SUMMARY

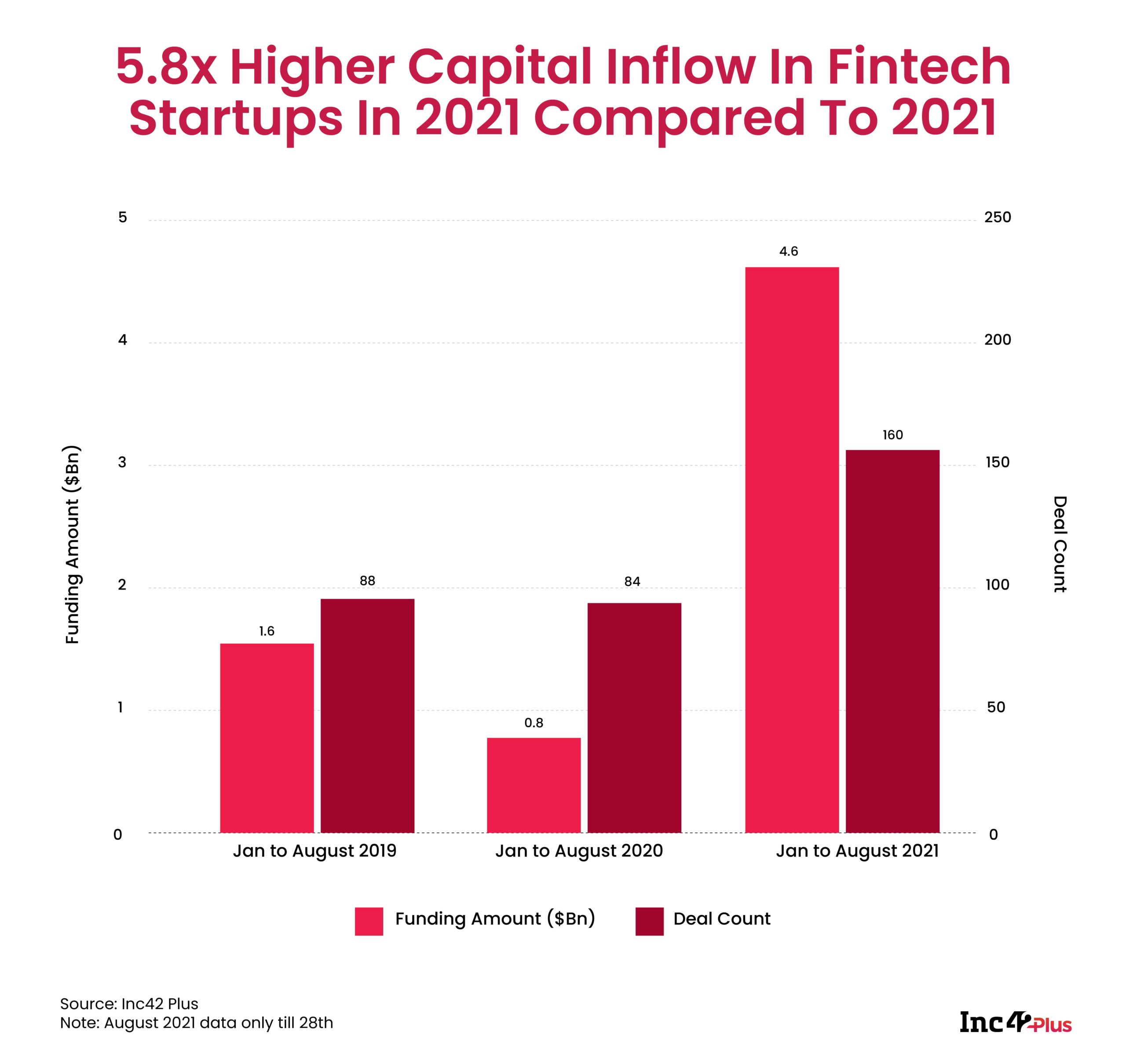

The fintech startup ecosystem saw 5.8x higher capital inflow to reach $4.6 Bn funding across 160 deals in January-August 2021 period

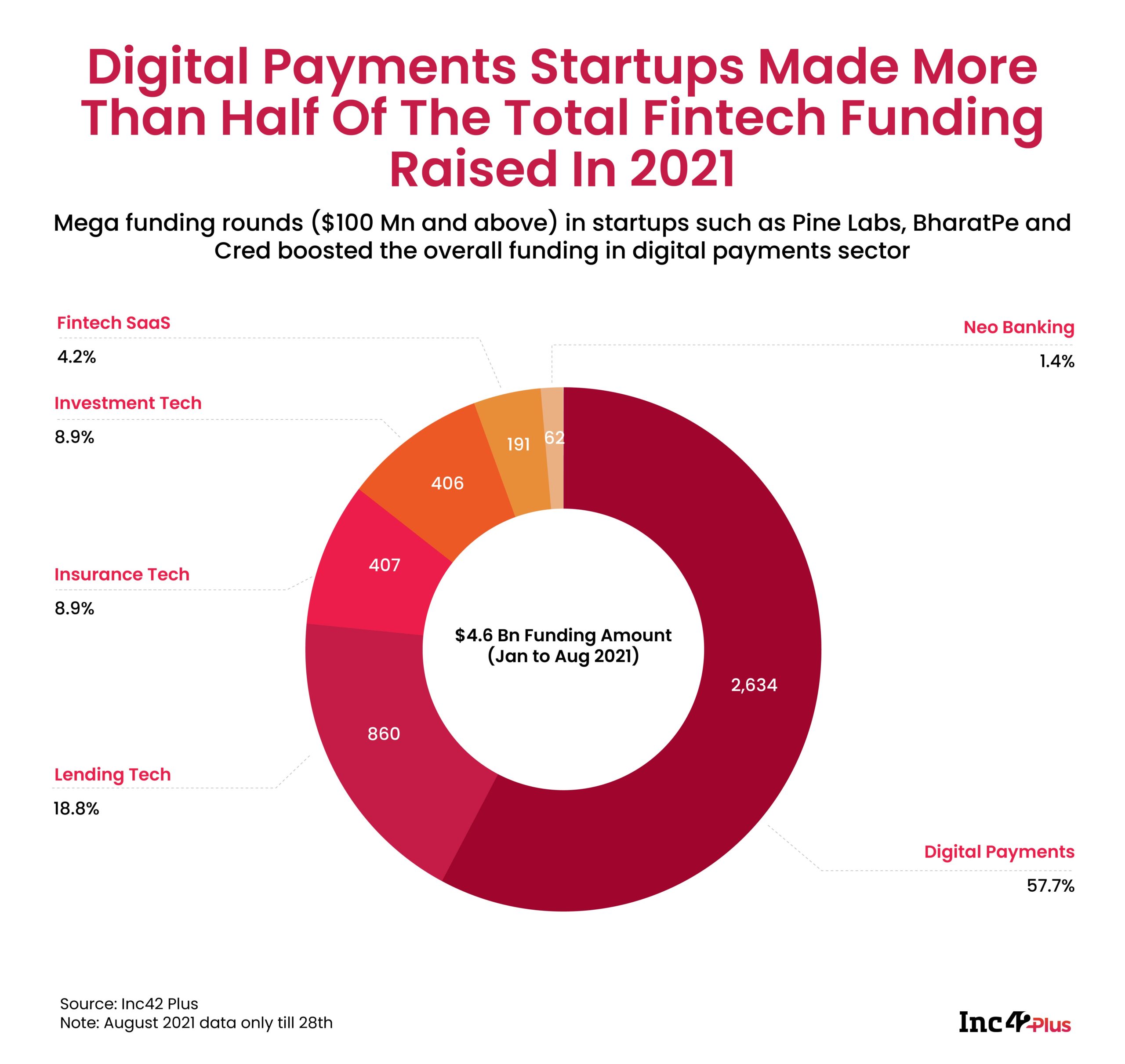

With 57.7% share, digital payments startups made more than half of the total fintech funding raised

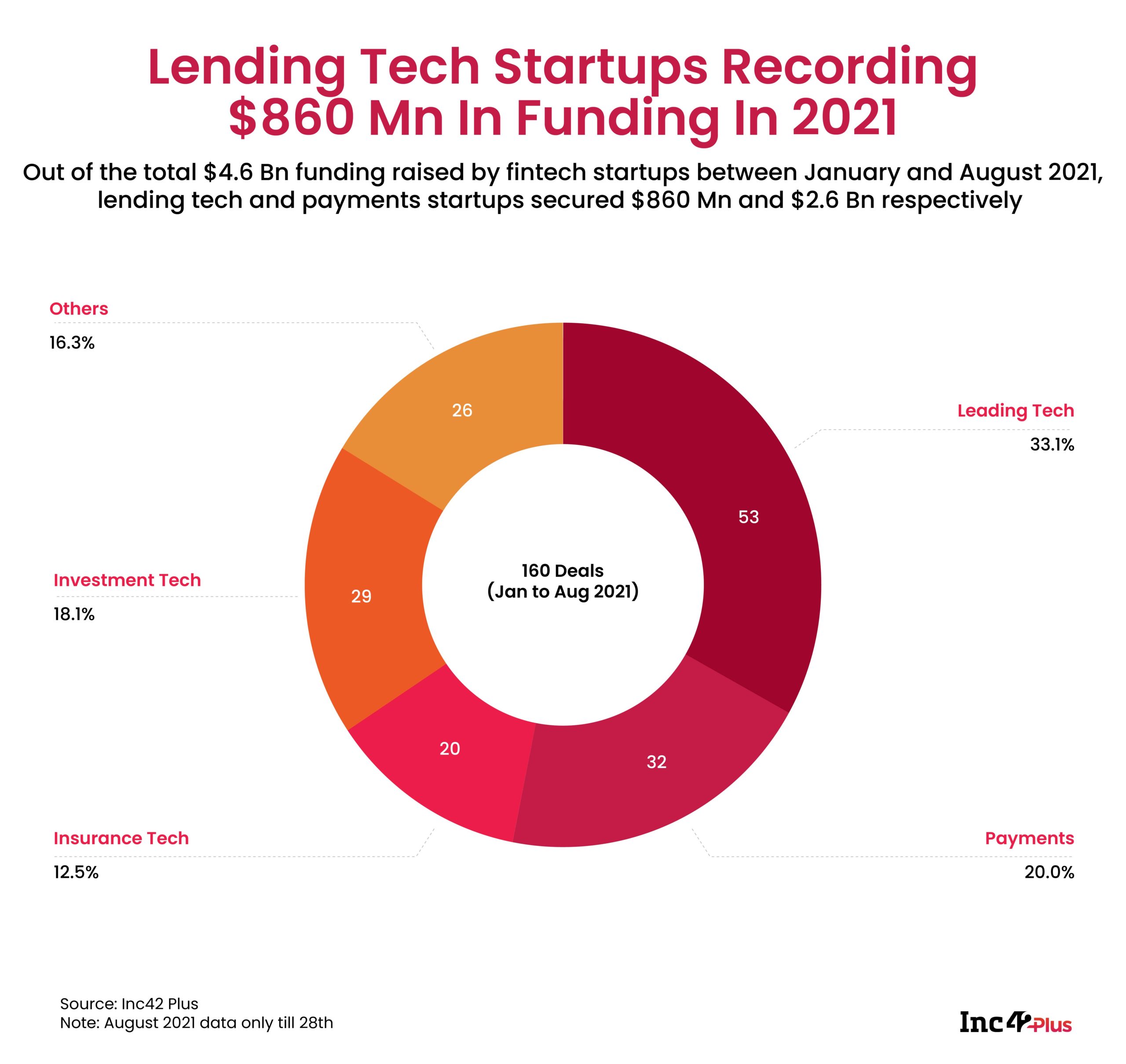

Lending tech and payments startups secured $860 Mn and $2.6 Bn, respectively

As the Indian startup funding hit an all-time high with $26 Bn raised in the first eight months of 2021, the fintech startup ecosystem saw 5.8x higher capital inflow to reach $4.6 Bn funding across 160 deals as compared to the same timeframe last year.

In January-August 2020, the fintech startup ecosystem had seen $0.8 Bn investment across 84 deals while in the same period in 2019, the fintech ecosystem reached $1.6 Bn in 88 deals in the country, indicating the growth trajectory led by the lending and digital payment startups in the pandemic i.e. 2020.

One of the biggest reasons for this growth in the Indian fintech ecosystem is the depth of business models within the fintech ecosystem, which allows plenty of room for niche plays.

While the startup majors and BFSI companies in this sector — the likes of Paytm, Policybazaar, PhonePe, BharatPe, Pine Labs and others — have carved out significant market share in specific categories, there’s still a whole lot of financial services these giants don’t cover and that’s where early-stage startups have the opportunity to disrupt and find a moat.

With 57.7% share, digital payments startups made more than half of the total fintech funding raised in the reported period. Mega funding rounds ($100 Mn and above) in startups such as Pine Labs, BharatPe and CRED boosted the overall funding in the digital payments sector.

The growth comes on the heels of a stupendous growth in transactions coming via the Unified Payments Interface (UPI).

According to Prabhu Ram, Head-Industry Intelligence Group, CyberMedia Research (CMR), India’s digital economy has been on the growth curve, enabled by the rise of powerful smartphones, very affordable data costs and pivotal government initiatives such as the Jan Dhan-Aadhaar-Mobile (JAM).

“The digital payments ecosystem has got a fillip with many new digital-native startups bringing forth new technology innovations, addressing consumer experience, and enabling ease of payments, amidst the pandemic,” Ram told Inc42.

The National Payments Corporation of India (NPCI) reported 3.5 Bn transactions worth INR 6.39 Lakh Cr in August 2021, growing 9.5% by volume and 5.4% by value over the previous month. In June and July, transaction volume grew by 10% and 15% respectively on a month-on-month basis while transaction value had grown by 11% and 10% respectively.

Paytm’s transaction volume spiked by 18% during July in comparison to PhonePe and Google Pay, which grew at 15% each.

Out of the total $4.6 Bn funding raised by fintech startups between January and August 2021, lending tech and payments startups secured $860 Mn and $2.6 Bn, respectively. Startups like OfBusiness, KreditBee and MPOWER were some of the prominent players in the lending tech ecosystem.

While the insurance tech ecosystem saw names like Digit Insurance, IPO-bound Policybazaar and RenewBuy grabbing the headlines, investment tech startups like groww, Smallcase and 5Paisa also made news.

Policybazaar has filed for an IPO, aiming to raise INR 6,017 Cr. Policybazaar’s IPO will comprise a fresh issue of INR 3,750 Cr and an offer for sale for shares worth INR 2,267.50 Cr. In fiscal year FY21 , the company reported revenue of INR 957.4 Cr and a loss of INR 150.2 Cr, 50% lower than the loss reported in FY20.

Bengaluru-based fintech unicorn Razorpay is also aiming to raise fresh funds between $200 Mn to $250 Mn in the coming days, reports said.