There could not have been a better time for me to write an article on the home services startups. Not because it is the hottest sector where technology is causing disruptions in a highly unorganized market to change the very structure of it. Simply because I happened to witness the way standardisation is trying to tame chaos in this sector on the very day I got this assignment.

The tap in my washroom had been leaking incessantly, and the local plumber I knew did not turn up despite of repeated calls. I was exasperated.

I looked up the list of startups in this sector, zeroed in on Zimmber and booked an appointment for a plumber online to fix the tap. My appointment was promptly acknowledged with an email, followed by a call from a Zimmber executive who had put me in a conference call with the assigned plumber so that I can guide the directions to my place and the chances of his getting late for the designated time are minimised. Smart! I thought. But I was still sceptical about it. Thankfully, the plumber turned up on time, he was quick to analyse the problem, fixed the faulty tap, and charged only what was mentioned on the site. No late appointments, no haggling, a pleasant service experience, and a satisfied customer.

The home services industry in India is growing rapidly with about 69 startups founded in 2014 alone!

I thought of the countless people who struggle on a daily basis to get such efficient home service experience – be it plumbing, carpentry, laundry, electronic repairing, requests for tutors, request for hobby classes and the entire gamut of service market, and I understood why Uberization of this sector was the next big thing happening in India.

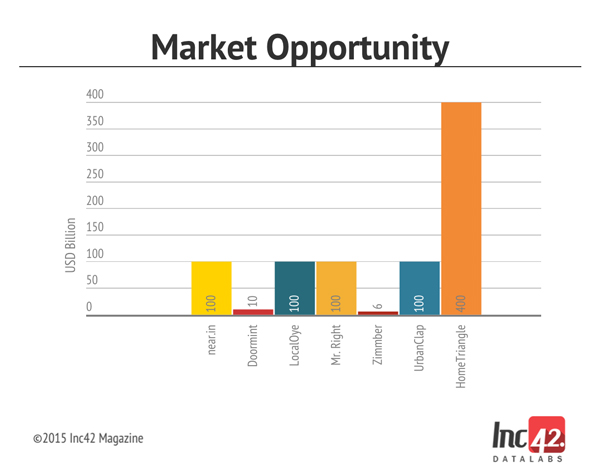

It’s another story altogether, that this highly disorganized market, holds an opportunity ranging from $100 Bn-$400 Bn.

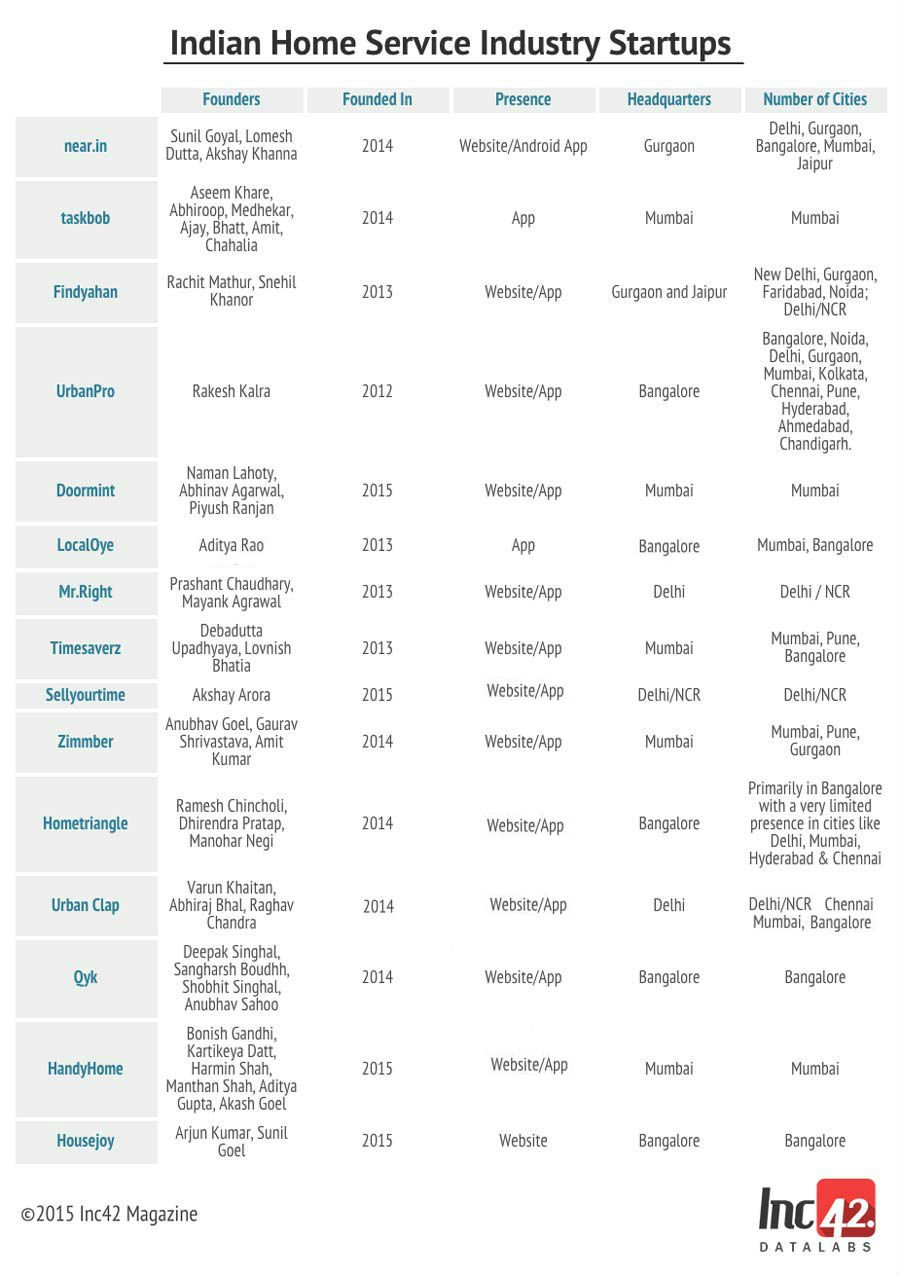

According to startup industry tracker Tracxn, the home services industry in India is growing rapidly with about 69 startups founded in 2014 alone. Players include HouseJoy, Zimmber, near.in, taskbob, Mr. Right, Findyahan, Urbanpro, Urbanclap, Doormint, Hometriangle, Qyk, and many others which provide home services like plumbing, painting, electrical service, laundry, pest control, in health and wellness for e.g. physiotherapists, yoga instructors, in tuition and hobby Classes for e.g. dance, music, zumba, maths, to events e.g. mehandi artists, photographers, and birthday party planners. The range of services provided varies from six to 1000.

This space will see the same activity that e-commerce segment in India is currently seeing with 1 or 2 players emerging as clear market leaders.

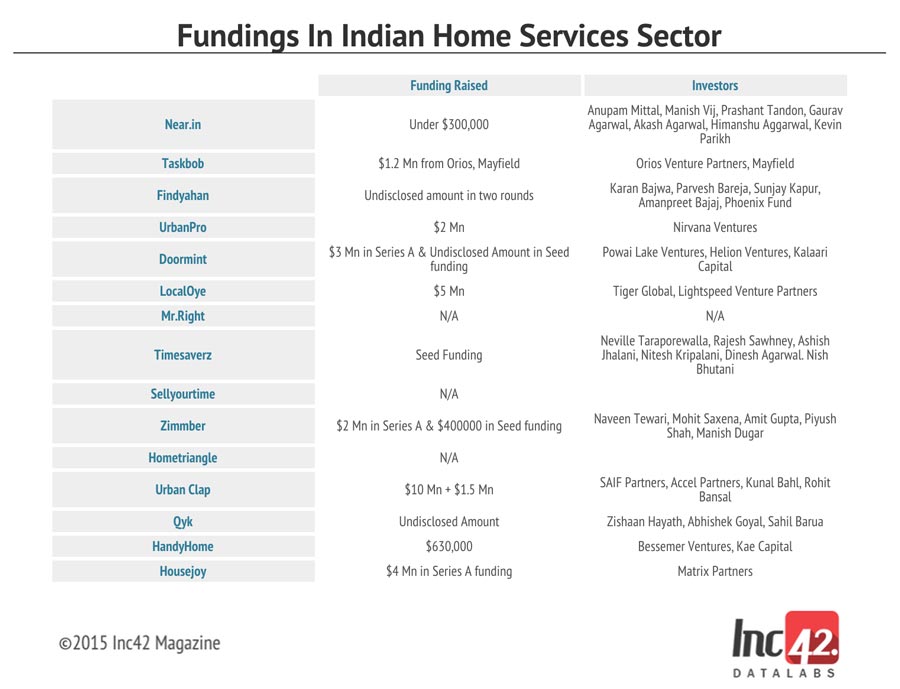

No wonder that the sector is witnessing an influx of funds from angel investors and institutional investors alike. The disclosed deal value alone by 15 of the startups listed below has crossed more than $25 million, indicating that the sector is fast catching attention of the VCs. As per LocalOye’s CEO Aditya Rao, “This space will see the same activity that e-commerce segment in India is currently seeing with 1 or 2 players emerging as clear market leaders.”

Fundings in The Sector

Growth in The Sector

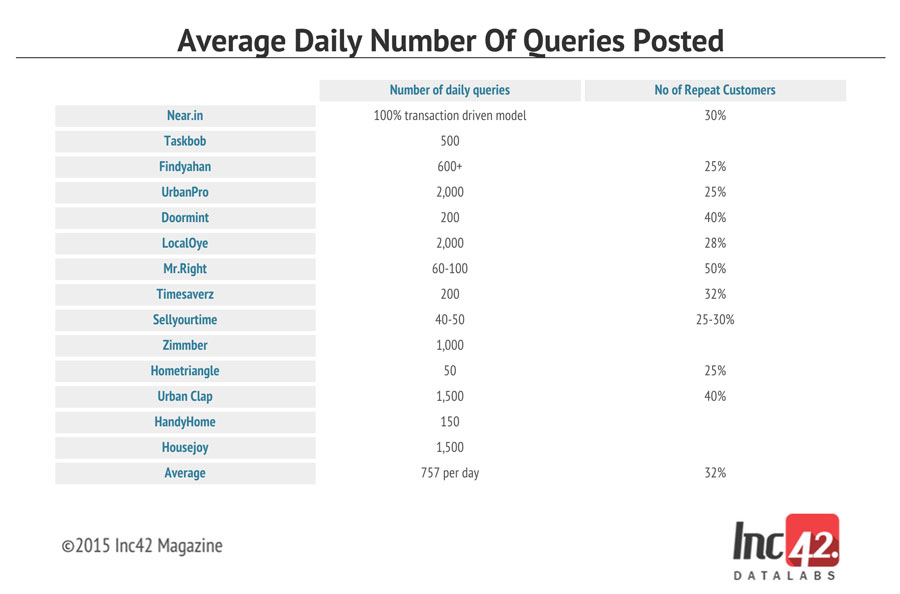

To truly understand how consumers have opened up the concept of hiring on-demand services, one needs to take a look at the number of daily transactions query log of these startups and the proportion of repeat customers. Doormint is based Mumbai receives about 200 requests daily on its platform, while Bangalore based HomeTriangle receives about 50 requests. Urbanpro, which claims to serve about 2,000 categories, receives over 1 million visits in a month from about 750K unique visitors.

Rakesh Kalra, CEO of Urbanpro states that, “UrbanPro generates a new enquiry for service professionals every minute. We constantly get visitors looking for best professionals for their work. About 68% of the enquiries come from tier 1 cities and rest from tier 2 and tier 3 cities.”

Similarly, the repeat customer percentage varies from 25% to 50%. Timesaverz, which is operational in Mumbai, Pune and Bangalore, serves around 200 requests a day across these 3 cities. As per CEO, Debadutta Upadhyaya, “On an average 32% of our customers are repeat customers.” Meanwhile, near.in, which does not measure its business metrics on the basis of queries, has some 1000+ customers using its platform on a daily basis, with around 30% repeat users.

Co-Founder Lomesh Dutta stated, “ Anyone can leave their phone number on the website (with no intent to do business with the service providers) so we don’t view that as the right metric. We are a 100% transaction driven model and measure the total number of fulfilled orders on a daily basis, pretty much like any e-commerce company does.”

More than 750 queries are raised daily to just these 14 startups in the home service market!

Hence on an average, more than 750 queries are raised daily to just these 14 startups in the home service market. This takes the total number of queries raised each day to 10,500. The number points to the in-roads these startups have made into the on-demand service market as well as in the lives and phones of consumers. Given the fact that smart phone penetration is going to increase monumentally in the coming years, the market opportunity and the competition in this sector is bound to rise manifold.

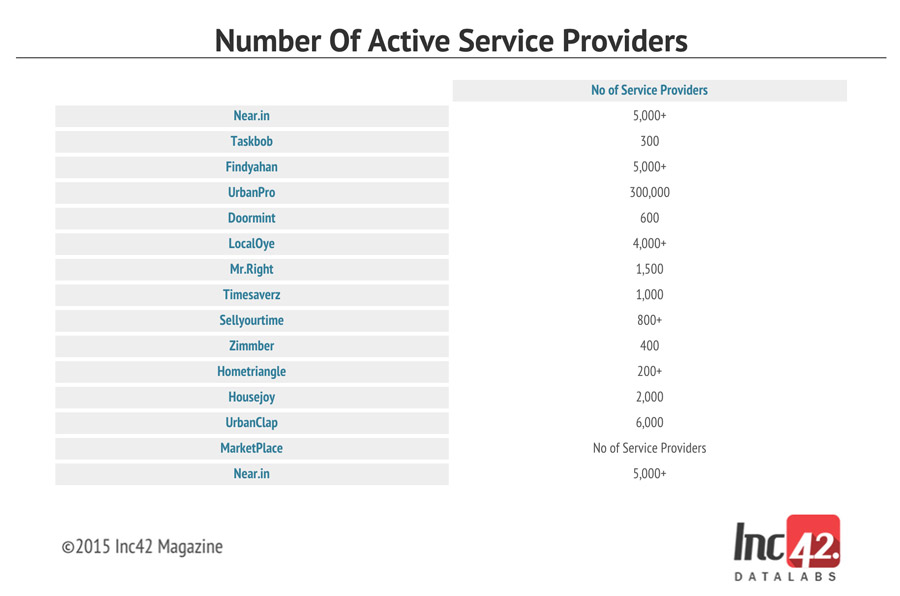

One look at the number of service providers associated with each firm indicates the level to which these startups are trying to standardise and organize this industry. Having a network of well-trained, verified and efficient servicemen is one of the most important drivers of this industry and hence these startups are making all such efforts to get the task force in place. For instance, Taskbob selects only top 10-20% servicemen it interviews. Further, it invests in heavily in training them and also provides an in-house “merchant app” to make the service assignment and completion amongst them operationally efficient, quicker and seamless.

Mobile Only Approach

Most of the aforementioned startups have given a thumbs up to leveraging the huge opportunity provided by the rising smartphone penetration in India by increasing focus on the mobile strategy. However, most of them also agree that mobile-only is not the only way to go for the home-services market. Debadutta Upadhyaya, founder of Timesaverz stated, “The buzz word is mobile – whether it has to be mobile also, mobile first or mobile only has to be a strategic decision depending on the product life cycle, the inherent benefits to the consumer and frequency quotient.”

Similarly Lomesh Dutta of near.in seconded that, “We view the service we are offering to the users as the first thing and then look at the best screens for someone to experience it. To us mobile is a screen (no doubt it has the widest adoption) and it is okay to focus on it first in the short term as a startup if you have limited resources. However, we don’t think it is good to think of our product as mobile only. Unless mobile web or desktop significantly degrades your use cases we don’t see the point of being on only one screen.”

Snehil Khanor, co-founder of FindYahan also reiterates the mobile-first strategy but not the mobile-only approach. He says, “We are mobile first but we don’t see ourselves being mobile only anytime soon.” Varun Khaitan, founder of UrbanClap stated, “More than 70% of our customers place a request through the mobile app. We have seen 5X more engagement from users on the mobile app compared to mobile web which just shows how mobile centric the Indian user is.”

Adopting a mobile only or to say ‘app only’ approach does not mean just shutting down your website. It should be aimed at creating a personalised experience for users and mobile app-only strategy allows companies to create that kind of experience.

As per Doormint’s co-founder Abhinav Aggarwal, “It is more than 10 billion dollars in India already in the current categories, bound to increase more and more with advent of internet and smart phone penetration.” Similarly both Findyahan and Timesavers agree that given the fact that all startups are actually trying to solve a pain point in their own way, the market opportunity is tremendous. Added to that is the fact that, “as India awakens to a mobile revolution that the world has not seen in terms of sheer numbers of smartphone users fulfilling most of their daily activities through mobile, the opportunity gets that much bigger.”

Near.in’s founder Lomesh Dutta says “The market size is projected to be around $100bn so there is a room for multiple players in the short term. Eventually 2-3 players will dominate the horizontal market and another few will be in some specific verticals such as washing, beauty etc.” Says HomeTriangle’s co-founder Manohar Negi, “This is such a big problem to solve and that is why we see many players trying to get into this.

As per market study the estimated size of home services is around $400 Billion per year.” Meanwhile Anubhav Goel, CEO of Zimmber says, “There are 220 million + internet users in India and more than 50 Million + doing online shopping. The local services market is worth more than 36000 Crore (~$6 billion).” As per Varun Khaitan, founder of UrbanClap, “Local services is a US$ 100 B + market opportunity. The highly disorganized nature of the market coupled with the existing demand and supply gaps, makes it an apt place to be in.”

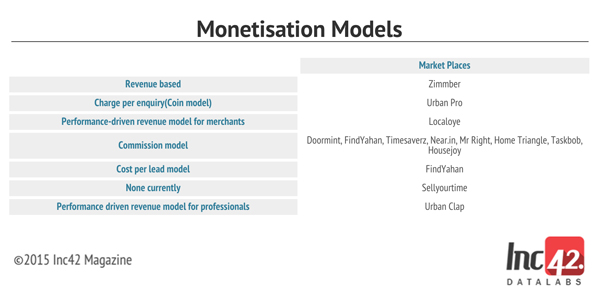

Monetisation Comparison

Home service startups are using a combination of business models as they try to standardize the highly fragmented market. Majority are working on the commission model wherein they charge 15-20% commission from the service providers on every successful task completed. Some like Zimmber are operating on the revenue model from day one, with the revenue and payments from the clients going through Zimmber. Localoye is completely free for customers and has built a very performance-driven revenue model for our merchants. Instead of charging them listing fees, merchants can buy a prepaid wallet and then money is deducted from that platform every time they successfully connect with a customer.

Urban Pro works on a coins model, which allows it to charge per enquiry that it generates. The service professionals purchase UrbanPro Coins (a currency specific to UrbanPro). These coins are used when responding to customer enquiries via the platform. Each response on average costs 20 UrbanPro coins.

Since it is an unorganized service industry, it is fraught with challenges like building an efficient supply and demand channel, reaching the right customer on time, and hiring, training, and monitoring service professionals. Since there are no clear price points or estimates or standards of delivery, standardizing services, ensuring transparency of prices, delivering a quality service, ensuring trustworthiness of a service provider, and maintaining quality check on a large scale are some major challenges these market players face. The shutting down of on-demand cleaning company Homejoy in US over class action suit by its service providers highlights the vulnerability of all such on-demand startups which provide services through contractual workers and not company employed people.

Challenges Faced

To counter these, many like Taskbob lay special emphasis on hiring the right people, providing them the right training, and monitoring them effectively. Mr Right for example has put in place several layers of security checks in order to verify the pros we sign up. The initial round is a telephonic conversation where the team identifies several behavioural measures to evaluate the service professionals. Next, they arrange an in-person meeting where all the required documents and IDs are collected from them. They work in conjunction with third party verification services to authenticate all their submitted IDs, their work history and their previous associations. Customer feedback is one of the most important metrics and some like Taskbob offer 100% cashback in case a customer is not happy with their services.

These firms are also trying to improve the quality of delivery through better use of technology in real time feedback, promotion of meritocracy among supply and real time location tracking. Near.in’s Lomesh Dutta says, “Like any marketplace the biggest thing is to carefully build your demand and supply together. If the service providers get in a lot of leads from you but it doesn’t convert then they will simply run away breaking the entire marketplace.”

Future of Industry

Given the number of players in this segment, the funds flowing in the sector, and the wide scope of the arena, the industry is witnessing and will witness a strong competition. The potential is huge; the question is which player can reach the customer fastest to provide a standardised solution. Hence the players are putting a lot of efforts on differentiation and expansion.

Market players are investing heavily in technology in order to make their platforms and apps more user friendly and easily connect consumers to relevant service providers.Doormint believes that there are two different approaches to approach the competition- one is just a curated connection marketplace and the other is the full stack end to end service delivery like theirs. Many like FindYahan and Taskbob are focussing on the quality of service providers. Timesaverz believes that a seamless end-to-end booking engine across web and mobile, geographical expanse, depth of categories and service partner network strength are its key differentiators. Players like Near.in are striving to provide a full end-to end experience-from scheduling and coordinating an appointment with the service providers, notifying user every step of the way to guaranteeing the quality of service.

Ultimately transparency in pricing and the delivery of the service experience will determine consumer preferences for one service over the other. As HomeTriangle’s founder Manohar Negi says, “I must say the problem is same and we all are trying to solve it differently.”

Given the fact that the sector is poised to receive a fillip with increasing smartphone and internet penetration just like e-commerce, all the players are already looking to expand their reach to encompass more and more geographical locations as well as augment the entire gamut of services. Home Triangle is scaling three categories every quarter and plans to have 10 major categories in place by the year end. Similarly Zimmber plans to setup operations in close to 37 cities by the end of 2016 through intelligent customer data mining.

As India awakens to a mobile revolution that the world has not seen in terms of sheer numbers of smartphone users fulfilling most of their daily activities through mobile, the opportunity gets that much bigger.

Many like Near.in will continue to add more and more service categories everyday depending on the user demand. Others like UrbanPro are looking forward to penetrate further in Tier II and Tier III cities as a number of our enquiries come from there. There is no stopping these players as the sector is poised towards a major boom. As Timesaverz’s Debadutta Upadhayaya puts it, “As India awakens to a mobile revolution that the world has not seen in terms of sheer numbers of smartphone users fulfilling most of their daily activities through mobile, the opportunity gets that much bigger.”