“In union, there is strength.” – Aesop

At the launch of its recent offering, SmartUp, Smita Bhagat, Branch Banking Head (North) and Co-head, ecommerce, HDFC Bank, told fledgling startups, “We help you grow your business and as a result we grow too.” In this one statement, Smita has aptly summed up the traditionally conservative banking sector’s evolving interest in the fundamentally risky, yet rapidly, growing Indian startup ecosystem. Today, it’s not just VCs and angel investors who are clamouring for a share in the startup pie. The banking sector (banks in general) has also woken up to slowly plant their feet in startup soil.

The reasons are pretty much clear. India is amongst the first five largest startup communities in the world, with the number of startups crossing 4,200 (at a growth of 40%) by the end of 2015. According to the Nasscom Startup Ecosystem Report 2015 titled ‘Startup India – Momentous Rise of the Indian Startup Ecosystem’, in terms of providing a conducive ecosystem for the startups to thrive, India has moved up to third position and has emerged the fastest growing base of startups worldwide. With the government’s ‘Startup India, Stand up India’ initiative, these numbers will go further north. No wonder, given the slew of measures being rolled out, it is changing fast. As per a report by Microsoft Ventures, the number of startups is expected to zoom from 3,100 in 2014 to an expected 11,500 startups by 2020.

These startups are constantly creating new business models, generating employment, scripting their success stories even beyond local borders. Needless to say, these new age businesses are a rising force and are now beginning to attract the interest of banks. Banking is one of the oldest professions of the world and with increasing digitisation and smartphone penetration, it itself is undergoing a sea change. Consequently, the times are ripe for a symbiotic collaboration between banks and these technology startups. These startups not only have potential as their clients but are also useful for banks in adding to their technology prowess. As a result, banks are engaging more and more with startups in different ways such as offering exclusive services, funding, and opening exclusive branches.

Exclusive Startup Bank

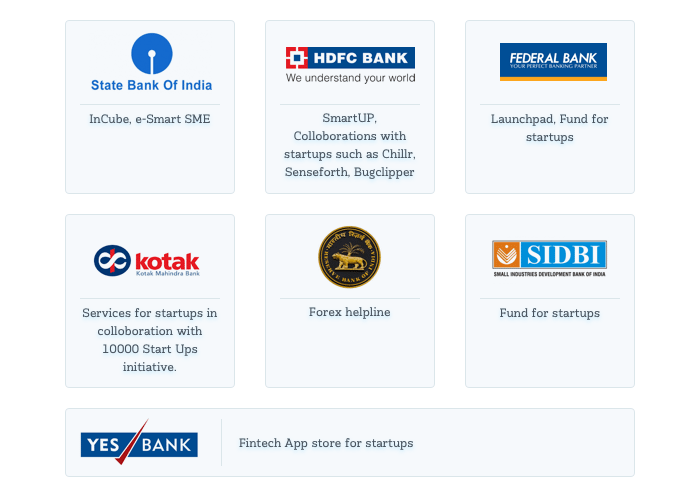

The fact that the startup community is now being recognised as a serious banking community was established by SBI’s launch of InCube – its first exclusive startup bank branch in Bangalore. Through ‘SBI InCube’, the bank will be helping, guiding and counselling the entrepreneurs in starting a new company or business enterprise.

And why this exclusive treatment for startups?

Talking at the launch event, SBI Chairman Arundhati Bhattacharya summarises the rationale behind it by saying, “We want to be a part of the growth of startups and India itself. We will support entrepreneurs in their ventures and let them do their job of innovating.”

No wonder, with services such as a dedicated relationship manager to satisfy all needs of a startup, end to end solution for mentoring startup for regulatory requirement, a dedicated startup counselling desk for round the clock assistance, cash management solutions that streamline a startup’s receivables and payables, SBI is striving to make its structure more amenable to the requirements of startups. In the pipeline are more InCube branches in Delhi-NCR and Pune.

Exclusive Banking Solutions

Wooing startups with easier and exclusive banking solutions are banks like HDFC which recently launched SmartUp – a dedicated banking solution for startups, in association with Zone Startups India, a startup accelerator in Mumbai. SmartUp is tailored to meet all the requirements of a startup – offering banking and payment solutions, along with advisory and forex services.

Everyone wants to partner with startups as was evidenced with the statement of Smita Bhagat, who said, “We believe startups in India need partners who will be with them right from the start of their entrepreneurial journey, creating solutions that evolve as the company grows.”

The key benefits of SmartUp current account include waiver of Average Monthly Balance for the first six months and extendable to 12 months, salary account for employees by waiving the minimum number of employees criterion, PayZapp for Business – a payment and collection solution, a dedicated relationship manager, recommendation of a chartered accountant for tax, regulatory and compliance issues, and opportunity to showcase products on SmartBuy (HDFC Bank’s exclusive offers platform) to 37 Mn HDFC customers.

And what kind of startups is the bank looking at to partner with?

Nitin Chugh, Country Head, Digital Banking, HDFC Bank, further explains, “We are taking an inside out approach, hence, we are looking for startups who have done some good work, ideas which make sense for our customers. Hence, we are looking at startups who have progressed beyond the idea stage and tested prototypes, passed the compliance framework, and have the support mechanism to scale it up.”

On similar lines is Kotak Bank’s association with NASSCOM’s Startup Warehouse where it provides services to entrepreneurs and startups under the NASSCOM 10,000 Startup Programme. Kotak Mahindra Bank is one of the anchor partners in the 10000 StartUps initiative – a startup incubation programme whose objective is to create 10,000 domain-specific startups in the country by 2020.

Similarly, ICICI bank’s general insurance arm ICICI Lombard has started offering dedicated products to startups, such as health insurance policy for startup ventures. The initiative, which is yet to be announced formally but has been launched in stealth mode, as per ET, will also see the launch of other products designed specifically for startups.

Launchpad Lounges

Not to be left behind in courting startups is the Federal Bank, which is all set to start ‘Launchpad’, a dedicated service for startups. These services will pilot in Bangalore and Ernakulam, with specialised lounges in the bank’s branches offering advice on capital, regulatory support, and even disburse funds. The idea is to act as a perfect breeding ground for future entrepreneurs. It would be looked after by bank executives as well as local specialists who would be able to advise on regulatory issues.

Shyam Srinivasan, managing director of Federal Bank, states, “We are talking to three or four startups daily. The challenge for a bank is to move away from a conservative credit mindset to a more entrepreneurial mindset and to accept the fact that out of 40 or 50 investments, only one might take off. So, even we are in the process of understanding how to engage with startups better.”

Shyam Srinivasan, managing director of Federal Bank, states, “We are talking to three or four startups daily. The challenge for a bank is to move away from a conservative credit mindset to a more entrepreneurial mindset and to accept the fact that out of 40 or 50 investments, only one might take off. So, even we are in the process of understanding how to engage with startups better.”

Direct Collaborations

Increasingly, banks are also collaborating more with startups in order to improve the digital banking experience for their consumers. In this direction, HDFC organised a Digital Innovation Summit this month, wherein about 30 fintech startups were shortlisted to showcase their ideas from the 105 applicants. Out of these, five startups—Senseforth Technologies, Tagnpin, Safe to Pay, Bugclipper Technologies, and Tapits Technologies—were selected as winners. These startups will get a chance to deploy their products in the bank, after they are further evaluated on technical, business, security, and compliance parameters. In fact, some of them are also working with other banks or running pilots.

These collaborations come on the back of efforts to simplify and innovate transaction in the digital platform. As per data revealed by HDFC bank, in 2005, internet and mobile based transactions constituted only 13% of its total transactions. In 2013, it stood at 44% and moved to 55% in 2014. Come 2015, and the share has risen to a whopping 63%. No wonder, the bank is strategically focusing on customer convenience, access and delight, using technology as an enabler.

In fact, HDFC’s association with startups started in 2015 when it entered into a partnership with fintech Startup Chillr. Following its suit, SBI and now even Federal Bank have integrated their platforms with Chillr. The addition that Federal Bank brings to the Chillr application is that they would allow even non-Federal Bank users to instantly open a Federal Bank account through a selfie and an ‘Aadhaar’ identification number, and allow them to receive payments through Chillr.

On the same lines, Yes Bank, in collaboration with software product think tank iSPIRT, has launched a fintech app store for Indian startups in the financial technology space. The store will hold a governance structure, making it easy for any startup in the fintech domain to access it and enable Yes Bank to establish an online app store that can be leveraged by such startups. With this association, YES Bank will be able to onboard these innovations rapidly and offer newer products in digital banking, mobile payments, lending etc. to their customers.

Additionally, this January, digital payments platform FreeCharge launched its new virtual card ‘FreeCharge Go’ in association with YES Bank, powered by MasterCard. With FreeCharge Go, customers can transact across all major ecommerce portals, pay for movie tickets, book event tickets, pay for various transportation services like bus, cabs and metro rides, buy groceries, etc. across all Indian websites.

On similar lines, Paytm launched a co-branded virtual prepaid card in association with ICICI Bank in December, while in January 2016, Oxigen launched its virtual card, powered by Visa, in association with another payment solutions provider ZAZOO and RBL Bank.

Said Ritesh Pai, Senior President and Country Head – Digital Banking at Yes Bank,

“Today banks are facing competition not just from other banks but also from ecommerce players, wallet players, and payment gateways. So, while banks have a lot of legacy, there is a need of newer solutions to cater to changing demographic requirements of consumers. Hence, the need for banks to collaborate with startups which are more nimble footed.”

Ritesh added that banks are not software companies who can churn out solutions day in and day out, and yet they cannot keep away from these solutions as well. So, while banks excel at backend activities, compliances and regulations, advisory activities, and playing the role of an enabler, startups excel at UI/UX and the user experience. Hence, it is a marriage of convenience between the two which would address the pain points in the society and target the young population which will come into mainstream and would enable large uptake of these solutions.

Elaborating on Yes Bank’s initiatives in this direction, Ritesh added that it is collaborating with many such startups in the field of robotics, analytics, cognitive intelligence, and fintech companies, with most of the solutions to be rolled out in the next 60-90 days. Yes Bank has also recently signed a MoU with T-Hub, a technology incubator set up by Telangana government, to set up a centre of excellence for startups in fintech space. Under the agreement, the association will help create a conducive business environment and support system for a large number of fintech startups.

Adds Venkatesh Hariharan from iSPIRT, “Banking is entering an era of non-linear change where the old rules no longer apply. In this scenario, the end-state is difficult to predict. Therefore, banks will have to look at taking a portfolio approach like VCs do, and making a variety of bets, monitoring the portfolio and doubling down on the best that work. They will also have to find new ways of partnering with startups, which is outside their usual procurement norms. We believe this could be a win-win for banks and startups because banks have deep expertise in regulatory compliance and risk management, while startups can bring an intuitive understanding of technology, and nimbleness to the table.”

Forex Helpline

Given the fact that many startups are now regularly raising funds from foreign investors and also taking their businesses global, RBI too has chipped in to do its bit for easing things out for them. The first step in this direction is creating a dedicated helpline to assist startups undertaking cross-border transactions, which would enable it to offer timely and effective information.

The central bank said in a statement, “While seeking guidance, the enterprises should provide complete information to the RBI and mention the specific issues on which they need guidance from the RBI in relation to the Foreign Exchange Management regulations.”

Additionally, the RBI is also planning to introduce regulatory changes to ease cross-border transactions for startups in India. This will enable startups to receive foreign VC investments without any restrictions. Key recommendations include letting startups transfer shares to other residents or non-residents, issuance of innovative FDI instruments, like convertible notes by startup enterprises, and online submission of forms for outward remittances, among others.

In a first, RBI has created a dedicated mailbox to provide assistance and guidance to the startup sector. Physical forms will be discontinued from Feb 8 and all investment and financial transactions will be reported on its electronic platform. The measures are in sync with the government’s Startup India initiative. RBI Governor, Raghuram Rajan in his policy statement said, these steps will help to ease doing business and contribute to an ecosystem that is conducive for growth of startups.

In a first, RBI has created a dedicated mailbox to provide assistance and guidance to the startup sector. Physical forms will be discontinued from Feb 8 and all investment and financial transactions will be reported on its electronic platform. The measures are in sync with the government’s Startup India initiative. RBI Governor, Raghuram Rajan in his policy statement said, these steps will help to ease doing business and contribute to an ecosystem that is conducive for growth of startups.

The Founder Speak

The startup founders are excited by this increasing interest from the banking community. Says Pratyush Halen, founder of Tapits Technologies or FingPay, which is working in the area of biometric payments with HDFC Bank,

“It’s beneficial for both. For the banks, they get new innovative concepts and ideas to implement from the young energetic people to improve conventional processes by automation and make them faster, simpler and better. Added to that is the fact that startups are more reasonable compared to big fat companies in terms of commercials, time required to build project, etc. The big companies simply build what is required but startups build what can be required further, what can make the experience better, and make things more efficient and cost effective etc. In a startup there are no boundaries, you can build whatever comes to your mind, you can go out of the way to solve problems in the industry better.”

For startups like his, it is dream come true as they get an extremely big platform to prove their mettle.

Aditya says, “We believe that there is much to be gained by all the stakeholders in the ecosystem when fintech startups like S2Pay and banks collaborate. Banks gain a lot as they get immediate access to innovative technology without going through long development cycle themselves and ones that fits in with its medium and long-term strategic business goals. For startups, it helps immensely as they work with an established partner which helps rolling out the product quickly without going through a long and expensive customer acquisition cycle.”

He further speaks about S2Pay’s collaboration with HDFC bank, which will allow bank customers to make payments at retails stores using their mobile phones without mobile network. “The bank can extend this payment mechanism to millions of merchants without needing to make any capital investments. So it’s a win-win solution, where in some sense the mythological David and Goliath work together to solve real-world problems quickly and more efficiently.”

Shridhar Marri, co-founder of Senseforth Technologies, which is working with HDFC in the area of customer response system powered by artificial intelligence, summarises the rationale between the growing love between startups and banks-the need for rapid innovation. Says Shridhar,

“Real innovation is happening outside the walled gardens of large enterprises. Startups have become the innovation churning pots brewing disruption. At startups, we can move fast and break things. We can afford to do that. In that process we invent new technologies, and new business models. However the large corporations cannot think of changing the engines mid flight. Given their size and scale, internal innovation efforts are always ridden with long cycle times, internal turf wars, and process minefields. After a pouring millions of dollars into internal innovation, they often end up with incremental innovation. How can you transform your product experience with incremental innovation?”

He adds that change management in large corporations is also really complex and has several unknowns. He says, “Often you do not know what to do with the ‘unwanted offspring’ of internal innovation. So, it is best to bring in innovation from outside in rapid fire bursts. You can bring in fresh thinking and new approaches to problem solving. Even a highly innovative company like Apple went out and bought technologies like Siri to augment its own internal innovation. Future minded organisations have realised this and have become highly approachable to startups.”

Of course, the flipside to it as he rightly points out is the fact that they come from distinctly different cultures. Startups question established wisdom. They take action with incomplete information. On the contrary, enterprises tend to depend on elaborate data models and spreadsheet-decision-making. He notes, “So, for startups, it is like dancing with a giant. There is every possibility that you will be out of step and get hurt. Fortunately, most of these partnerships have incredible support from senior management, who in fact, are solely driving this phenomenon. With their blessings, these sizzling love affairs can turn into long lasting relationships.”

Similarly, Jaineel Aga, founder of Planet Superheroes, believes that banks have a significant captive audience which startups can leverage. Says Jaineel,

Similarly, Jaineel Aga, founder of Planet Superheroes, believes that banks have a significant captive audience which startups can leverage. Says Jaineel,

“A bank’s relations with its customers are pretty inelastic. One won’t change banks unless the service is bad or someone is offering a stronger proposition. Hence, for startups it’s an opportunity to get access to a large visible audience. For banks, the relationship enables them to stay at the top of the next wave of growth, given the increase in digital banking, and improved customer experience.” Planet Superheroes has entered into relations with HDFC Bank and ICICI bank, and a tactical alliance with Ratnakar Bank, where it would give freebies/ vouchers to the bank’s customers of a certain age who would resonate with the startup’s offerings.

Naiyya Saggi, founder of BabyChakra, which has recently tied up top banks in the country states two major reasons for the growing association between banks and startups. Naiyya says, “A leading bank’s platform gives access to lakhs of potential users for Babychakra. Some of our partners, such as HDFC, have also promised us targeted marketing to better educate their clients about us.”

Naiyya Saggi, founder of BabyChakra, which has recently tied up top banks in the country states two major reasons for the growing association between banks and startups. Naiyya says, “A leading bank’s platform gives access to lakhs of potential users for Babychakra. Some of our partners, such as HDFC, have also promised us targeted marketing to better educate their clients about us.”

Though banks and startups may be from different cultures, but going by the trend, it appears these collaborations are expected to rise. For startups, this increasing interest from banks means better help with managing their financial affairs and traversing the maze of regulatory framework and a wider platform to play. For banks, who are seeking to tango with rapidly changing technologies in the financial service domain, this is an opportunity to not only learn from the best but also play a significant role in building sustainable businesses – ones that could one day be worth billions, and be their most valuable customers. After all, as they say, “Opportunity dances with those already on the dance floor.”