resources for 6 months, so he felt $500K would give him enough cushion to tide a few mistakes.

After 3 months of trying to raise money and talking to over 12 potential targeted investors in his list, he found out that the appetite for hardware was just not there.

Well, there was appetite for a hardware company, but only at “scale”. Not in the initial phases, meaning the target investors, who were “early, seed and angel investors” wanted to see upwards of 500 to in one case, over 5000 units, before they were willing to to give the angel terms – $500K at $2M valuation. My friend felt he was being low-balled, but he had no other options.

Most investors he approached were unwilling to fund his hardware company.

This is not about hardware though, the same “investors unwilling to fund” anything outside known or proven models exist in other areas as well. Markets get in and out of favor. The flavors of the month are big data, anything marketplace (consumer) and most all things SaaS, etc. and cloud (B2B).

So, when he reached out to me, my initial reaction was the same as other investors. Having burned my hand in hardware companies, I was unwilling to fund anything close to hardware. Over the last 9 months we have funded 10 hardware companies and 30+ software. Except for one hardware company, the rest still have not shipped product (nearly 3-12 months after they promised to do so) and most have been unable to raise a follow on round of funding.

On the other hand, 50% the software companies have been able to secure follow on funding. I understand funding is no measure of success, but it is a key milestone.

Instead I asked him to position his product as a “Insurance and driver data as a service” – DIDDaaS (forgive me) platform and get the version 1 out with software alone, instead of hardware. Turns out that worked. After 3 weeks of meeting the same investors he did before, with a software only, asset light play he was able to get $250K committed to start.

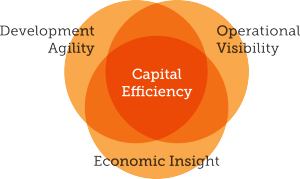

Trends point to the fact that even software companies are forgoing being capital efficient, but if your story depends on raising a lot of capital to be competitive, I’d say change the story to appeal to the capital efficient investor, EVEN if you end up raising a lot of capital.